What Is the Easiest Credit Card to Get With No Credit?

Quick Answer

The easiest credit cards to get with no credit history are often secured credit cards and cards that use alternative credit data to evaluate your eligibility.

If you want to start building your credit history, a credit card can be a great way to accomplish your goal. However, your options will be somewhat limited, so it's important to know where to look.

In general, the easiest credit card to get with no credit history is a secured card or a card that uses a nontraditional underwriting process to review your application. Here's what you need to know about your options.

What Is the Easiest Credit Card to Get for Beginners?

For many people, the main option is a secured credit card. Secured credit cards require an upfront security deposit—usually equal to your credit limit—to act as collateral for any debt you incur with the card. That deposit is held in a separate account and can be seized if you fail to pay off charges you make with the card.

If you use your secured credit card responsibly, some card issuers may opt to return your deposit after a period of several months and convert your account to an unsecured card. In other cases, however, you'll need to close your account to get your deposit back.

In recent years, financial technology companies and even some major card issuers have begun to offer unsecured starter credit cards with nontraditional underwriting processes and structures that make it easier to get approved without a credit history.

Secured Credit Card vs. Unsecured Credit Card

For the most part, secured and unsecured credit cards function similarly. However, there are some key differences to understand.

| Feature | Secured Credit Card | Unsecured Credit Card |

|---|---|---|

| Collateral requirement | Security deposit | None |

| Credit score requirement | Generally poor or no credit history | Options available for all credit score ranges |

| Credit limits | Generally low and equal to your security deposit | Can vary, but generally higher |

| Potential features | Rewards, credit line increases, conversion to unsecured card | Rewards, welcome bonuses, 0% intro APR promotions, travel and shopping perks, insurance protections |

| Costs | Typically charge high APRs; some don't charge annual fees | APRs and annual fees can vary |

What to Do if You're Denied a Secured Card

If you apply for a secured credit card and get denied, the card issuer will send you an adverse action letter that details the reasons for the denial, along with information about your rights as a consumer and where you can obtain a copy of your credit report.

Review the adverse action letter to get a better understanding of which areas of your credit history or overall financial situation you can address to improve your odds of getting approved the next time you apply.

Alternatively, you can pursue other ways to build credit, including the following.

Opt for a Nontraditional Credit Card

You may be able to get approved for a credit card that doesn't focus on your credit history.

Debit-credit hybrid cards may be another option, as they generally don't require a credit check when you apply.

Get a Retail Credit Card

Store credit cards offered by retailers and gas stations typically have less stringent credit requirements than traditional credit cards. If you shop regularly with a specific retailer, you can also take advantage of rewards, discounts, free shipping and other perks.

That said, credit limits are usually low, so it can be easy to rack up a high credit utilization rate, which can hurt your credit. Additionally, many store credit cards restrict you to using them only with the co-branded retailer, limiting your spending options. If you have issues with overspending, the extra perks could make it difficult to stay within your budget.

Become an Authorized User

If you have a loved one who uses their credit card responsibly, consider asking them to add you as an authorized user on their account. With authorized-user status, the entire account history will show up on your credit reports. If the primary cardholder makes payments on time and keeps their credit utilization low, it could help you establish a positive history and give your credit scores a boost.

Get Credit for Other On-Time Payments

Historically, monthly obligations like rent, utility bills, phone bills and insurance premiums haven't been included in consumer credit reports. However, Experian Boost®ø now makes it possible to add these and even streaming service payments to your Experian credit file.

After registering for the free feature, you'll link your bank accounts and select which bills you want to include. Once you confirm, your credit scores could see an instant increase.

Apply for a Credit-Builder Loan

A credit-builder loan can be used in addition to or instead of a credit card to build your credit history. With this type of loan, the lender holds the loan proceeds—usually $300 to $1,000—in a savings account while you make payments over a period of six to 24 months.

The lender reports your payments to the credit bureaus, and then disburses the loan funds to you once you complete your repayment term. Credit-builder loans typically charge lower interest rates than secured credit cards, but you'll still want to make sure you find a monthly payment that works with your budget.

How to Build Credit With a Credit Card

If you get approved for a credit card, it's important to develop good credit habits as quickly as possible to ensure a positive credit history. Here are some steps you can take:

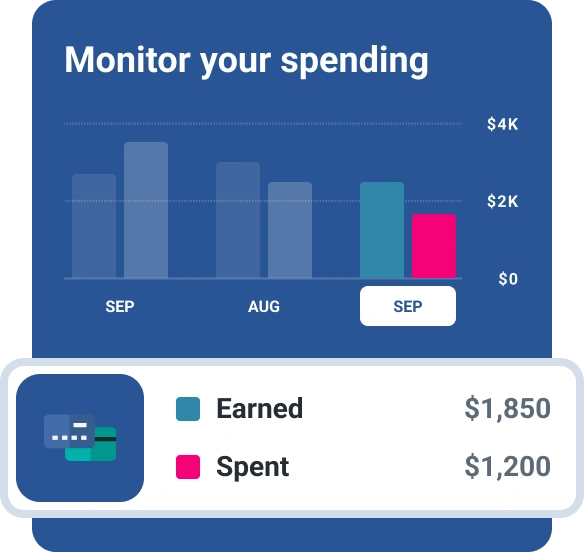

- Spend on a budget. If you don't already have one, create a budget to ensure that you don't spend more than you can afford to pay in full each month. Paying your balance off every month not only helps you avoid interest charges but can also prevent your credit card debt from getting out of hand.

- Keep your utilization rate low. Because starter credit cards often offer a low credit limit, it can be easy to use up a significant portion of your available credit with just a few purchases. Consider using your card infrequently or making multiple payments throughout the month to keep your utilization rate low.

- Always pay on time. Your payment history is the most important factor in your credit score, so it's imperative that you always pay your bill on time. If you miss a payment by 30 days or more, it could cause significant, lasting damage to your credit score. To ensure on-time payment, consider setting up autopay on your account. If you'd rather pay manually, set up an alert for your due date.

- Keep the account active. While you may think that not using your credit card is a good thing, the card issuer may choose to close the account if you stop using it. Each issuer has its own criteria for what counts as an inactive account, but it's generally best to use your card at least once every six months. If you don't plan on using it regularly and don't want to make occasional purchases, consider putting one of your monthly subscriptions on the card and paying it off every month.

Weigh Your Options

Being new to credit can limit your options, but the good news is that many credit card issuers are willing to work with people who are building credit for the first time.

Take your time to research and compare options based on your credit situation. In addition to deposit requirements, you may also consider other features, such as fees, rewards, interest rates and benefits to make sure you're getting the best card possible for your needs.

As you work to build your credit history, Experian Go™ can help you by providing you with free access to your FICO® ScoreΘ and Experian credit report, along with insights and tools that can help you practice good credit habits. It can also make it easier to track your progress over time and address potential problems if they arise.

Looking to build credit?

Discover secured credit card offers matched to you, so you can apply with confidence. Get started with your FICO® Score for free.

See your offersAbout the author

Ben Luthi has worked in financial planning, banking and auto finance, and writes about all aspects of money. His work has appeared in Time, Success, USA Today, Credit Karma, NerdWallet, Wirecutter and more.

Read more from Ben