Why Did My Credit Score Drop?

Quick Answer

Reasons why your credit score could have dropped include a missing or late payment, a recent application for new credit, running up a large credit card balance or closing a credit card.

Your credit score can drop for a number of reasons, including a recent late or missed payment, an application for new credit or a change to your credit limit or usage. To understand why your credit may have gone down, it's important to understand what affects your credit scores. Payment history has the biggest impact on your score, followed by the amounts owed on your debt accounts and the length of your credit history.

There are other elements, too, that could affect your credit scores, such as inaccurate information on your credit report. Read on for seven common reasons for a credit score drop, plus how to improve your credit if it recently decreased.

1. You Have Late or Missing Payments

Your payment history is the most important factor in your FICO® ScoreΘ, the credit scoring model used by 90% of top lenders. It accounts for 35% of your score, and even one late or missed payment can have a negative impact. So, it's key to make sure you make all your payments on time.

If you are more than 30 days past due on a payment, credit issuers will likely report the delinquency to at least one of the three major credit bureaus, likely resulting in a drop in your score. Payments that become 60 or 90 days past due will have an even greater effect on your score.

If these delinquencies are not paid, the credit issuer may send your debt to a collection agency, and the collection account may be recorded on your credit report. Records of your late and missed payments remain in your credit file for seven years, while positive payment history on an open account can stay on file indefinitely (or 10 years if the account is closed in good standing).

Learn more: What Affects Your Credit Scores?

2. You Recently Applied for New Credit

Whenever you apply for a new line of credit, lenders will request a copy of your credit report to determine your creditworthiness. They decide whether to lend to you by viewing characteristics like your payment history, credit usage and the types of accounts you currently hold.

Each time you authorize someone other than yourself, such as a lender, to check your credit history, a hard inquiry is recorded on your credit report and could slightly affect your score. If you apply for too much credit in a short period of time, it can negatively impact your scores and affect the likelihood that lenders will approve you for new credit.

Depending on how many inquiries you already have, a new hard inquiry could cause your score to drop, but potentially only for a short period of time. And any effect on your credit score should disappear in about one year.

Learn more: How Many Hard Inquiries Is Too Many?

3. Your Credit Utilization Increased

Maxing out your credit card—or getting close to your limit—could cause a quick drop in your credit score. Depending on your card's credit limit, making a large purchase or simply running up your balance can increase your credit utilization ratio, the second most important factor in calculating your FICO® Score. Increased credit utilization can indicate to lenders that you are overextended and that, financially, you're not well-positioned to take on new debt.

You can calculate your overall credit utilization ratio by adding all your credit card balances at any given time and dividing that sum by your total revolving credit limit. For example, if you typically charge about $2,000 each month, and your total credit limit across all your cards is $10,000, your overall utilization ratio will be 20%.

Credit scoring models consider overall credit utilization across all credit cards as well as each card's utilization ratio. You should aim to keep your credit utilization ratio below 30%, and for the best scores, below 10%. So, if your total credit limit is $10,000, keep your balances below $3,000 at all times to help keep your score in good shape.

Learn more: How to Calculate Credit Card Utilization

4. One of Your Credit Limits Decreased

An issuer might lower your credit limit for a number of reasons, including if you've been using the card infrequently or repeatedly spending over the limit. If one of your credit limits decreases, it can increase your credit utilization ratio and negatively affect your credit scores.

Imagine this example: If your total credit limit was $10,000 and you carried a balance of $3,000, your utilization ratio would be 30%. If a credit card issuer lowered your limit to $6,000, but your balance remained the same, your utilization ratio would jump up to 50%. Even though you didn't charge up a higher balance, your overall credit utilization ratio increased. That, in turn, could cause your credit score to drop.

Credit card issuers set initial credit limits based on factors including:

- Income

- Debt-to-income ratio

- Credit history

- Credit score

You can request a credit limit increase from your current issuers or open a new credit card account if you're concerned that your credit limit is too low. But know that if your limit recently went down, an increase might be hard to come by, and it may be best to wait to request more credit until your score improves.

Learn more: What to Do if Your Credit Limit Decreases

5. You Closed a Credit Card

Closing a credit card has the potential to hurt your credit score if it increases your credit utilization ratio. When you cancel a credit card account, you reduce the amount of revolving credit available to you, which can cause your utilization to spike (particularly if you carry high balances on other cards).

