FICO Score vs. Credit Score: What’s the Difference?

Quick Answer

FICO® offers some of the most widely used credit scores, and people often use "FICO® Score" and "credit score" interchangeably. However, not all credit scores are FICO® Scores.

A FICO® ScoreΘ is a branded name for the type of credit score that the company FICO makes and sells. FICO was one of the first companies to offer these scores, which is why the name became genericized. It's similar to how people use Kleenex, Band-Aid and Escalator to describe tissues, adhesive bandages and moving staircases.

However, there are different types of credit scores and different kinds of FICO® Scores. Lenders can choose which score, or scores, to use when making decisions and managing customers' accounts. As a result, understanding how credit scores work can be important when you're trying to build your credit or get a loan.

Is a FICO® Score the Same as a Credit Score?

A FICO® Score is the general name that FICO uses for its credit scoring models. As a result, all FICO® Scores are credit scores. However, not all credit scores are FICO® Scores.

Other companies, such as VantageScore®, also create and sell credit scores. Additionally, some lenders develop their own credit scores to use in place of, or in combination with, a credit score from FICO or VantageScore.

Learn more: Credit Score Basics: Everything You Need to Know

What Is a FICO® Score?

Let's dig a little deeper into what a FICO® Score is and why the term became synonymous with credit scores in general.

In 1989, FICO released one of the first credit scores that were based on consumers' credit histories and that different types of lenders could use. Within a few years, FICO's credit scores were available through all three national credit bureaus (Experian, TransUnion and Equifax), and more and more lenders started using the scores when making decisions. Importantly, Fannie Mae and Freddie Mac adopted FICO® Scores as the standardized credit scores for conforming mortgages in 1995.

Since then, FICO has developed and released many different versions of its credit scores. You can broadly put FICO's credit scores into three groups:

- Base FICO® Scores: The base FICO® Scores are intended to be used by any type of lender to better understand the likelihood that someone will miss payments in the future. Recent versions of these scores have standardized names, such as FICO® Score 8, FICO® Score 9 and FICO® Score 10. The FICO® Score 10 suite of scores includes a standard FICO® Score 10 model and additional models that can consider trended credit data (FICO® Score 10 T) and/or buy now, pay later (BNPL) data (FICO® Score 10 T BNPL and FICO® Score 10 BNPL).

- Industry-specific FICO® Scores: FICO creates variations on its base scores for auto lenders and credit card issuers. For example, there's a FICO Auto Score 10 that goes with the base FICO® Score 10.

- FICO® Scores using alternative data: FICO creates several scores that consider information that's not in someone's credit report. For example, the UltraFICO® and FICO XD scores can consider information from a person's bank account or utility accounts, respectively.

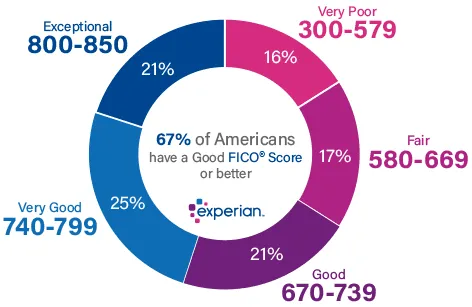

Most FICO® Scores range from 300 to 850, but industry-specific scores have a 250 to 900 range. With all the scores, having a higher score is better because it indicates a person is less likely to miss a payment.

What Is a Credit Score?

A credit score is the numerical output of a credit scoring model. It's an easy-to-read and relatively easy-to-understand way to assess creditworthiness.

The inner workings of each credit scoring model differ. However, most credit scoring models try to predict the likelihood that someone will fall 90 days behind on a bill within the next 24 months. A higher credit score means someone is less likely to miss a payment, but credit scores don't directly correlate with the likelihood of missing a payment.

Example: It's not as if someone with a 760 credit score has an X% chance of missing a payment and someone with a 700 score has a Y% chance. Instead, on average, someone with a 760 credit score is less likely to miss a debt payment than someone with a 700 credit score, and more likely to miss a payment than people with scores over 760.

What Do Credit Scores Consider?

Each credit scoring model might use different weights and factors to calculate a credit score. However, most credit scores try to predict the same thing and use similar data sources:

- Your credit history: Most FICO® Scores and VantageScore credit scores only consider information from one of your credit reports from a national credit bureau—Experian, TransUnion or Equifax—when calculating a specific score.

- Alternative, non-credit data: Some scores consider additional information, such as the UltraFICO® and FICO XD scores mentioned above. The VantageScore 4plus™ model can also consider a person's banking history.

- Proprietary data: Creditors' scores may also consider proprietary information, such as your history with the company.

As a result, although your credit scores can differ, many people's credit scores tend to move up or down in tandem over time.

Learn more: Facts About Credit You May Not Know

Why Do I Have Different FICO® Scores?

