How Can a Starter Credit Card Help Build Credit?

It's something of a Catch-22: To qualify for most credit cards, you need to have a credit history. But without a credit card or other type of loan, you can't build credit.

Traditionally, the only credit card options for people with little or no credit history have been secured credit cards (which require a security deposit), student credit cards and unsecured cards with steep annual percentage rates (APRs) and high ongoing fees.

Fortunately, that's no longer the case with every starter credit card. Here's why you should consider a starter credit card and what to look out for.

What Is a Starter Credit Card?

As the name suggests, a starter credit card is designed for people who have a limited credit history or no experience with credit at all.

These cards can provide access to the credit system, helping you establish a positive credit history as you use the card responsibly and pay your bill on time each month.

In general, there are three types of starter credit cards: secured credit cards, student credit cards and unsecured credit cards for bad or no credit.

Secured Credit Cards

Secured credit cards function the same as unsecured cards with one key difference: They require a security deposit—typically equal to your desired credit limit—to get approved. Because this reduces the lender's risk, secured cards can be easier to qualify for than unsecured cards.

"It's easier to get a secured card rather than an unsecured one because you're basically taking the risk away from an issuer," says Bill Hardekopf, CEO of LowCards.com. "You're securing the loan with a deposit [and] that deposit basically acts as your credit limit."

In most cases, you'll get the deposit back after you close the account in the future. Some card issuers, however, may choose to refund your deposit while your account is still open, effectively converting it into an unsecured card.

Many secured credit cards charge an annual fee, but some of the best secured cards don't. Also, don't expect a lot of perks with one of these cards, although some do offer cash back rewards.

Student Credit Cards

If you're a college student, you may be able to qualify for a student credit card. Unlike secured cards, you don't need a security deposit to get approved for one of these.

Most student credit cards don't charge an annual fee, and many even offer rewards on everyday purchases. But just because you're a college student, it doesn't mean you'd automatically qualify.

Unsecured Credit Cards for Bad or No Credit

Some credit card issuers offer a chance to build credit without needing to put up a security deposit, but these cards tend to have drawbacks, such as high interest rates.

"They will come with higher interest rates because someone with limited credit is a risk, and issuers base their interest rates on risk," Hardekopf says. "The lower your credit scores, the higher the risk you are, so the higher the interest rates you will get."

In some cases, you could be required to pay a one-time processing or program fee when you get approved, a monthly fee, an annual fee and an APR upwards of 30%.

Don't stress too much about the rate, though. Your goal should be to use the card in a way that the APR is irrelevant: Pay your balance off every month, and you won't be charged interest. Doing so will save you money and be the safest path to building credit.

Why It's a Good Idea to Get a Starter Credit Card

In most cases, a starter credit card won't have ideal terms. But it's still a good idea to consider getting one if you're new to credit. The most important reason for one is that it'll make it easier to qualify for inexpensive credit in the future.

If you wait until you need to buy a car or a home and don't have a credit history, you may have a hard time getting approved. Even if you can get an auto or mortgage loan with a limited credit history, you're unlikely to qualify for the best terms and interest rate.

Building a good credit history can also help you in other ways, including:

- Improving your chances of renting an apartment, home or condo

- Giving you an advantage over other job candidates if a prospective employer runs a credit check

- Reducing or eliminating the required deposit when signing up for a utility account

- Decreasing your auto and homeowners insurance premiums

It can take a while to establish a good or excellent credit history, and the sooner you start building your credit, the sooner you can start reaping the benefits.

More Tips on How to Build Credit

As you use your new starter credit card, here are some things to keep in mind as you work on establishing your credit history from scratch:

- Pay on time, every time. A late payment won't be added to your credit report until it's been 30 days since you missed it. But it's still a good idea to pay your bill on time every month to avoid interest charges and fees (with most cards).

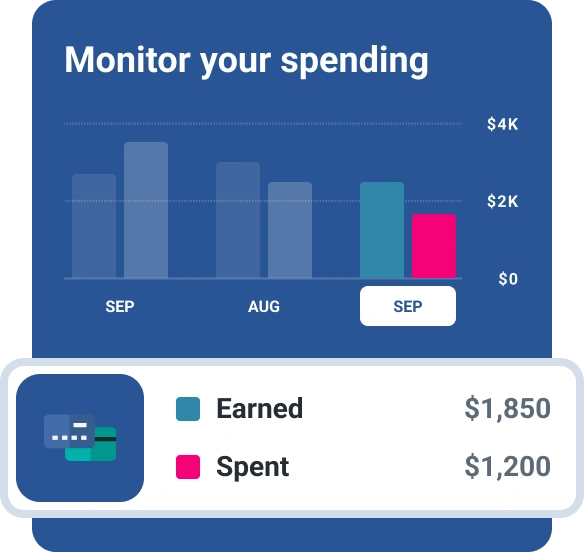

- Keep your balance low. Your credit utilization rate can have a significant effect on your credit score, so try to keep it at least below 30% at all times. To accomplish this, especially if you have a low credit limit, use the card sparingly or make multiple payments throughout the month.

- Get added as an authorized user. If you have a parent or other family member who uses credit cards responsibly, consider asking them to add you as an authorized user on their account. Once you're added, the entire card history will be added to your credit report, which can further help improve your credit scores.

- Avoid unnecessary borrowing. Once you start getting some momentum with building your credit, you may be tempted to apply for more credit cards or loans. While adding more tradelines, or accounts, to your credit report can help improve your scores, going into debt unnecessarily could make things worse in the long run.

As you start building your credit history, get your free credit score from Experian to keep track of your progress, and watch for potential issues that you need to address. Building credit can take time, but the benefits are worth the effort.

Looking to build credit?

Discover secured credit card offers matched to you, so you can apply with confidence. Get started with your FICO® Score for free.

See your offersAbout the author

Ben Luthi has worked in financial planning, banking and auto finance, and writes about all aspects of money. His work has appeared in Time, Success, USA Today, Credit Karma, NerdWallet, Wirecutter and more.

Read more from Ben