What Is a FICO Score, and Why Is It Important?

Quick Answer

A FICO® Score is a type of credit score typically ranging from 300 to 850 that companies use to evaluate your creditworthiness. Your FICO® Scores can impact your eligibility and offers when you apply for a loan or credit card and affect other areas of your life, like your options when renting or getting insurance.

Many companies use credit scores when reviewing credit applications and managing accounts. One of the most popular types of credit scores is the FICO® ScoresΘ 10 and 10 T. But there are different versions of the FICO® Score, and companies can choose the version that best fits their needs. Here's what to know about the different types of FICO® Scores, what factors into these credit scores and why they're important.

What Is a FICO® Score?

FICO was one of the first companies to create a credit score for lenders based on a consumer's credit reports. The broad applicability and usefulness of the FICO® Score made it one of the most popular ways for companies to evaluate risk. And the FICO® Score became so popular that the terms credit score and FICO® Score are often used interchangeably.

Over the years, FICO has developed different versions of its FICO® Scores:

- Base FICO® Scores: The Base FICO® Scores are intended to predict the likelihood that a person falls behind on any type of credit account. These scores, such as FICO® Score 8, FICO® Score 9 and FICO® Scores 10 and 10 T range from 300 to 850.

- Industry -specific FICO® Scores. FICO creates industry-specific scores for auto lenders and credit card issuers. They're built on top of the new base scores, so there's a FICO Auto Score 10 that goes with the base FICO® Score 10. The industry-specific scores range from 250 to 900.

- FICO® Scores that use alternative data: The UltraFICO® and FICO XD scores consider data that isn't traditionally found in your credit report, such as utility payments and banking history data, if you agree to connect your bank account. They can help companies score people who aren't scorable with other FICO models or adjust a score based on the alternative data to help people qualify for new credit accounts. The scores range from 300 to 850.

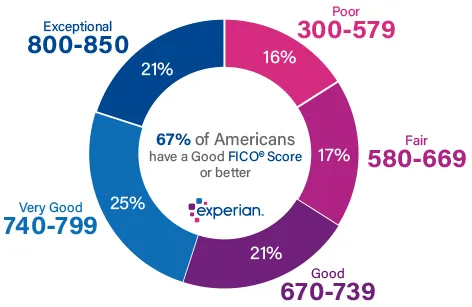

Additionally, FICO breaks down its scores into score ranges, which companies and people can use to determine if someone has poor, good or exceptional credit. The industry-specific scores extend the poor and exceptional ranges, so poor is 250 to 579 and exceptional is 800 to 900. But the base model breakdowns are as follows:

How Is a FICO® Score Calculated?

Most FICO® Scores are based solely on the information in one of your credit reports from the major credit bureaus: Experian, TransUnion or Equifax.

FICO shares how different factors influence the average person's FICO® Score, which can help you if you're working to improve your credit. However, the specific scoring calculations are a trade secret, and the influence of different factors can vary depending on what's in your credit report.

Payment History: 35%

Your payment history with credit cards and loans is the most important factor in your FICO® Scores. Paying your bills on time is one of the best ways to improve your credit scores. Late payments, collection accounts and filing for bankruptcy could hurt your FICO® Score.

Amounts Owed: 30%

How much you owe, the balances on different types of credit accounts and the number of accounts with balances can affect your FICO® Scores. Your credit utilization ratio—the portion of available credit you're using on revolving accounts, like credit cards—can also be a significant factor. Paying off accounts and having a low utilization rate is best for your FICO® Scores.

Length of Credit History: 15%

The length of your credit history refers to the age of the open and closed accounts in your credit report. The average age of your accounts and the ages of your oldest and newest accounts could be factors. A longer credit history is a plus.

Credit Mix: 10%

Your credit mix refers to your experience managing different types of credit accounts, such as credit cards and installment loans like an auto loan or mortgage. Having experience with different types of credit can help your FICO® Scores.

New Credit: 10%

Lenders typically consider it a red flag if you apply for or open several new credit accounts in a short period. Even applications that are denied could hurt your FICO® Scores because the hard inquiry from the credit check still gets added to your report.

Learn more: The Complete Guide to Understanding Credit Scores

FICO® Score vs. VantageScore® models

FICO® Scores are used by 90% of top lenders, according to the company. However, companies can also use VantageScore credit scores when reviewing applications and managing customers' accounts. Some companies also create and use custom scoring models instead of, or alongside, a FICO® Score or VantageScore credit score.

