Can You Get a Secured Credit Card With No Deposit?

Quick Answer

You need to set aside money for a security deposit to use a secured credit card. Often, you have to send the deposit before opening your account. But some secured card issuers have an arrangement that’s more like a prepaid card.

A secured credit card requires you to set aside money for a security deposit. Generally, this means sending the credit card issuer money before you open your account, with the amount you send determining your card's credit limit. You can get that security deposit back when you close the account if it's paid off. However, some secured cards allow you to move money in and out of the account that secures the credit line, letting you dynamically adjust your spending limit.

Why Do Secured Credit Cards Require a Deposit?

Secured cards require a security deposit because the cards often don't require a high (or any) credit score. Lenders use credit scores to understand the likelihood that they'll be repaid. They might not want to lend money to someone who has a low credit score, or doesn't have enough credit history to be scoreable. By requiring a security deposit, the card issuer can limit its risk of losing money.

When you open a secured credit card, you can often choose the security deposit amount from a limited range, such as $200 to $3,000. The amount you send will determine your card's credit limit. You won't get it back until you close your account or transition to an unsecured card—which is only an option with some secured cards.

You'll still have to make your monthly payments if you want to build credit, avoid late payment fees and keep your account in good standing. But the card issuer can keep the security deposit if you fall behind on their payments. Once you have fair to good credit, you can likely qualify for an unsecured card that doesn't require a security deposit.

Some Secured Cards Don't Require an Upfront Deposit

While the approach described above has been the standard for years, some card issuers are now giving applicants a new option.

Instead of requiring an upfront security deposit, they work more like prepaid cards. You can transfer money into an account and then use your credit card to spend the money. If you change your mind, you can transfer the funds out of the account whenever you want. Unlike prepaid cards, your payments get reported to the credit bureau to help you build credit.

Some of these cards also don't require a credit check. However, you may need to have a bank account with the company and meet other requirements, such as setting up a regular direct deposit, to qualify.

Alternatives to a Secured Card

While you can use a secured card to build credit, you might not be able to afford or want to part with the money you'll need to set aside as a security deposit. Here are a few alternative options:

- Cards that don't require an upfront deposit: Look to see if you can open and qualify for an account and secured credit card that doesn't require a large upfront deposit. A few fintech companies also offer debit cards that you can use to build credit.

- Unsecured credit cards: There are unsecured cards that don't require good credit, although they may have high fees and few perks. Also, look into unsecured cards that don't require any credit because the card issuer reviews your bank account history rather than credit history.

- A credit-builder loan: Similar to a secured card, a credit-builder loan requires you to lock up funds equal to your loan amount. You can build credit with your loan payments and get the full amount unlocked once you pay off the loan.

- Become an authorized user: If someone else adds you as an authorized user on one of their credit cards, the account information might be reported under your name and help you establish or build credit.

- Experian Go™: You can use Experian Go to create your Experian credit report, even if you don't have any credit accounts or credit history. This is the first step in qualifying for a credit score.

- Experian Boost®ø: Once you have a credit report, you can use Experian Boost to get credit for bills you already pay, including your utility, telecom, rent and certain streaming service payments.

Building your credit can help you qualify for additional financial products, including premium credit cards and personal loans with low rates and no fees. But if you need to borrow money right away, you could look into a personal loan (there are secured and unsecured options) and various types of emergency loans.

See If You Match With a Secured Card

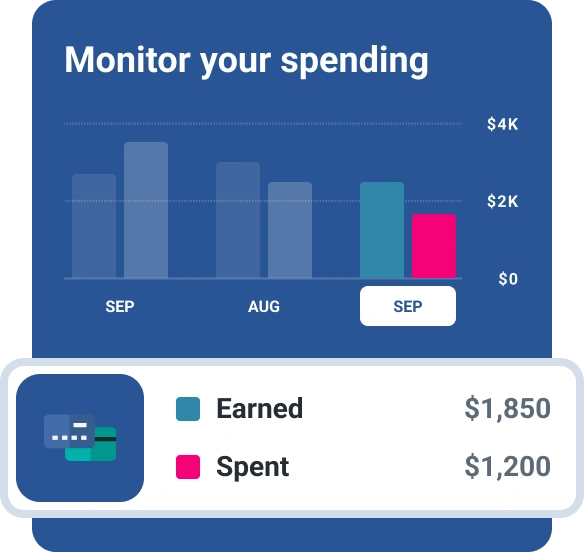

Many credit card issuers offer secured credit cards, and you may want to compare your options before applying. Look into the security deposit requirement, annual fees, rewards and whether there's a way to transition to an unsecured card later. If you use Experian's free comparison tool, you can quickly compare cards and get matched with credit card offers based on your unique credit profile.

Don’t apply blindly

Apply for credit cards confidently with personalized offers based on your credit profile. Get started with your FICO® Score for free.

See your offersAbout the author

Louis DeNicola is freelance personal finance and credit writer who works with Fortune 500 financial services firms, FinTech startups, and non-profits to teach people about money and credit. His clients include BlueVine, Discover, LendingTree, Money Management International, U.S News and Wirecutter.

Read more from Louis