Best Personal loans for 2026: Check rates with no impact to your FICO® ScoreΘ

Find the best personal loans with competitive rates and flexible terms tailored to your credit profile.⍉ Compare top lenders and find the right loan for you.

Compare personal loans from our partners

As of February 2026, compare personal loans with rates as low as 4.99%, loan amounts up to $250,000 and same-day funding options available.

Recommended FICO® ScoreΘ

Fair - Good

| Est. APR | 7.99 - 35.99% |

|---|---|

| Term | 24 - 48 mo |

| Loan amount | $2,000 - $30,000 |

| Est. monthly payment | $90 - $1,187 |

Recommended FICO® ScoreΘ

Good - Exceptional

| Est. APR | 7.74 - 35.49% |

|---|---|

| Term | 24 - 84 mo |

| Loan amount | $5,000 - $100,000 |

| Est. monthly payment | $226 - $3,237 |

Recommended FICO® ScoreΘ

Fair - Exceptional

| Est. APR | 6.45 - 33.64% |

|---|---|

| Term | 36 - 60 mo |

| Loan amount | $1,000 - $50,000 |

| Est. monthly payment | $31 - $1,731 |

Recommended FICO® ScoreΘ

Fair - Exceptional

| Est. APR | 7.70 - 24.50% |

|---|---|

| Term | 24 - 60 mo |

| Loan amount | $5,000 - $50,000 |

| Est. monthly payment | $225 - $1,453 |

Recommended FICO® ScoreΘ

Poor - Exceptional

| Est. APR | 8.99 - 35.99% |

|---|---|

| Term | 24 - 60 mo |

| Loan amount | $2,000 - $50,000 |

| Est. monthly payment | $91 - $1,806 |

Recommended FICO® ScoreΘ

Poor - Exceptional

| Est. APR | 6.70 - 35.99% |

|---|---|

| Term | 36 - 60 mo |

| Loan amount | $1,000 - $50,000 |

| Est. monthly payment | $31 - $1,806 |

Recommended FICO® ScoreΘ

Fair - Exceptional

| Est. APR | 6.99 - 35.99% |

|---|---|

| Term | 36 - 60 mo |

| Loan amount | $2,000 - $50,000 |

| Est. monthly payment | $62 - $1,806 |

Recommended FICO® ScoreΘ

Fair - Exceptional

| Est. APR | 4.99 - 32.39% |

|---|---|

| Term | 24 - 60 mo |

| Loan amount | $1,000 - $60,000 |

| Est. monthly payment | $44 - $2,030 |

Recommended FICO® ScoreΘ

Fair - Very Good

| Est. APR | 11.11% |

|---|---|

| Term | 12 - 60 mo |

| Loan amount | $1,000 - $10,000 |

| Est. monthly payment | $88 - $218 |

Recommended FICO® ScoreΘ

Fair - Exceptional

| Est. APR | 7.99 - 35.99% |

|---|---|

| Term | 24 - 60 mo |

| Loan amount | $5,000 - $40,000 |

| Est. monthly payment | $226 - $1,445 |

Recommended FICO® ScoreΘ

Fair - Exceptional

| Est. APR | 6.99 - 26.99% |

|---|---|

| Term | 24 - 60 mo |

| Loan amount | $15,000 - $50,000 |

| Est. monthly payment | $672 - $1,526 |

Recommended FICO® ScoreΘ

Fair - Very Good

| Est. APR | 9.95 - 35.95% |

|---|---|

| Term | 24 - 60 mo |

| Loan amount | $2,000 - $35,000 |

| Est. monthly payment | $92 - $1,264 |

Recommended FICO® ScoreΘ

Fair - Exceptional

| Est. APR | 8.39 - 28.70% |

|---|---|

| Term | 60 - 120 mo |

| Loan amount | $20,000 - $250,000 |

| Est. monthly payment | $409 - $6,352 |

Recommended FICO® ScoreΘ

Good - Exceptional

| Est. APR | 10.24 - 26.39% |

|---|---|

| Term | 24 - 72 mo |

| Loan amount | $3,000 - $50,000 |

| Est. monthly payment | $139 - $1,390 |

Recommended FICO® ScoreΘ

Poor - Good

| Est. APR | 9.99 - 35.99% |

|---|---|

| Term | 36 - 60 mo |

| Loan amount | $1,000 - $35,000 |

| Est. monthly payment | $32 - $1,264 |

Recommended FICO® ScoreΘ

Fair - Exceptional

| Est. APR | 8.47 - 33.64% |

|---|---|

| Term | 36 - 60 mo |

| Loan amount | $1,000 - $50,000 |

| Est. monthly payment | $32 - $1,731 |

Recommended FICO® ScoreΘ

Poor - Exceptional

| Est. APR | 18.00 - 35.99% |

|---|---|

| Term | 36 - 60 mo |

| Loan amount | $1,500 - $20,000 |

| Est. monthly payment | $54 - $723 |

You could save up to $3,531* with a low, fixed-rate personal loan

| High-interest credit card | Personal loan | |

|---|---|---|

| Balance | $11,700 | $11,700 |

| Monthly payment | $334 for 60 months | $275 for 60 months |

| Average interest rate | 23.62% | 14.48% |

| Total paid with interest | $20,041 | $16,510 |

| *Estimated interest savings: $3,531 | ||

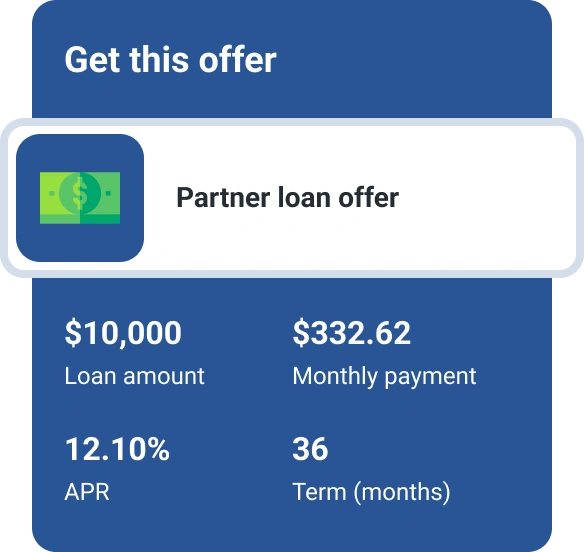

Experian could help find the best personal loan for you

It’s free

Check your loan options for free—it won’t hurt your credit scores.

Save on fees

Get matched to lenders that offer no application fees and no prepayment penalties. Look for these labels on your matched loan offers.

Loans for all credit types

Even consumers with low credit scores or no credit history have personal loan options available.

Get cash fast at competitive rates

Compare rates across multiple lenders and get your loan fast—with same-day funding available.

Get prequalified

Find out how much you can borrow before you apply. Getting prequalified helps you better compare options.

Loans from $1,000 to $250,000

From getting a small loan to funding a big project that fits your budget and needs, Experian has you covered.

Why trust Experian for personal loans?

Shop trusted lenders all in one place

Experian works with reputable lenders to provide consumers with the best options.

Our model

Experian offers loan options tailored to your credit profile that could improve your chances for approval.

Security

Experian uses bank-level encryption and data protection to keep your information safe.