How Long Should I Keep a Secured Credit Card?

Quick Answer

Whether you're building credit from scratch or rebuilding a poor credit history, there's no minimum amount of time you should hold on to a secured credit card. Instead, focus on how the card is helping you work toward your goal and consider the card's features to determine the right approach.

Secured credit cards can be a great way for credit newbies to establish a credit history or for people who have made some missteps to rebuild a positive credit profile. But they're generally not designed to be forever cards, and in some cases, you can't get your security deposit back unless you close the account.

But how long should you hold on to a secured credit card? There's no hard-and-fast rule. The right answer depends on your current credit situation, how well you manage the account, the card's upgrade options and other factors.

How Long Does It Take to Build Credit With a Secured Card?

If you have a limited credit history or a low credit score, a secured credit card can help you build credit with responsible use. But there's no predetermined timeline for how long that will take. Ultimately, it depends on a few factors, including:

- Your current credit health: If you're building credit from scratch, it may take you longer to establish a good credit score with your secured credit card compared to someone who already has some positive credit history. On the flip side, if you have some serious derogatory marks on your credit reports, it can take even longer because the negative influence of those marks can hinder your efforts early on.

- How you use the account: The best way to build a positive credit history is to maintain a low balance—your credit utilization rate is one of the most influential factors in your credit score—and pay your bill on time every month. Unfortunately, secured credit cards typically have low credit limits due to their security deposit requirement. If you're regularly bumping up against your credit limit, it can take longer to accomplish your goal.

- Other credit-building efforts: Using a secured credit card is just one of the many ways you can build credit. If you're expanding your efforts with other credit-building strategies, it can help accelerate the process.

At a minimum, it can take several months—and sometimes longer than a year—to build up your credit score enough to qualify for better credit card options.

Should I Close a Secured Credit Card After Building Credit?

Once you've achieved your credit goal, you may be considering closing the secured credit card. However, there are a few things to consider before you proceed:

- You'll lose the available credit. The more available credit you have, the better it is for your credit utilization rate. If you cancel your secured credit card and don't have significant available credit on another card, it could hurt your credit score in the short term.

- You may lose your oldest account. If you didn't have a credit history before you opened the secured credit card, closing it would negatively impact your length of credit history, which incorporates how long your oldest account has been open and has an impact on credit scores.

- It could affect your credit mix. Having different types of credit can help improve your credit score. If you have a secured credit card and a student loan, for instance, closing the card will make your credit file less diverse, which can negatively affect your credit score.

Before closing the card, check with your card issuer about upgrade options. Some, for instance, may automatically consider you for an upgrade or conversion to an unsecured card after a certain amount of time has passed. When this happens, you'll receive a refund of your deposit.

If you haven't received an upgrade, reach out to your card issuer and ask about your options.

If your credit card issuer won't allow you to upgrade or convert your secured card to an unsecured credit card and return your deposit—or the card charges a hefty annual fee—it may be better to close the account and get your money back and avoid further charges.

How to Properly Close a Secured Card

If you've decided that closing your secured credit card is the right move, here are some steps you can take to minimize the potential negative consequences:

- Wait until you've opened a new credit card. If your credit is in good shape, consider opening another credit card so the loss of the available credit on the secured card will have less of an impact on your credit score. Just try to avoid applying for too many credit cards too quickly—multiple hard inquiries in a short period can damage your credit.

- Pay off your balance. Some credit card issuers won't close your account until there's a zero balance. Stop using the card and wait until pending transactions go through, then pay off the balance in full.

- Cancel recurring charges. If you set up your secured credit card to pay for subscriptions or other recurring bills, change the payment method so there's no risk of another charge going through while you're in the process of canceling the account.

- Redeem your rewards. If your secured credit card offers cash back, points or miles, check your rewards balance and redeem what you can to avoid forfeiting that value.

- Contact your credit card issuer. Depending on your card issuer, you may be able to request an account closure through your online account, over the phone or even in person. Explain your reason for canceling the card and make sure the card issuer has the correct information for your security deposit refund. Request written confirmation once the account has been closed.

- Keep an eye on your credit reports. Because credit card issuers typically only report to the credit reporting agencies once a month, it can take a while before the closure shows up on your credit report. You can check your Experian credit report for free anytime to stay on top of the process.

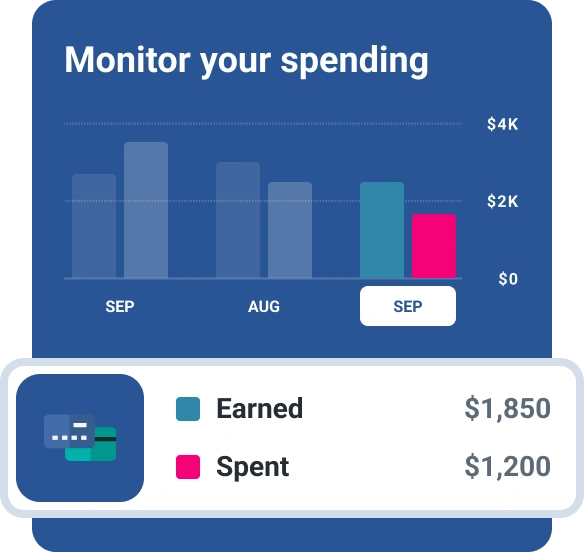

Monitor Your Credit Progress Throughout the Process

Regardless of where you are on your credit journey, it's important to check your credit score and reports regularly to understand how your actions impact your overall credit health.

With Experian's credit monitoring service, you'll get free access to your FICO® ScoreΘ and Experian credit report, making it easy to track your progress. You'll also get real-time alerts when changes are made to your report, so you can spot potential issues, including identity theft, before they get out of hand.

Looking to build credit?

Discover secured credit card offers matched to you, so you can apply with confidence. Get started with your FICO® Score for free.

See your offersAbout the author

Ben Luthi has worked in financial planning, banking and auto finance, and writes about all aspects of money. His work has appeared in Time, Success, USA Today, Credit Karma, NerdWallet, Wirecutter and more.

Read more from Ben