What’s the Most Important Factor of Your Credit Score?

Quick Answer

The most important factor of your credit score is payment history, making up 35% of your FICO Score.

You may know you have a credit score—and likely several scores—but do you know how your scores are calculated? Your credit score may seem like it's the result of a mystical mathematical formula, but the factors that go into calculating your credit score are pretty straightforward.

The most important factor of your FICO® ScoreΘ is your payment history, or how you've managed your credit accounts. Close behind is the amounts owed—and more specifically how much of your available credit you're using—on your credit accounts. The three other factors carry less weight. Here's what you need to know.

Payment History Is the Most Important Factor of Your Credit Score

Payment history accounts for 35% of your FICO® Score, used by 90% of top lenders. Four other factors that go into your credit score calculation make up the remaining 65%.

Keep in mind that there are as many as 40 versions of the FICO® Score, meaning you may have one score that's used to determine whether your credit card application is approved, another score for a mortgage application and yet another score for an auto loan application. When calculating these various scores, FICO weighs your payment history on your credit accounts most.

Why is payment history more important than the other factors? A lender wants to protect itself from risk. Therefore, it wants to know whether you've made timely payments on current and previous credit accounts. According to FICO, research shows payment history is typically the strongest predictor of whether you'll pay your debts on time, thus the heavier emphasis on this factor.

What Bills Affect My Payment History?

Several kinds of bills affect your payment history. These include:

- Credit cards, including Mastercard, Visa, American Express and Discover cards

- Retail credit cards from stores

- Installment loans, such as auto loans and mortgages, that involve making regular payments for a set term

- Accounts from finance companies

In addition to these accounts, FICO considers bankruptcies and collection accounts as part of payment history. Both can have a significant negative effect on your scores.

Bills from providers of phone, utility, cable TV and streaming services also may affect your payment history. In the past, these accounts would only impact your credit if they were sent to collections as a result of nonpayment, in which case they'd stay on your credit report for seven years and negatively affect your score.

Today, these accounts can actually help improve your FICO® Score, through Experian Boost®ø. With Experian Boost, you can allow Experian to securely access your online payment history for phone, utility, cable TV and certain streaming service providers. Then, on-time payments on authorized accounts will start showing up on your Experian credit report, and your FICO® Score may get a boost.

How Long Do Late Payments Stay on Credit Reports?

Late payments can stay on your credit report for up to seven years. They can damage your credit score, but the effect on your score fades over time.

Not all late payments show up on your payment history, however. If you didn't make a credit card payment by the due date and instead made the payment a day late or a week late, you could be hit with a late fee by the card issuer, but your credit won't be hurt.

Why is that? Because credit card issuers won't notify the major credit bureaus (Experian, TransUnion and Equifax) about a late payment until a full billing cycle, or 30 days, has gone by.

The situation changes if the payment is more than 30 days late. In this case, the creditor reports the payment as late to the credit bureaus, and the effect on your credit scores can depend partly on how long your account was delinquent before you made a payment. So, a payment that's 60 days late will do more harm than a payment that's more than 30 days late but less harm than a payment that's 90 days late.

How to Improve Your Payment History

You can improve your payment history by taking these actions:

- Pay on time. The simplest way to improve your payment history is to pay every bill on time.

- Make at least the minimum payment. While you should aim to pay your balance in full every month, making at least the minimum due is enough to keep your account in good standing.

- Catch up on past-due payments. Bringing unpaid bills current will help your score over time.

- Set up automatic bill payments. If you put your payments on autopilot, you reduce the chance that a bill will go unpaid.

- Set up payment alerts. Many creditors let you create reminders to inform you when upcoming payments are due.

Other Factors That Impact Your Credit Score

While payment history ranks as the top factor in calculating your FICO® Score, it's important to be aware of the four other factors:

- Amounts owed (30%): The amount of available revolving credit you're using (also known as your credit utilization ratio) and how much debt you're carrying accounts for 30% of your score. If you're using too much of your available credit, it may be a sign that you're financially strapped and might end up defaulting on your debt. For the best scores, keep your credit usage on each of your individual revolving accounts, such as credit cards, under 10%.

- Length of credit history (15%): Generally, a longer credit history can result in a higher score.

- Mix of credit types (10%): Managing different types of credit, such as credit cards, mortgage loans and personal loans, can help your score.

- New credit (10%): Opening several new credit accounts over a short period of time may signal risky financial behavior. It also reduces the average age of your accounts, which can lower your score. It's best to only apply for new credit when you need it.

The Bottom Line

Because payment history is the most important factor in your FICO® Score, paying all your bills by the due date can go a long way to helping you build a positive credit history over time. To ensure your payment history and other aspects of your credit are in good shape, check your credit scores for free from Experian and regularly review your credit reports.

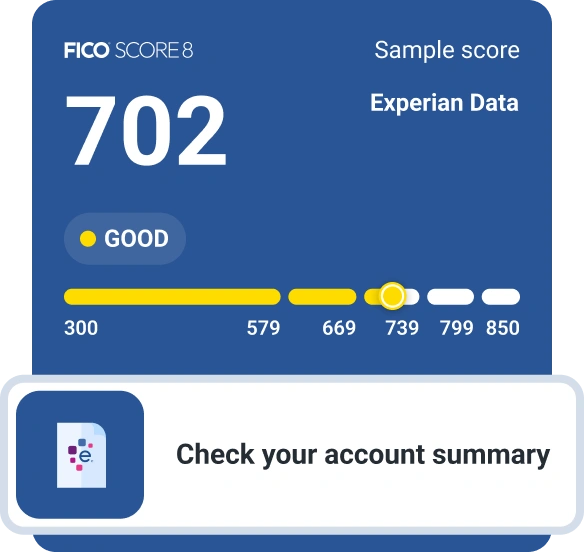

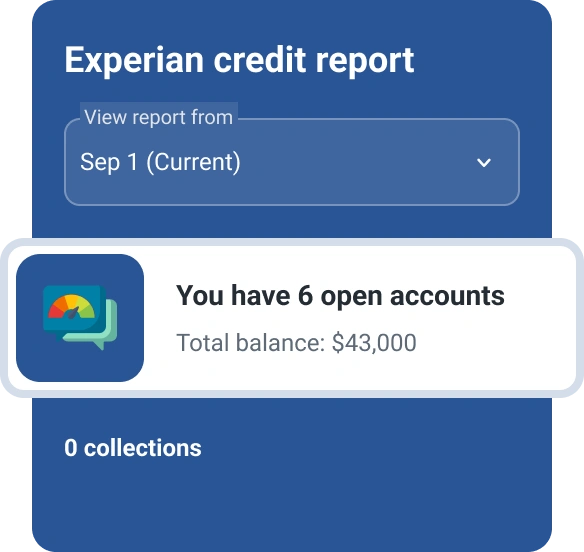

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

John Egan is a freelance writer, editor and content marketing strategist in Austin, Texas. His work has been published by outlets such as CreditCards.com, Bankrate, Credit Karma, LendingTree, PolicyGenius, HuffPost, National Real Estate Investor and Urban Land.

Read more from John