How Often Should I Check My Credit Score?

Quick Answer

At a minimum, you should check your credit score once a year. Additionally, check it several months before applying for new credit and passively monitor your scores for potentially suspicious changes in the interim.

Checking your own credit will never hurt your scores, and you can check your credit reports and scores as often as you want. But checking your credit every day, or even checking it weekly or monthly, isn't always necessary.

You might want to keep a close eye on your credit if you're actively trying to improve your credit or you're preparing for an important credit application. Otherwise, consider using credit monitoring services that will inform you about important changes in your credit report and then take a closer look once or twice a year.

Why Is It Important to Check Your Credit?

Checking your credit reports and credit scores is important because it can help you:

- Know where you stand: Having a general sense of your credit scores could help you determine if you'll qualify for new loans or credit cards and the terms you might receive.

- Track your progress: Regularly checking your credit scores can help you monitor your progress if you're trying to improve your credit.

- Detect fraud: If your credit score drops and you're not sure why, take a close look at your credit reports. Unexpected accounts or activity could be an indication that someone is using your identity to open credit cards or take out loans.

- Spot credit report errors: Credit reports are generally accurate, but mistakes happen. Review your credit reports for errors; you have the right to file a dispute with the creditor or the credit bureau if you find one.

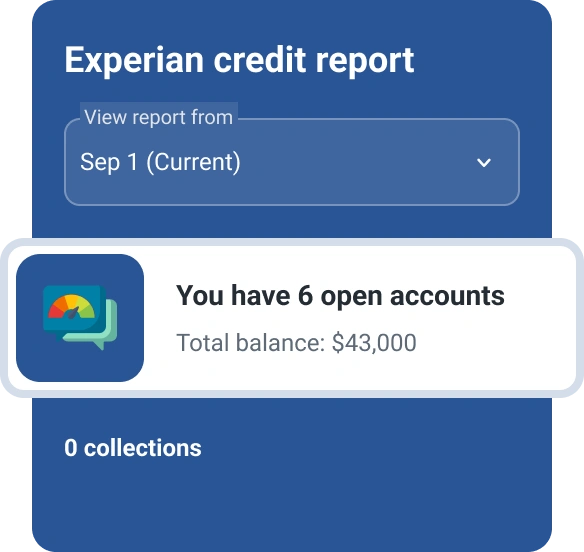

You can also use credit monitoring services to passively monitor your credit reports and scores. For example, Experian's free credit monitoring service will send you alerts when there are important changes in your Experian credit report or FICO® ScoreΘ and credit report for free (a paid membership can also provide reports from the other two credit bureaus, Equifax and TransUnion). You can find additional services that may offer credit monitoring for your credit reports, and for other types of credit scores.

Learn more: How Can I Get Free Credit Monitoring?

How Often Should You Check Your Credit?

You may want to check your credit reports and scores on a regular schedule, such as annually. Additionally, check your credit early in the process of buying a home or car and before submitting certain applications. Here are some general guidelines:

- At least once a year: At a minimum, look over your credit reports and check your credit scores at least once every year. You could use a different annual occasion as a reminder. For instance, you might check it during the first week of a new year, after filing your tax return or when you review your health insurance plan.

- Several months before you apply for a big loan: Many people spend weeks or months shopping for a new car or home. Check your credit early in the process to see if you'll likely qualify for an auto loan or mortgage, and find out how you can quickly improve your credit scores to get a better offer. Also, review your credit reports for errors or fraudulent activity because it may take several weeks to correct your reports.

- Right before you apply for a loan or credit card: Check your credit again before submitting a loan or credit card application. A new credit application will likely lead to a hard inquiry (a record of the lender's credit report request), which could temporarily hurt your credit scores a small amount even if you don't get approved. You might want to hold off on applying if you think your score is too low. However, you can also see if the lender offers a preapproval or prequalification with a soft credit inquiry. These can tell you if you'll likely get approved without affecting your credit scores.

- Before you submit a job or rental application: Employers and landlords may review your credit as part of a background check. Employers don't receive your credit score, but you still want to be prepared to explain potential red flags, such as a recent bankruptcy or large number of collection accounts. Landlords might check your reports and score, and you similarly want to be prepared to explain what led to negative marks or a low score.

You also might want to check your credit after you apply for credit, open or close an account or if one of your accounts gets sent to collections because all of these events can affect your credit scores.

Learn more: Why You Should Review Your Credit Report Regularly

How Often Is My Credit Score Updated?

It might seem like your credit scores are constantly being updated behind the scenes, but that's not actually what happens.

Your credit scores are generated on demand. First, a credit bureau (Experian, TransUnion or Equifax) creates your credit report. Then, one or more credit scoring models can analyze the report to generate a credit score. The process starts over every time you or someone else requests your credit score.

Generally, you'll see a change in your credit score if there's been a change in the underlying credit report data. This could include a new account, payment or inquiry. However, credit scores also consider several time-related attributes, such as the average age of your accounts or how long it's been since a negative item was added to your credit report. As a result, the passage of time can change your credit scores even if everything else stays the same.

