What Is a Foreign Transaction Fee?

Quick Answer

A foreign transaction fee is a percentage-based fee on all purchases made in foreign currencies, whether abroad or online. For credit cards that charge a foreign transaction fee, the cost is generally 1% to 3% of the purchase.

A foreign transaction fee is a fee you may be charged when you use a credit card outside the U.S. or when making purchases online in a foreign currency. If you're not mindful of foreign transaction fees on your credit card while traveling overseas, your trip costs could increase quickly. Not all credit cards have foreign transaction fees, however. Here's what you need to know.

What Is a Foreign Transaction Fee?

A foreign transaction fee is a fee charged by some credit card issuers for making purchases in a foreign currency. You may incur this percentage-based fee, sometimes called a foreign purchase transaction fee or foreign currency conversion fee, when:

- You use the credit card for a purchase or cash advance outside the U.S.

- You use the credit card to purchase products or services in a foreign currency.

Foreign transaction fees will appear on your credit card's monthly statement as a separate item or a fee.

Whether your card has a foreign transaction fee or not, you might have to pay a markup on the currency conversion rate, though the amount can vary depending on the credit card network and currencies. Visa and Mastercard have online calculators to check their current exchange rates and fees.

Dynamic Currency Conversion

When you're making an online purchase with a foreign merchant, or at a point-of-sale device abroad, you may get the option to pay in U.S. dollars (USD) rather than local currency. This is called dynamic currency conversion (DCC), which might sound like an easy way to avoid foreign transaction fees, but it often ends up costing more.

The benefit of DCC is that it converts currency for you, so it's easy to see how much you're spending in USD. But with DCC, your card network is no longer handling currency conversion at their exchange rate; instead, the foreign bank or payment provider sets the exchange rate and handles conversion. They typically include a markup and sometimes additional fees, which usually ends up costing more than if you'd just paid in local currency and let your issuer do the work.

If you're struggling to figure out how much you're spending, just look up the exchange rate that morning and whip out your phone's calculator or a currency conversion site. This extra step can save you money over the course of a trip abroad.

How Much Does a Foreign Transaction Fee Cost?

Foreign transaction fees generally cost 1% to 3% of the transaction amount. While not all credit cards come with foreign transaction fees, those that do typically charge the percentage-based fee rather than a flat fee.

This fee sounds small but it can really add up. Say you and your significant other stop in Italy on vacation and put everything for one night on a credit card. You spend the USD equivalent of $150 on a hotel room, $100 for shopping, $75 for a meal, $50 for a tour and $25 for a taxi. That's $400 total, so if your credit card's transaction fee is 2%, you'll spend an extra $8 on foreign transaction fees (not including any markup on the conversion rate).

Again, that might not sound like much. But think about an overseas trip of a week or two, or longer, and every swipe can add up to a hefty amount of wasted money.

How to Avoid Foreign Transaction Fees

Some credit card fees are inescapable, but here are three ways to avoid paying foreign transaction fees:

- Use a credit card with no foreign transaction fee. This is the best and safest option when traveling: You still get the protections of a credit card while avoiding a foreign transaction fee with every purchase. Travel credit cards usually do not charge foreign transaction fees.

- Use a debit card with no foreign transaction fee. Likewise, some debit cards charge foreign transaction fees, while others don't. Even if your debit card doesn't have the fee, though, debit cards have less fraud protection than credit cards. Since purchases in foreign countries and/or on foreign websites are inherently riskier, your bank account could be vulnerable if you don't catch fraud fast enough.

- Pay with cash. Exchange or withdraw cash in the country's currency, either before or during your trip. Just be aware that some banks charge higher fees for ATM withdrawals outside the U.S., plus conversion or transaction fees.

The Bottom Line

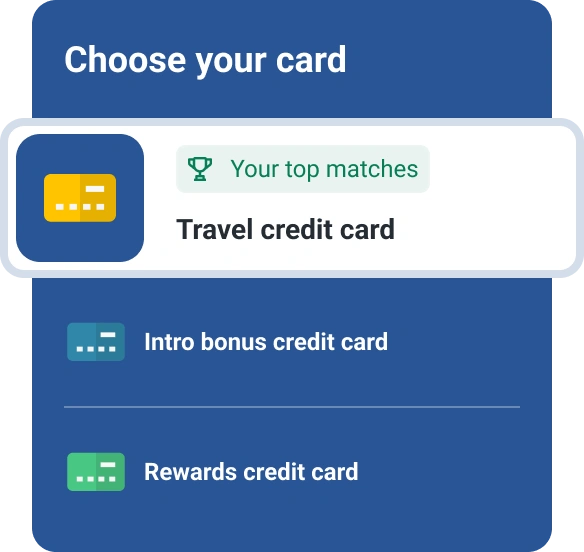

Whether you plan to head overseas for a trip, or you're stateside and want to purchase speciality items from a foreign website, think carefully about which card to use. A credit card is often your best option, and one without a foreign transaction fee will save you the most money. If you don't yet have one, Experian can show you credit cards matched to your unique profile; just read the fees and terms carefully to ensure there's no foreign transaction fee.

Don’t apply blindly

Apply for credit cards confidently with personalized offers based on your credit profile. Get started with your FICO® Score for free.

See your offersAbout the author

Emily Starbuck Gerson is a freelance writer who specializes in personal finance, small business, LGBTQ and travel topics. She’s been a journalist for over a decade and has worked as a staff writer at CreditCards.com and NerdWallet. Emily’s work has appeared in CNBC, MarketWatch, Business Insider, USA Today, The Christian Science Monitor and the Chicago Tribute, among other websites and publications.

Read more from Emily Starbuck