There are many similarities and several differences between the FICO and VantageScore models.

Number of Scores

Both companies develop and release new scores over time, but:

- FICO has dozens of scoring models. FICO releases new versions of its score that have a single name, but it technically creates three versions of each score—one to go with each credit bureau. There are over 40 versions of the FICO® Score.

- VantageScore has five scoring models. VantageScore creates scoring models that can work with a credit report from any of the three credit bureaus. It has released five scoring models: VantageScore 1.0 through 4.0 and 4plus.

Score Ranges

Most FICO® Score and VantageScore credit scores use the 300 to 850 range. The FICO industry-specific scores are an exception as they range from 250 to 900.

Older VantageScore 1.0 and 2.0 models used a different range (501 to 990), but VantageScore models have ranged from 300 to 850 since 2013.

Scoring Factors

Most FICO and VantageScore credit scores use the same underlying data to try to predict the likelihood that someone will miss a bill payment in the following two years. As a result, the same types of actions can similarly affect all your scores. But the scoring models consider and weight information differently.

Here's how FICO and VantageScore describe the relative importance of different factors for the average person.

| Factor | Weight | Factor | Weight |

|---|---|---|---|

| Payment history | 35% | Payment history | Extremely influential |

| Amounts owed | 30% | Total credit usage | Highly influential |

| Length of credit history | 15% | Credit mix and experience | Highly influential |

| New credit | 10% | New accounts opened | Moderately influential |

| Credit mix | 10% | Balances and available credit | Less influential |

Scoring Requirements

You need to have a minimum amount of information in your credit report for a scoring model to generate a score.

FICO® Scores require:

- An account that's at least six months old, and

- Activity on a credit account during the past six months

These requirements can be met with one or two accounts in your credit report.

VantageScore credit scores require:

- A credit account, even if it's less than six months old and hasn't been active recently, or

- A collection account or bankruptcy filing

Lender Usage

FICO doesn't specify how companies use its credit scores, but lenders commonly use credit scores when deciding who to send offers to, reviewing applications and managing existing accounts.

More than 3,400 organizations use VantageScore credit scores, according to a 2023 VantageScore Market Study Report. These include top banks and credit card issuers. Companies use VantageScore credit scores similar to how they use FICO® Scores.

One of the biggest differences in usage is that mortgage lenders generally use FICO® Scores when making lending decisions. However, that may change by the end of 2025, when mortgage lenders may need to provide both FICO and VantageScore credit scores to investors.

Why Are FICO® Scores Important?

Your FICO® Scores can affect many decisions and offers, including:

- Whether you get approved for a new loan or credit card

- Your interest rate and fees on new credit accounts

- Your loan amount or credit limit

- Whether you can rent a home or apartment

- The security deposit when you rent a home or apartment

Improving your FICO® Scores can help you get approved and receive better offers.

Learn more: Facts About Credit You May Not Know

How to Get Your FICO® Score for Free

You can get your FICO® Score 8 from Experian for free with ongoing score tracking. If you want additional scores, such as industry-specific scores, look into Experian's paid premium memberships.

You may also be able to see one of your FICO® Scores for free from your lender, credit card issuer or financial counselor. FICO has an online list with many of the companies that participate in its FICO® Score Open Access program, which allows companies to share the FICO® Score that they receive with their customers.

Frequently Asked Questions

Get Personalized Insights on Your FICO® Score

You can have many FICO® Scores, and no score is necessarily better or more real than the others. In fact, you often won't know which credit score a creditor will use when evaluating your application or account. However, because the scoring factors are all similar, the changes that affect one of your scores can influence all the others.

A free Experian account allows you to track your FICO® Score 8, and it shows you how you're faring with each of the five scoring categories. You can also see the top five factors that are helping or hurting your FICO® Score.

What’s on your credit report?

Stay up to date with your latest credit information—and get your FICO® Score for free.

Get your free reportNo credit card required

About the author

Brianna McGurran is a freelance journalist and writing teacher based in Brooklyn, New York. Most recently, she was a staff writer and spokesperson at the personal finance website NerdWallet, where she wrote "Ask Brianna," a financial advice column syndicated by the Associated Press.

Read more from Brianna