620 Credit Score: Is it Good or Bad?

A FICO® ScoreΘ of 620 places you within a population of consumers whose credit may be seen as Fair. Your 620 FICO® Score is lower than the average U.S. credit score.

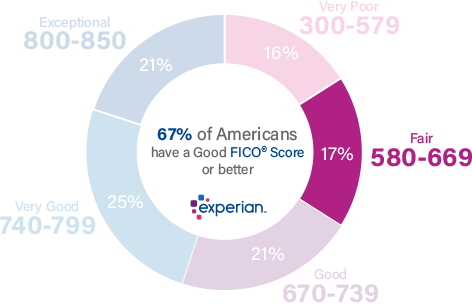

17% of all consumers have Scores in the Fair range (580-669).

Statistically speaking, 28% of consumers with credit scores in the Fair range are likely to become seriously delinquent in the future.

Some lenders dislike those odds and choose not to work with individuals whose FICO® Scores fall within this range. Lenders focused on "subprime" borrowers, on the other hand, may seek out consumers with scores in the Fair range, but they typically charge high fees and steep interest rates. Consumers with FICO® Scores in the good range (670-739) or higher are generally offered significantly better borrowing terms.

How to improve your 620 Credit Score

Think of your FICO® Score of 620 as a springboard to higher scores. Raising your credit score is a gradual process, but it's one you can begin right away.

84% of U.S. consumers' FICO® Scores are higher than 620.

You share a 620 FICO® Score with tens of thousands of other Americans, but none of them has that score for quite the same reasons you do. For insights into the specific causes of your score, and ideas on how to improve it, get copies of your credit reports and check your FICO® Score. Included with the score, you will find score-improvement suggestions based on your unique credit history. If you use those guidelines to adopt better credit habits, your score may begin to increase, bringing better credit opportunities.

Learn and grow your credit score

While everyone with a FICO® Score of 620 gets there by his or her own unique path, people with scores in the Fair range often have experienced credit-management challenges.

The credit reports of 95% of Americans with a FICO® Score of 620 include late payments of 30 days past due.

Credit reports of individuals with Fair credit cores in the Fair range often list late payments (30 days or more past due) and collections accounts, which indicate a creditor has given up trying to recover an unpaid debt and sold the obligation to a third-party collections agent.

Some people with FICO® Scores in the Fair category may even have major negative events on their credit reports, such as foreclosures or bankruptcies—events that severely lower scores. Full recovery from these setbacks can take up to 10 years, but you can take steps now to get your score moving in the right direction.

Studying the report that accompanies your FICO® Score can help you identify the events that lowered your score. If you correct the behaviors that led to those events, work steadily to improve your credit, you can lay the groundwork to build up a better credit score.

Past deeds (and misdeeds) feed your credit score

Credit-scoring systems such as FICO® use information compiled in your credit reports to calculate your score. More recent events in your credit history tend to count more than older activities and, as with any type of analysis, some kinds of information carry more weight than others. Knowing which activities matter most can help you prioritize the steps to take when working toward a better credit score:

Late and missed payments are among the most significant factors to your credit score. More than one-third of your score (35%) is influenced by the presence (or absence) of late or missed payments. Lenders want borrowers who pay their bills on time, and individuals who have missed payments are statistically more likely to default (go 90 days past due without a payment) than those who pay their bills on time. If late or missed payments are part of your credit history, you can do yourself and your credit score a favor by developing a routine for paying your bills promptly.

Utilization rate on revolving credit is responsible for nearly one-third (30%) of your credit score. Utilization, or usage rate, is a technical way of describing how close you are to "maxing out" your credit card accounts. You can measure your utilization on an account-by-account basis by dividing each outstanding balance by the card's spending limit, and multiplying by 100 to get a percentage. You can also calculate your total utilization rate by dividing the sum of all balances by the sum of all spending limits.

| Balance | Spending limit | Utilization rate (%) | |

|---|---|---|---|

| MasterCard | $1,200 | $4,000 | 30% |

| VISA | $1,000 | $6,000 | 17% |

| American Express | $3,000 | $10,000 | 30% |

| Total | $5,200 | $20,000 | 26% |

Most experts agree that utilization rates in excess of 30%— on individual accounts and all accounts in total—tend to lower credit scores. The closer any of these utilization rates gets to 100%, the more it hurts your credit score.

