How Secured Credit Card Deposits Work

Quick Answer

The deposit in a secured credit card acts as collateral and is typically equal to your credit limit. Card issuers use your deposit to pay off your balance if you default, but you can’t use it to make your monthly payments.

It can be challenging to get approved for a credit card if you're new to credit or have poor credit. Secured credit cards, secured by a deposit you make when applying for the card, can offer a solution. The security deposit on a secured credit card is generally equal to your credit limit and acts as collateral, making card issuers more willing to extend you credit.

What Is a Security Deposit for a Credit Card?

A security deposit is a refundable deposit that serves as collateral for a secured credit card. You make the deposit when you open the credit card account. The credit card issuer keeps the deposit and only uses it if you default on your credit card balance. However, you can't use the security deposit to pay your monthly credit card bill.

In most cases, your credit limit is equal to your security deposit. If you make a $200 security deposit, for example, you usually receive a $200 credit limit. However, some card issuers offer a credit limit higher than your security deposit.

Eventually, you may be able to increase the card's credit limit by making an additional security deposit or by regularly paying your bill on time. Check your credit card's terms to see how you can increase your credit limit.

How to Make a Deposit on a Secured Credit Card

Making a security deposit is usually the last step in applying for a secured credit card. Here's how that process works.

- Fill out an application online. You'll be asked for personal details such as your name, Social Security number and monthly income.

- Select your desired credit limit. You can generally choose a credit limit between $200 and $2,000, depending on the card.

- Make a security deposit. In addition to a deposit equal to your chosen credit limit, there may be additional fees, such as processing or application fees. You can pay by debit or electronic funds transfer. Have your bank account information handy and make sure there's enough money in the account to cover the payment.

- Get approved. After making your security deposit, you'll generally be approved right away. Some card issuers let you wait until you're approved to make your security deposit. You must make the deposit within a certain time, though, or the approval will be withdrawn.

- Start using your secured credit card. Once you receive your secured credit card in the mail and activate it, you can start using it like any other credit card.

When Do You Get Your Secured Credit Card Deposit Back?

You typically get your secured credit card deposit back when you pay your balance and close your account or when your secured credit card converts to an unsecured card. After you demonstrate responsible use of your secured credit card over a certain period, the card issuer may offer to convert it to an unsecured card.

If you're interested in this option, make sure the card issuer offers unsecured credit cards before you apply for a secured card. Check the terms and conditions of the card for details about when you can get your deposit back.

How to Get a Credit Card Without a Security Deposit

Even if you have poor credit or are new to credit, it's possible to get a credit card without paying a security deposit. Here are some alternatives:

- Find credit cards that don't require a credit check. Instead of checking your credit report and credit score, some credit card issuers evaluate your credit application using alternative data. They may check your banking history; your buy now pay, later history; or your history of utility, rent or subscription service payments.

- Get a cosigner. Most major credit card issuers don't allow cosigners anymore, but you may be able to find a card that does. A cosigner on a credit card applies for the card with you and promises to pay if you default on your credit card balance. Having a cosigner with a good credit score may enhance your odds of being approved for a credit card.

- Become an authorized user on someone else's credit card. Will a family member or friend with good credit add you to their credit card account? As an authorized user, you can use the card for purchases, but the primary cardholder is legally responsible for payments. If the card issuer reports payments to the three major credit bureaus (Experian, TransUnion and Equifax), you can benefit from the account owner's positive payment history.

- Improve your credit. Get your free credit report from all three credit bureaus at AnnualCreditReport.com and make sure the information is complete and up to date. If you see anything you believe is inaccurate, file a dispute. Next, work on improving your credit scores by bringing any late accounts current. Make payments on time going forward and pay down credit card debt to reduce your credit utilization ratio.

- Sign up for Experian Boost®ø. Payments for rent, utility bills, phone bills, insurance premiums, streaming subscriptions and internet services aren't normally included in your credit report and don't affect your credit score—unless you use Experian Boost. This free feature adds on-time payments of these bills to your Experian credit history, which could help increase your FICO® ScoreΘ.

- Consider taking out a credit-builder loan. Designed to help build credit, a credit-builder loan deposits a lump sum into a savings account in your name. You make monthly payments on the loan, which are reported to the credit bureaus. After repaying the loan, you receive the money in the savings account possibly including interest earned. If you've made your payments on time, your credit score could benefit too. Make sure your lender reports your payment activity to all three credit bureaus.

Some card issuers offer to convert your secured credit card into an unsecured card once you've made payments on time for six to 12 months. Others require you to request an unsecured card. Once you're approved for an unsecured card from the same card issuer, your secured card is closed and your security deposit is refunded. After showing responsible use with your secured card, you may qualify for unsecured cards from other card issuers that do not require a security deposit.

The Bottom Line

When you're new to credit or trying to repair damaged credit, getting a secured credit card that reports to the major credit bureaus is a good way to build a solid credit history. No matter what type of credit card you obtain, using credit responsibly is key to improving your credit score. Late payments can ding your credit, so consider setting up autopayments to ensure your bill is always paid on time.

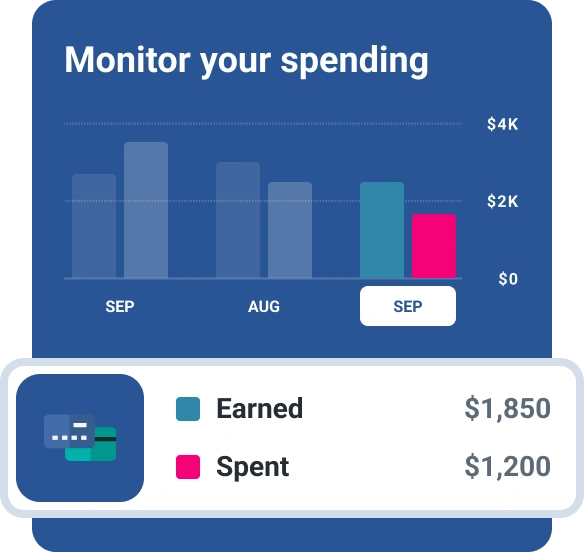

Signing up for Experian's free credit monitoring is an easy way to keep an eye on your credit. You'll get alerts of important changes in your credit usage and can see whether your efforts to improve your credit are paying off.

Looking to build credit?

Discover secured credit card offers matched to you, so you can apply with confidence. Get started with your FICO® Score for free.

See your offersAbout the author

Karen Axelton is Experian’s in-house senior personal finance writer. She has over 20 years of experience as a journalist and has written or ghostwritten content for a variety of financial services companies.

Read more from Karen