You can have different FICO® Scores for several reasons:

- FICO® Scores only analyze one of your credit reports at a time. A FICO® Score analyzes the information in one of your credit reports to calculate a score. However, it's common for your credit reports from Experian, TransUnion and Equifax to differ. As a result, your FICO® Score 10—or any other type of FICO® Score—could be different depending on which of your reports it's scoring.

- FICO regularly releases new versions of its scoring models. The new FICO® Score models may incorporate changes in consumer behavior, new regulations and technological advances. As a result, your FICO® Score 9 and FICO® Score 10 can differ even if they're both based on your Experian credit report.

- The FICO® Scores you're checking were calculated at different times. Different services might offer you several FICO® Score versions based on one or more credit reports. However, you also have to check when the scores are updated. Because credit scores are calculated at the moment they're requested, your scores can differ because of changes in your credit report—even from hour to hour.

You may also have different credit scores if you're comparing one of your FICO® Scores to a VantageScore credit score.

What Is My Real Credit Score?

There is no single "real" credit score. Companies can choose which credit scores to use when reviewing applications and managing customers' accounts, and you won't necessarily know which score a company will use ahead of time.

Example: When you're shopping for an auto loan, you may try to get offers from several lenders. One lender might use a FICO® Score 9, another a FICO Auto Score 10 and a third a VantageScore 4.0. Your scores may vary, but each is very real in the sense that the lender is using it to determine if you qualify for a loan and the rates and terms to offer you.

Because most credit scores rely on the same underlying data, building positive credit can help you get good credit scores regardless of the model. Conversely, negative items, such as late payments or a bankruptcy, could hurt all of your credit scores.

Learn more: How to Build Credit: A Comprehensive Guide

How to Check Your FICO® Score

There are many ways to check your credit scores, including different types of FICO® Scores, like through Experian. Some common ones include services that offer scores for a one-time fee, paid membership programs and free membership programs.

You also may be able to get a FICO® Score for free from your current:

- Lenders

- Credit card issuers

- Banks and credit unions

- Credit and financial counseling organizations

Checking multiple FICO® Scores can be interesting. But before you pay for a score, review the fine print to see which FICO® Score versions are included and which credit reports they're based on.

Tip: Checking your credit scores will not lower your credit scores. Your request to see your credit score is a soft inquiry, which never impacts your credit score.

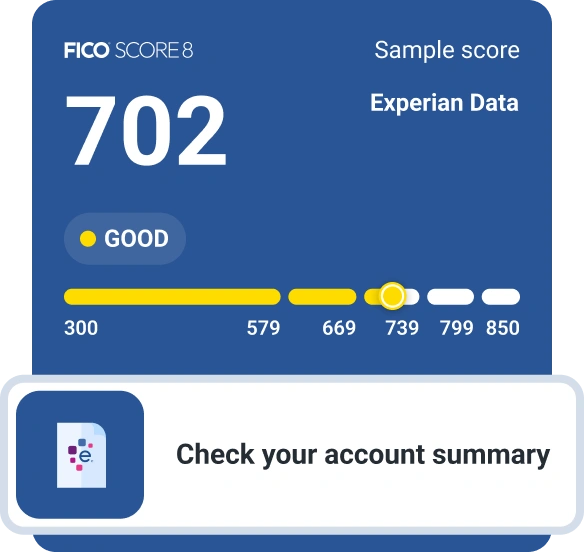

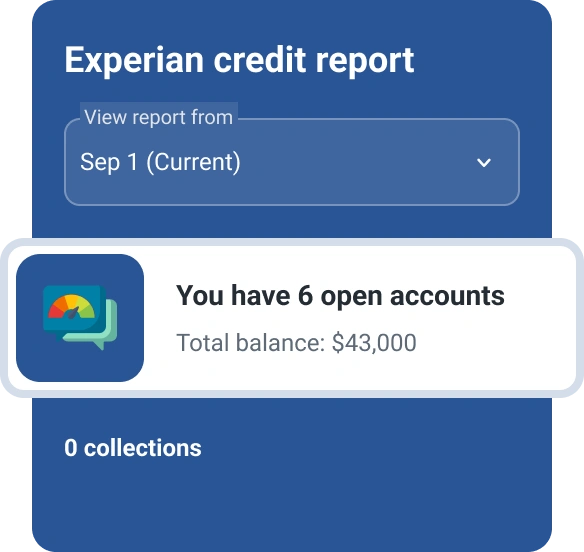

Check and Monitor Your FICO® Score for Free

You can get free access to a FICO® Score 8 based on your Experian credit report with an Experian account. You'll also learn about which factors are helping or hurting your score the most, and you can track your score over time. If you're looking for a new credit card or loan, Experian also might be able to show you personalized offers based on your credit profile.

What’s on your credit report?

Stay up to date with your latest credit information—and get your FICO® Score for free.

Get your free reportNo credit card required

About the author

Louis DeNicola is freelance personal finance and credit writer who works with Fortune 500 financial services firms, FinTech startups, and non-profits to teach people about money and credit. His clients include BlueVine, Discover, LendingTree, Money Management International, U.S News and Wirecutter.

Read more from Louis