Some companies or apps only give you access to an updated credit report or score monthly or quarterly. You might see the most recently updated version if you log in between these updates. But the app is determining that timeline, not the credit reporting or scoring system, and you may see a different report or score if you check elsewhere.

Learn more: How Often Is a Credit Report Updated?

How to Check Your Credit Score

You can check many of your credit scores and your credit reports online.

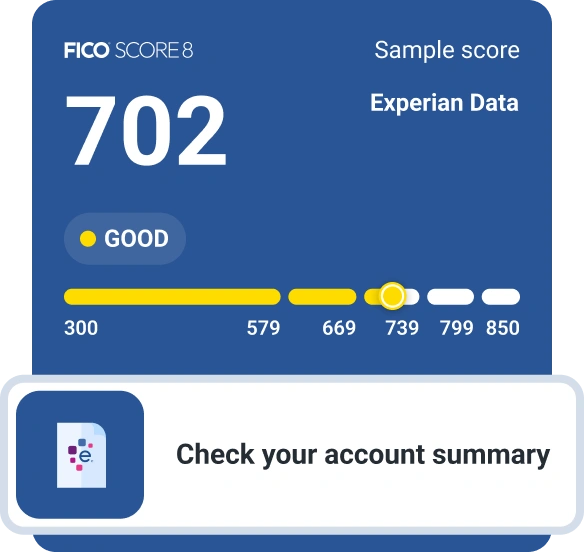

- Experian offers your FICO® Score and credit report for free with daily credit report and score updates and customizable alerts. Experian also offers paid premium memberships with tri-bureau monitoring.

- You can request free copies of each of your three credit reports every week on AnnualCreditReport.com, but these don't include a credit score.

- Many banks, credit unions, lenders and credit card issuers offer free credit scores to current and prospective customers, but they don't always include a credit report.

- Some fintech companies give customers free credit reports and scores.

- Nonprofit credit counselors might work with you to review your credit reports and scores, and offer low-cost or free financial advice.

- You can purchase your credit scores or credit score monitoring subscriptions.

Depending on whom you request your credit report or score from, you may get either a FICO® Score or VantageScore® credit score, and the score could be based on your Experian, TransUnion or Equifax credit report.

Your credit scores will generally be different depending on the type of credit score and which credit report it analyzes. But that isn't a mistake, and one score isn't more real than the others.

Creditors can choose which credit score, or scores, to use when reviewing your application, so any of your scores might be important. If you want to know which one the creditor will use, you could try asking before you apply.

Learn more: Which Credit Scores Do Mortgage Lenders Use?

What Determines Your Credit Score?

Most credit scores only consider the information from one of your credit reports. And although various scores use different criteria or weighting to calculate your score, they tend to rely on similar scoring factors. So, while an exact score depends on the scoring model and which credit report it's analyzing, all your credit scores may trend in the same direction over time.

Some of the common scoring factors include:

- Your debt payment history

- Credit card balances relative to their credit limits, also known as credit utilization

- Account balances

- Experience with different types of credit

- The age of your credit accounts

- Whether you've recently applied for or opened new accounts

In general, a long history of making on-time payments and maintaining low balances on your credit cards can help all of your credit scores. Missing a payment, filing for bankruptcy or having an account sent to collections can hurt all your credit scores.

Some newer credit scoring models also consider trends in your credit report, such as whether you tend to pay more than the minimum on your credit cards and changes in your credit utilization rate.

A few scores also consider alternative credit data—relevant and regulated information that's not on your credit report. For example, the creditor might ask you to link a bank account, and the credit scoring model can analyze your banking data when calculating your credit score.

Learn more: Credit Score Basics: Everything You Need to Know

Does Checking My Credit Score Lower It?

Checking your credit score will result in a new soft inquiry in the credit report that the score is based on. Credit inquiries are simply records of who viewed your credit, and soft inquiries have zero impact on your credit scores.

The other type of credit report inquiry, a hard inquiry, is typically associated with applications for new credit accounts. Unlike soft inquiries, a hard inquiry might cause your credit scores to drop. But even though hard inquiries can stay on your credit reports for up to two years, they tend to have a small impact on your scores. Hard inquiries only impact your FICO® Scores for up to 12 months, and the impact is often fewer than five points.

Learn more: Do Multiple Loan Inquiries Affect Your Credit Score?

Keep an Eye on Your Credit Without Overthinking It

Your credit scores can have a significant impact on major moments of your life, such as when you want to buy or rent a home. Closely watching your scores and improving or maintaining them could be helpful leading up to these moments.

Otherwise, you don't necessarily need to check your credit every day or week. Instead, set a regular schedule for when you'll review your credit reports and use credit monitoring services to get alerted about significant changes.

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

Louis DeNicola is freelance personal finance and credit writer who works with Fortune 500 financial services firms, FinTech startups, and non-profits to teach people about money and credit. His clients include BlueVine, Discover, LendingTree, Money Management International, U.S News and Wirecutter.

Read more from Louis