8 Common Credit Mistakes and How to Avoid Them

Quick Answer

Not checking your credit score often enough, missing payments, taking on unnecessary credit and closing credit card accounts are just some of the common credit mistakes you can easily avoid.

Your credit score is one of many important indicators of your financial health, so it's crucial to build and maintain a good credit history. Part of that process is to understand how certain actions can impact your credit profile and to avoid potential mistakes that can stifle your progress and even damage your credit score for years to come.

As you learn more about the factors that affect your credit score, here are some of the most common credit mistakes and how to avoid them.

1. Ignoring Your Credit

Monitoring your credit score is a good way to not only keep track of your progress but also to spot potential issues and address them before they do significant damage. If you don't check your credit regularly, you could miss out on warning signs of greater issues.

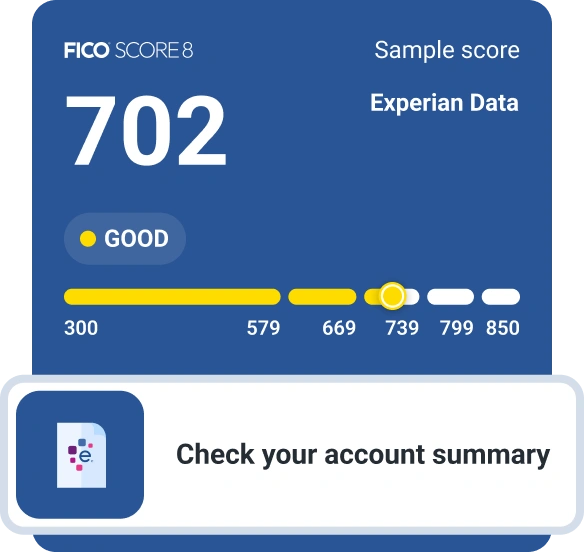

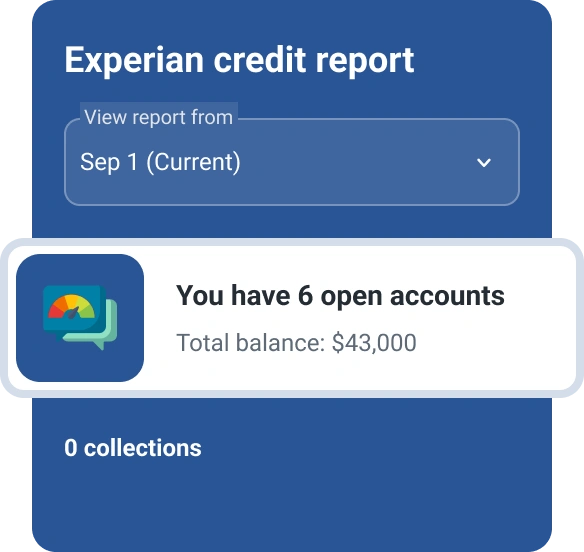

With Experian's free credit monitoring service, you'll get access to your FICO® ScoreΘ and Experian credit report, which you can check as often as you want. You can also get a free copy of your credit reports from Experian, TransUnion and Equifax through AnnualCreditReport.com.

As you maintain a pulse on your credit health, look for items in your credit report that have the potential to hurt your credit score or are already doing damage so you can address them quickly. These issues may include high balances, missed payments or accounts you don't recognize.

2. Not Paying Bills on Time

Your payment history is the most influential factor in your FICO® Score, which means that missing even one payment by 30 days or more could wreak havoc on your credit. What's more, late payments typically remain on your credit reports for seven years.

While its impact on your score may diminish over time, especially if you start paying on time going forward, it can still hamper your credit growth.

To ensure you pay all your bills on time, request payment reminders from your lenders or, even better, set up autopay through your lender or bank account.

3. Only Making Minimum Payments

Minimum payments on a credit card might appear to make your debt more affordable, but interest charges can put a strain on your budget. As your balance grows, it can also potentially damage your credit because it increases your credit utilization rate, or the percentage of your available credit you're using at a given time.