Closing a credit card account you have had for some time can also eventually shorten your average credit age, which could factor into your credit score.

The length of your credit history counts for 15% of your FICO® Score, and a longer history is better for your scores. Keep in mind, however, that if your account is closed in good standing (meaning you made all your payments on time), it could remain on your credit report for up to 10 years and contribute to a positive payment history during that time.

Unless the card has a high annual fee or tempts you to overspend, you might want to keep the account open to maintain your credit limit and length of credit history.

Learn more: Should You Cancel Your Unused Credit Cards or Keep Them?

6. There Is Inaccurate Information on Your Credit Report

Regularly checking your credit reports is one of the best ways to ensure no inaccurate information shows up in your file. Although it's rare, mistakes happen, and it is possible that incorrect information on your credit report—such as an inaccurate payment history—is causing your scores to drop.

If something in your report is inaccurate, it could be a result of a lender accidentally reporting the wrong information. It could also be a sign that you have fallen victim to identity fraud. You have the right to dispute information you don't recognize or believe is potentially fraudulent. If you see something you believe is inaccurate, you can dispute the information with all three credit bureaus.

7. You've Experienced a Major Event Such as Foreclosure or Bankruptcy

The late payments that often lead up to a bankruptcy or foreclosure harm your credit scores—and the events themselves can make matters worse.

Bankruptcy is a legal process initiated by borrowers looking to get relief from debt payments, and it causes severe harm to a consumer's credit.

The amount of time a bankruptcy stays on a credit report depends on the type of bankruptcy filed:

- Chapter 7 bankruptcy appears on your report for 10 years from the date you filed.

- Chapter 13 bankruptcy appears on your credit report for seven years from the date you filed.

Foreclosure is when your mortgage lender takes possession of your house, often following at least four consecutive months of missed payments, and also seriously damages your credit.

In addition to damaging your credit score, either event can disqualify you from certain types of borrowing in the future. A mortgage lender may be unlikely to take you on as a borrower if you have a foreclosure in your past, for instance. Foreclosure stays on your credit report for seven years.

What Is a Good or Bad Credit Score?