Age is your friend. All other factors being the same, the longer you've been a user of credit, the higher your credit score is likely to be. There's not much that can be done about that if you're a new borrower, and it also doesn't help much if your recent credit history is marred by late missed payments or high utilization rates. If you manage your credit carefully and stay timely with your payments, however, your credit score will tend to increase with time. Length of credit history is responsible for as much as 15% of your credit score.

Your total debt and its composition are responsible for about 10% of your credit score. The FICO® credit scoring system tends to favor individuals with multiple credit accounts, consisting of a mix of installment loans (e.g., car loans, mortgages and student loans, with set monthly payments and fixed payback periods) and revolving credit (accounts such as credit cards that enable you to borrow against a spending limit and make payments of varying amounts each month).

Credit applications and new credit accounts typically have short-term negative effects on your credit score. When borrowers apply for new credit or take on additional debt, they assume greater risk of being able to pay their bills. Credit scoring systems like FICO® typically cause scores to dip a bit when that happens, but scores will typically rebound within a few months as long as you keep up with all your payments. New-credit activity can contribute up to 10% of your overall credit score.

Public records such as bankruptcies have severe negative impacts on your credit score if they appear on your credit report. Because they do not appear in every credit report, these entries cannot be compared to other credit-score influences in terms of percentage, but they can eclipse all other factors and severely lower your credit score. A bankruptcy, for instance, can remain on your credit report for 10 years, and may effectively prevent you from getting credit for much or all of that time.

Learn and grow your credit score

Fair credit scores can't be turned into exceptional ones overnight, and only the passage of time can repair some negative issues that contribute to Fair credit scores, such as bankruptcy and foreclosure. No matter the reason for your Fair score, you can start immediately to improve the ways you handle credit, which can lead in turn to credit-score improvements.

Look into obtaining a secured credit card. A secured credit card requires you to put down a deposit in the full amount of your spending limit—typically a few hundred dollars. Confirm that the As you use the card and make regular payments, the lender reports your activity to the national credit bureaus, where they are recorded in your credit files. (Making timely payments and avoiding "maxing out" the card will favor credit-score improvements.

Consider a credit-builder loan. Available from many credit unions, these loans take can several forms, but all are designed to help improve personal credit histories. In one popular version, the credit union places the money you borrow in a savings account, where it earns interest but is inaccessible to you until the loan is paid off. Once you've paid the loan in full, you get access to the funds and the accumulated interest. It's a clever savings tool, but the credit union also reports your payments to national credit bureaus, so regular, on-time payments can lead to credit-score improvements. (Check before taking out a loan to make sure the lender reports to all three national credit bureaus.)

Consider a debt-management plan. For families with finances stretched too thin to keep up with debt payments, a debt-management plan (DMP) can bring much-needed relief. Getting one requires you to work with a qualified credit counseling agency, who negotiates with your creditors to set up a workable repayment plan. It's a serious step that significantly lowers your credit score and effectively closes all your credit accounts, but it's less severe than bankruptcy, and it can help families in dires straits get back on their feet. Even if you decide a DMP isn't for you, meeting with a credit counselor (not a credit-repair company) may give you some new tools for building up your credit.

Pay your bills on time. Late and missed payments hurt credit scores, so avoid them. Take advantage of automatic payments, calendar alarms, and other automated tools—or just use sticky notes and a paper calendar. Do whatever you can to help you remember, and you'll soon take on good habits that favor credit-score improvements.

Avoid high credit utilization rates. High credit utilization, or debt usage. The FICO® scoring system bases about 30% of your credit score on this measurement—the percentage of your available credit limit represented by your outstanding payment balances. Try to keep your utilization across all your accounts below about 30% to avoid lowering your score.

Among consumers with FICO® credit scores of 620, the average utilization rate is 57.2%.

Try to establish a solid credit mix. You shouldn’t take on debt you don’t need, but prudent borrowing, including a combination of revolving credit and installment debt, can be beneficial to your credit score.

Learn more about your credit score

A 620 FICO® Score is a good starting point for building a better credit score. Boosting your score into the good range could help you gain access to more credit options, lower interest rates, and reduced fees. You can begin by getting your free credit report from Experian and checking your credit score to find out the specific factors that impact your score the most. Read more about score ranges and what a good credit score is.