As your card balances rise above 30% of your credit limits, the impact on your credit scores increases greatly. Generally speaking, the lower, the better. Make it a priority to pay down your credit card debt, and consider using other payment methods until you achieve your goal. If you have multiple credit card balances, consider attacking your debt with the avalanche method or snowball approach.

4. Applying for Multiple Credit Cards at Once

Virtually every time you apply for credit, the lender runs a hard inquiry to check your credit report. When you're seeking certain types of loans, such as mortgage and auto loans, having multiple inquiries in a short period typically won't do much harm because they're all counted as one inquiry when calculating your credit score.

That's not how it works with credit cards, though. When you apply for multiple credit cards in a short period, each inquiry will count against you. On its own, one inquiry may only knock a few points off your credit score, but multiple inquiries can have a compounding effect on your score.

If you want to have multiple credit cards, space out your applications by at least six months. Also, consider researching credit cards and better understand your likelihood of being approved before completing an application. Experian's card comparison tool can match you with credit cards according to your credit profile.

5. Taking on Unnecessary Credit

Taking out a loan to buy a home or a car may be unavoidable. Student loans are also often necessary to pay for a college education.

But if you intend to use student loan funds for non-educational purposes, get a personal loan to pay for a vacation or rack up a credit card balance with discretionary purchases, you could easily rack up more debt than you can afford to pay back, putting you at risk of late payments and even default.

The simplest solution is to only apply for credit when you really need it. This way, you'll avoid paying interest charges unnecessarily and stretching yourself too thin financially.

6. Closing Credit Card Accounts

When you close a credit card account in good standing—meaning you've never missed a payment—its history will remain on your credit reports for 10 years. But when you cancel a credit card, you lose its available credit immediately, which could cause your credit utilization rate to go up and hurt your credit score.

Additionally, your credit score will no longer benefit from the additional on-time payments you'd make over time. That won't necessarily hurt your credit score on its own, but it could impede its growth.

Before you close a credit card, carefully consider your reasoning. For example, if you've struggled with overspending or don't want the temptation, a potential hit to your credit could be worth it. The same is true if the card has an annual fee and you're not getting enough value from the account to make up for it.

7. Opting for Longer Auto Loan Terms

A long auto loan term may seem like a good idea because it lowers your monthly payment. An 84-month loan may result in lower monthly payments, but longer-term auto loans can have unintended consequences that potentially impact your credit.

In particular, if your car depreciates faster than you can pay off the debt, you'll be underwater on your loan. If the vehicle gets totaled in an accident or you want to trade it in for a newer car, you could be on the hook for the difference, and if you can't pay it, the lender could send it to collections. Not only that, a longer-term loan will result in paying much more in interest over the life of the loan.

If you're having trouble with the higher monthly payment that comes with a shorter-term loan, look for ways to reduce how much you borrow. Options include putting down more money, removing add-ons like a maintenance package or service contract or buying a less expensive vehicle.

8. Becoming Complacent

Managing your money well often requires that you regularly check your accounts, be proactive about saving and paying off debt, and look for opportunities to be more efficient with your cash flow.

As a result, it can be easy to become complacent about your situation, especially if you have a higher income. Unfortunately, complacency can make it easier to miss out on negative trends and poor credit habits that could have a significant negative impact in the long run.

While it might be good to take a break now and then, try to automate your finances as much as possible, so money management doesn't drain you.

Building Credit Is a Long Game

It can take years to get your credit score to where you want it to be. Checking your credit report and score regularly, paying your bills on time, keeping your credit card balances low and avoiding debt that could put a strain on your budget can all help you build and maintain a strong credit profile.

The more quickly you develop these habits and avoid credit missteps, the easier it will be to continue those behaviors over time and enjoy cheaper financing, lower auto and homeowners insurance rates and more.

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

Ben Luthi has worked in financial planning, banking and auto finance, and writes about all aspects of money. His work has appeared in Time, Success, USA Today, Credit Karma, NerdWallet, Wirecutter and more.

Read more from Ben