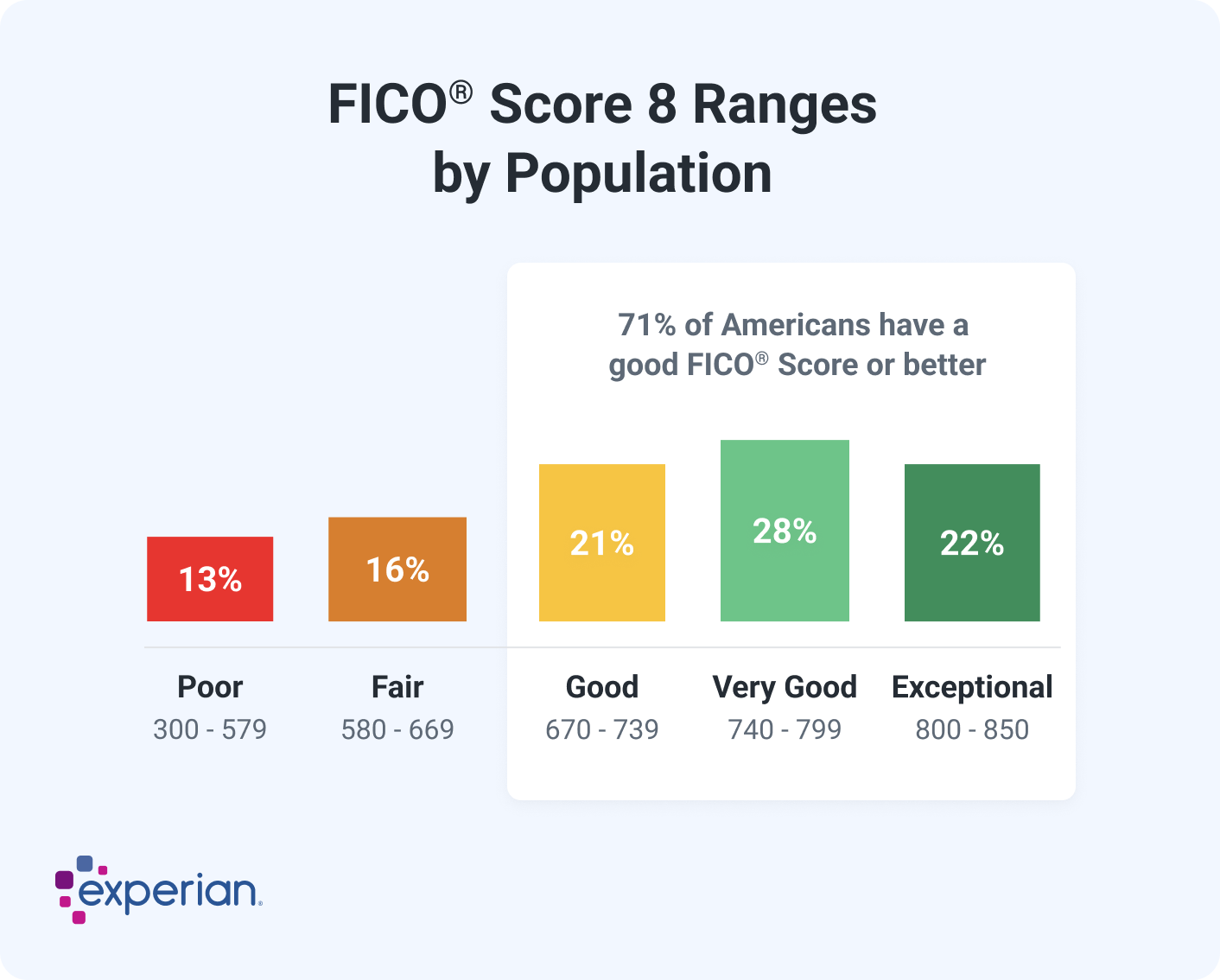

A good credit score is one that falls between 670 and 739 for a FICO® Score, which uses a scoring range of 300 to 850. Scores above 739 are considered very good or exceptional. Scores below 669 are considered fair or poor. In 2023, the average FICO® Score in the U.S. was 715, according to Experian data.

Maintaining a good credit score has plenty of benefits, including potentially saving you a significant amount of money—and stress—over time. Good scores will likely help you qualify for more credit products at lower interest rates. Bad scores, on the other hand, may prevent you from qualifying for certain types of credit or may result in getting approved for credit products at higher interest rates, since your profile presents a bigger risk to the lender.

Learn more: What Are the Different Credit Score Ranges?

Ways to Improve Your Credit Scores

Here are several ways that you can improve your credit scores.

- Pay your bills on time. This is one of the most crucial steps to getting and keeping a good credit score. The best way to pay on time is to set up automatic payments so you won't miss a bill. But make sure you have enough money in the connected bank account to avoid an overdraft.

- Minimize overall debt. If possible, don't lean on credit to buy items you're not able to pay for in cash, or that you can't pay off by the end of the month. This keeps your payments manageable and your ongoing credit utilization ratio low. Your goal should be to bring your credit card balance to $0 at month's end.

- Monitor your credit regularly. Routinely checking your credit score can help you identify dips in your score quickly and course-correct if necessary. Free credit monitoring from Experian can help you keep tabs on both your FICO® Score and credit report, and keep you updated when there are any changes to your credit report.

- Avoid applying for unnecessary credit cards. Not only do some cards have pricey annual fees, but an abundance of cards might result in more spending than you can handle.

- Practice responsible spending habits. Setting up a budget—even a general one that categorizes your spending into a few overall buckets and doesn't require too much upkeep—can help you spend within your means over the long term.

Learn more: How to Improve Your Credit Score

Frequently Asked Questions

What to Do About a Dip in Credit

A drop in your credit score can be stressful, but it doesn't have to be permanent. There are ways to bring your score back up and to prevent another decrease in the future.

To see personalized information on what caused your credit score to change, plus advice on credit moves you can make to increase your score, check your credit score for free through Experian. Remember that credit scores are dynamic, and that you have the ability to improve yours with your own habits—an empowering truth that you can apply to other parts of your financial life too.

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

Brianna McGurran is a freelance journalist and writing teacher based in Brooklyn, New York. Most recently, she was a staff writer and spokesperson at the personal finance website NerdWallet, where she wrote "Ask Brianna," a financial advice column syndicated by the Associated Press.

Read more from Brianna