779 Credit Score: Is it Good or Bad?

Your score falls within the range of scores, from 740 to 799, that is considered Very Good. A 779 FICO® Score is above the average credit score. Consumers in this range may qualify for better interest rates from lenders.

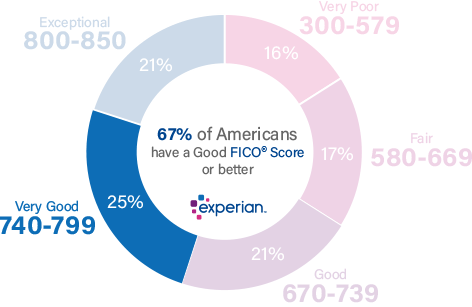

25% of all consumers have FICO® Scores in the Very Good range.

Approximately 1% of consumers with Very Good FICO® Scores are likely to become seriously delinquent in the future.

Improving your 779 Credit Score

A FICO® Score of 779 is well above the average credit score of 714, but there's still some room for improvement.

Among consumers with FICO® credit scores of 779, the average utilization rate is 14.7%.

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, you'll receive information about ways you can boost your score, based on specific information in your credit file. You'll find some good general score-improvement tips here.

Advantages of your Very Good credit score

A credit score in the Very Good range signifies a proven track record of timely bill payment and good credit management. Late payments and other negative entries on your credit file are rare or nonexistent, and if any appear, they are likely to be at least a few years in the past.

People with credit scores of 779 typically pay their bills on time; in fact, late payments appear on just 18% of their credit reports.

People like you with Very Good credit scores are attractive customers to banks and credit card issuers, who typically offer borrowers like you better-than-average lending terms. These may include opportunities to refinance older loans at better rates than you were able to get in years past, and chances to sign up for credit cards with enticing rewards as well as relatively low interest rates.

How to keep on track with a Very Good credit score

Your 779 credit score means you've been doing a lot right. To avoid losing ground, be mindful of avoiding behaviors that can lower your credit score.

Factors that can have negative effects on Very Good credit scores include:

Utilization rate on revolving credit Utilization, or usage rate, is a measure of how close you are to "maxing out" credit card accounts. You can calculate it for each of your credit card accounts by dividing the outstanding balance by the card's borrowing limit, and then multiplying by 100 to get a percentage. You can also figure your total utilization rate by dividing the sum of all your card balances by the sum of all their spending limits (including the limits on cards with no outstanding balances).

| Balance | Spending limit | Utilization rate (%) | |

|---|---|---|---|

| MasterCard | $1,200 | $4,000 | 30% |

| VISA | $1,000 | $6,000 | 17% |

| American Express | $3,000 | $10,000 | 30% |

| Total | $5,200 | $20,000 | 26% |

Most experts recommend keeping your utilization rates at or below 30%— on individual accounts and all accounts in total—to avoid lowering your credit scores. The closer any of these rates gets to 100%, the more it hurts your credit score. Utilization rate is responsible for nearly one-third (30%) of your credit score.

Late and missed payments matter a lot. More than one-third of your score (35%) is influenced by the presence (or absence) of late or missed payments. If late or missed payments are part of your credit history, you'll help your credit score significantly if you get into the routine of paying your bills promptly.

Time is on your side. If you manage your credit carefully and stay timely with your payments, however, your credit score will tend to increase with time. In fact, if all other score influences are the same, an longer credit history will yield a higher credit score than a shorter one. There's not much you can do to change this if you're a new borrower, other than be patient and keep up with your bills. Length of credit history is responsible for as much as 15% of your credit score.

Debt composition. The FICO® credit scoring system tends to favor multiple credit accounts, with a mix of revolving credit (accounts such as credit cards that enable you to borrow against a spending limit and make monthly payments of varying amounts) and installment loans (e.g., car loans, mortgages and student loans, with set monthly payments and fixed payback periods). Credit mix is responsible for about 10% of your credit score.

Credit applications and new credit accounts typically have short-term negative effects on your credit score. When you apply for new credit or take on additional debt, credit-scoring systems flag you as being at greater risk of being able to pay your bills. Credit scores drop a small amount when that happens, but typically rebound within a few months, as long as you keep up with all your payments. New credit activity can contribute up to 10% of your overall credit score.

When public records appear on your credit report they can have severe negative impacts on your credit score. Entries such as bankruptcies do not appear in every credit report, so they cannot be compared to other credit-score influences in percentage terms, but they can overshadow all other factors and severely lower your credit score. A bankruptcy, for instance, can remain on your credit report for 10 years. If there are liens or judgments on your credit report, it's in your best interest to settle them as soon as possible.

61% of individuals with a 779 FICO® Score have credit portfolios that include auto loans. 51% have a mortgage.

Shield your credit score from fraud

People with Very Good credit scores can be attractive targets for identity thieves, eager to hijack your hard-won credit history. To guard against this possibility, consider using credit-monitoring and identity theft-protection services that can detect unauthorized credit activity. Credit monitoring and identity theft protection services with credit lock features can alert you before criminals can take out bogus loans in your name.

Credit monitoring is also useful for tracking changes in your credit scores. It can spur you to take action if your score starts to slip downward, and help you measure improvement as you work toward a FICO® Score in the Exceptional range (800-850).

Credit card fraud was the most common form of identity theft (133,015 reports), followed by employment or tax-related fraud (82,051 reports), phone or utilities fraud (55,045 reports), and bank fraud (50,517 reports) in 2017, according to the FTC.

Learn more about your credit score

A 779 credit score is Very Good, but it can be even better. Boosting your score into the Exceptional range could let you qualify you for the very best interest rates and terms. A great starting point is to get your check your credit score to find out the specific factors that impact your score the most. Read more about score ranges and what a good credit score is.