What Credit Card Can I Get With a 600 Credit Score?

A credit score of 600 puts you in the "fair" credit range, which can limit your credit card choices, especially if you're looking for a rewards card. But there are a handful of card options worth considering while you work to build your credit history.

If you're looking for a new credit card with a 600 credit score, here's what you need to know.

Is 600 a Good Credit Score?

The traditional FICO Score, which is the most widely used credit score by lenders, has a range of 300 to 850. Depending on where your credit score stands, it could fall into one of five categories. With a 600 credit score, you're firmly in the fair credit range.

Having a relatively low credit score typically results in higher interest rates on credit cards and loans. Also, many lenders have minimum credit requirements, so you could have a difficult time getting approved for certain cards.

Best Credit Cards for a 600 Credit Score

There are many different types of credit cards available. Depending on your goals and credit situation, you may consider one of the following:

- Secured credit cards: Designed primarily for people with bad or little credit, these cards function similarly to regular credit cards, but require an upfront security deposit as collateral. While you can get a secured credit card with fair credit, you may prefer an unsecured card if you can qualify for it and if the fees and interest are better than what you can find with a secured card.

- Student credit cards: Designed for college students, these cards are often available for people with limited or fair credit.

- Store credit cards: These cards are offered by retail stores and often allow you to earn rewards and get perks when you shop with the retailer. Most store cards are available to people with low credit scores.

- Rewards credit cards: These cards offer rewards in the form of cash back, points or miles. Most rewards credit cards are reserved for consumers with good credit or better, but some are available for fair-credit borrowers.

- 0% intro APR credit cards: With one of these cards, you can enjoy no interest on purchases for an introductory period after you open an account. They're generally only available if you have good credit or better.

- Balance transfer credit cards: These cards function similarly to 0% intro APR cards, but provide an interest-free period on balances that you transfer from other credit cards. Balance transfer cards typically require that you have at least good credit.

- Low-interest credit cards: Instead of offering an introductory 0% APR period, these cards provide a low ongoing interest rate—typically under the current average credit card APR. You generally need very good or exceptional credit to get approved for one of these cards.

- Small business credit cards: If you own a small business, this type of card can help you manage your expenses and take advantage of certain business-related perks. Most of these cards target business owners with good credit or better, but there are some options if you have fair credit.

What to Do if You're Denied a Credit Card

If you have a 600 credit score and apply for a card that's designed for people with good credit or better, you may have a tough time getting approved. Even applying for a fair-credit credit card doesn't guarantee approval.

If you do get denied, credit card issuers are required by law to give you an explanation as to why you were rejected. This typically comes in the form of an adverse action letter. The reasons listed in the letter will give you a better idea of which areas of your credit history you need to address.

You can also get free access to your Experian credit report if you've been denied credit. As you read through your report, look for items that could be damaging your credit score and work to address them.

One way to get approved if you've been denied for a card is to apply with a cosigner next time. Not all credit card issuers allow cosigners—Bank of America and U.S. Bank are the only major card issuers that do. But if you can get a credit card with a cosigner, it can boost your approval odds and give you another credit account that you can use to further build a positive credit history.

You can also use features offered by Experian to see what credit cards you may be matched to.

How to Improve Your Credit Score Before Applying for Credit Cards

Even if your credit score is good enough to get a credit card for fair credit, you may want to take some time to improve your credit before you apply. Depending on the current state of your credit, this process can take time, but it could make it possible for you to get approved for a better credit card.

The best place to start with improving credit is to check your credit report and credit score. These will give you a better idea of what's impacting your credit score and how you can address it.

To improve your credit before applying for a card:

- Pay your bills on time, every time.

- Get caught up on past-due payments, and pay off collection accounts.

- Pay down high credit card balances.

- Avoid closing old credit card accounts.

- Dispute inaccuracies with the credit bureaus.

- Avoid applying for new credit unless absolutely necessary.

- Use Experian Boost®ø to get credit for on-time utility and phone payments.

You can also ask a family member who has a good credit history to add you as an authorized user on one of their credit card accounts. This arrangement results in the entire history of the account being added to your credit reports, which can help improve your credit score.

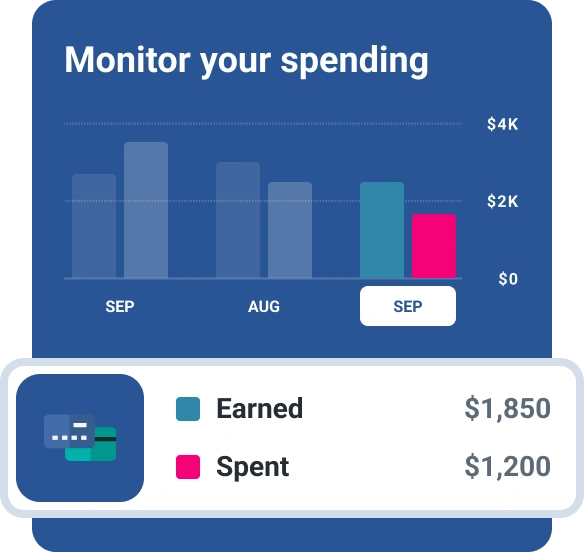

Continue to Monitor Your Credit After Approval

While your goal right now may be to get a new credit card, it's important to continue to monitor your credit after you get approved. It's especially important if you expect to take on more debt in the future for major purchases like vehicles or a home.

Building and maintaining a high credit score can also allow you to save on auto and homeowners insurance, and make it easier to get into an apartment. Some employers also check your credit report, so monitoring your credit and addressing potential concerns as they come up can help keep you on the right track.

Looking to build credit?

Discover secured credit card offers matched to you, so you can apply with confidence. Get started with your FICO® Score for free.

See your offersAbout the author

Ben Luthi has worked in financial planning, banking and auto finance, and writes about all aspects of money. His work has appeared in Time, Success, USA Today, Credit Karma, NerdWallet, Wirecutter and more.

Read more from Ben