How to Use a Secured Credit Card

Quick Answer

A secured credit card can help you establish credit or improve an existing credit score. You can:

In many ways, a secured credit card works just like a traditional credit card. Paying your bill on time and maintaining a low balance can help increase your credit score. The opposite is also true.

What makes a secured credit card unique is that it requires a refundable upfront security deposit. The goal is to gradually improve your credit so you'll have more opportunities for unsecured cards and other credit products. Here's how to use a secured credit card to your advantage.

1. Decide if a Secured Credit Card Is Right for You

A secured credit card can be useful if:

- You're building your credit from scratch. Credit card issuers often have minimum credit score requirements. If you have a thin credit file or no credit history, you might have trouble qualifying for a traditional unsecured card. However, a secured credit card may be a good first step because the required deposit makes it easier to qualify—and using it responsibly can help you build credit.

- You have poor credit. If a low credit score is making it hard to get an unsecured card, you might consider a secured credit card since eligibility requirements tend to be looser. You can also improve your score over time by maintaining a positive payment history and keeping your credit utilization rate down.

2. Check Your Credit Score

It helps to know your credit score before applying for a new credit card since credit card issuers will be looking at it when they decide whether to approve your application. It can give you an idea of what cards you might qualify for and the interest rates that may be available to you. Knowing your score can also help you avoid applying for cards you may not be eligible for. This is important since applying for too many credit cards at once can have a negative impact on your credit score.

3. Choose the Right Secured Credit Card

Not all secured credit cards are created equal. Keep the following factors in mind when shopping around for the right card:

- Annual fees: Some card issuers charge an annual or monthly fee to keep the account active. According to the most recent data from the Consumer Financial Protection Bureau, the average annual fee was $94 in 2020.

- Annual percentage rates (APRs): The APR tells you what your interest costs will be if you carry a balance. Rates tend to be higher with secured credit cards—in some cases, upwards of 30%. But you can avoid this fee if you pay off your balance in full each month.

- Miscellaneous fees: Look out for other credit card fees. Some card issuers tack on application fees, processing fees, foreign transaction fees and other cardholder charges. Be sure to read the fine print.

4. Pay the Required Deposit

Secured cards require a refundable security deposit, which will likely determine your credit limit. Collecting a deposit reduces risk for the card issuer. If you stop making your payments, they'll hang on to that money. Required minimum deposits vary—$200 is common, though some start as low as $49. You can put down more and may receive a higher credit limit if you have the means.

5. Start Using the Card

Apart from the security deposit, secured credit cards work just like traditional unsecured credit cards. Every time you swipe your card, the transaction total will be added to your account balance. You'll be responsible for making a minimum payment when your monthly bill comes due. This amount is usually calculated as a percentage of your statement balance.

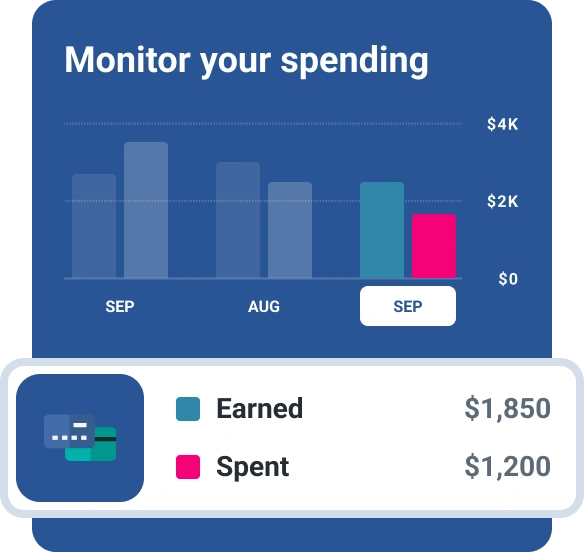

Aim to pay off your balance in full each month. Doing so allows you to avoid interest and can help improve your credit score. One rule of thumb is to use your secured credit card for necessary bills and regular spending. If you have to pay for these things anyway, why not get credit for it? Just be sure to only charge as much as you can afford to pay off each month. Also keep in mind that once you receive a secured card and start using it, it could take up to two months for the new account to appear on your credit report.

6. Pay Your Bill on Time Every Month

Like other creditors, secured card issuers may report your payment activity to the three major consumer credit bureaus (Experian, TransUnion and Equifax)—in fact, you want a secured card that does this so you can use it to build credit. These payments will include on-time payments that reflect positively in your credit report and any negative information, such as late payments and high balances.

Your payment history makes up 35% of your FICO® ScoreΘ. What's more, a single late payment will remain on your credit report for seven years. Setting up automatic payments can help you stay current on your account.

7. Don't Max Out Your Card

It's ideal to pay off your credit card balances in full each month. If you must carry a balance, try to keep it below about 30% of your credit limit. For example, if your credit limit is $1,000, you'll want to keep your balance below $300. Exceeding that amount can hurt your credit score because credit utilization is an important factor in score calculations. The upside is that any credit damage caused by a high utilization rate should improve soon after you pay down the balance, all other things being equal.

8. Upgrade to an Unsecured Credit Card

Some secured credit card issuers may automatically approve you for an unsecured card after you've made on-time payments for a number of months. Others will require you to formally apply. Using your secured card may also help you improve your credit to the point that you become eligible for unsecured credit cards from other issuers.

In this case, you can choose to either keep your secured card open or close it and get your security deposit back. When deciding your next move, take a look at your finances and the effect closing a secured card could have on your credit utilization rate.

The Bottom Line

Using a secured credit card can be a great way to build or improve your credit. With responsible use, you can eventually transition to an unsecured card. Finding the right card is an important step. Using features from Experian can make that part a little easier, providing personalized credit card recommendations based on your credit profile.

Looking to build credit?

Discover secured credit card offers matched to you, so you can apply with confidence. Get started with your FICO® Score for free.

See your offersAbout the author

Marianne Hayes is a longtime freelance writer who's been covering personal finance for nearly a decade. She specializes in everything from debt management and budgeting to investing and saving. Marianne has written for CNBC, Redbook, Cosmopolitan, Good Housekeeping and more.

Read more from Marianne