Why Are My Credit Scores Different?

Quick Answer

Your credit scores can differ for many reasons, including which scoring model is used, which credit report is used and timing of when score updates are made.

Your credit scores can vary depending on the type of credit score, the credit report it scores and when the score is calculated. It's common for someone to have many different credit scores at the same time. This makes sense when you understand what credit scores are and how companies use them. Plus, you'll find out why some basic tips for managing your credit can improve all your credit scores at the same time.

What Is a Credit Score?

A credit score is the result of a computer program analyzing a person's credit report and predicting how likely they are to miss a bill payment in the future. Specifically, many credit scores try to predict the likelihood that someone will miss a payment by at least 90 days in the next 24 months.

Creditors could try to analyze your credit report to come up with their own prediction, and some creditors do create their own custom scores. However, many creditors use a FICO® ScoresΘ or VantageScore® credit score to help them make decisions.

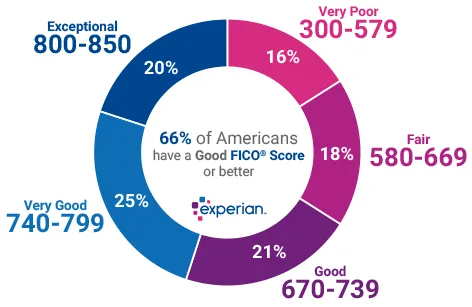

Many FICO and VantageScore credit scores range from 300 to 850, with a higher credit score indicating the person is less likely to miss a payment. Creditors might set a minimum credit score requirement for their loans and credit cards. Beyond that, applicants with higher credit scores might qualify for more favorable terms, like lower interest rates and fees.

What Is a FICO® Score?

FICO creates many data analytics products for companies, including the popular FICO® Scores that are used by 90% of top lenders. There are actually many versions of the FICO® Score because FICO regularly develops new scoring models that incorporate new technology, new data and changing consumer behavior. The various FICO® Scores fall into three groups:

- Base FICO® Scores: The base FICO® Scores include FICO® Score 8, FICO® Score 9 and FICO® Score 10. There's also a FICO® Score 10 T, which is similar to FICO® Score 10 but considers trends in your credit history, such as whether your credit utilization ratio is increasing or decreasing over time. FICO creates these credit scores to predict late payments on any type of credit obligation.

- Industry-specific FICO® Scores: FICO also creates industry-specific versions of the base scores to better predict risk for credit card issuers and auto loan lenders. For example, the FICO® Score 10 suite includes a base FICO® Score 10, a FICO Auto Score 10 and a FICO Bankcard 10.

- FICO® Scores that use alternative data: FICO offers the UltraFICO and FICO XD scores, which can consider information that isn't found on your credit report. For example, the scoring model might consider your banking history if you agree to link your bank account. These scores can be helpful if creditors are reviewing an application from someone who isn't otherwise scoreable or who might qualify for a better offer based on one of these scores.

The base and alternative data FICO® Scores range from 300 to 850, and the industry-specific scores range from 250 to 900. With all credit scores, higher scores indicate a higher level of creditworthiness (and lower risk to creditors), which could help consumers when they are seeking loans and other forms of credit.

FICO breaks down the score range into smaller ranges that could indicate whether someone has poor or exceptional credit—or something in between. The industry-specific scores have larger ranges for the poor and exceptional credit ranges.

What Is a VantageScore Credit Score?

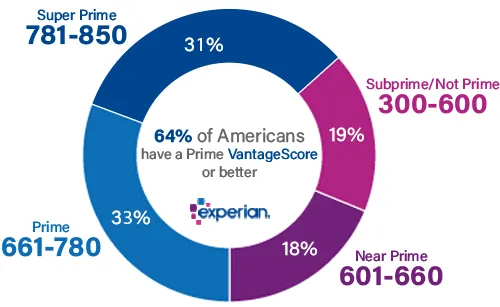

In 2006, Experian, TransUnion and Equifax created VantageScore, an independently managed company that develops credit scoring models. Since then, VantageScore has released five versions of the VantageScore credit score: VantageScore 1.0 through 4.0, and VantageScore 4plus™.

The VantageScore 4.0, released in 2017, considers trends in a consumer's credit history. The VantageScore 4plus was announced in May 2024 and can consider data from connected bank or credit card accounts, if you choose to link those accounts.

The VantageScore 3.0 and newer models use a credit score range of 300 to 850. The VantageScore credit score also suggests groups that indicate whether someone has poor to excellent credit.

Reasons Why You Have So Many Different Credit Scores

You might see different credit scores when you check your credit or get a letter from a creditor for several reasons:

Different Scoring Models

Creditors and credit score checking programs can choose from dozens of different credit scores. Even if scoring models have the same score range, differences in what the scores consider can lead to different outcomes.

Example: When it comes to mortgages, lenders use different scoring models for each credit bureau:

- FICO® Score 2, or Experian/Fair Isaac Risk Model v2

- FICO® Score 5, or Equifax Beacon 5

- FICO® Score 4, or TransUnion FICO Risk Score 04

Different Credit Reports

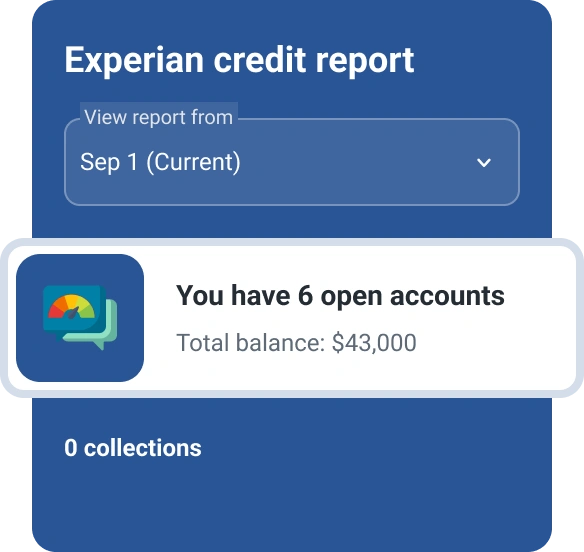

Your credit reports from Experian, TransUnion and Equifax could have different information because creditors can choose which bureau(s) they want to report to, as well as what they report and when. As a result, the same scoring model could give you different credit scores based on each of your three credit reports.

Example: Your FICO® Score 8 based on Experian data likely differs from your VantageScore 3.0 based on TransUnion data.

Different Timing

Some credit score monitoring services offer daily, weekly, monthly or quarterly updates. A credit score is a snapshot based on a credit report at a specific moment. So, all else being equal, you could still get different scores if the scores were created at different times.

Example: If you check your FICO® Score 8 with both your credit card issuer and Experian today, the scores could differ based on when they were last updated.

What Credit Score Matters Most?

There isn't a single credit score that matters the most. What's going to be most important for you is likely the score the lender or card issuer uses to evaluate your application. But in most situations, you won't know which credit report or score the company will request.

One exception is with mortgage applications. Many lenders use older FICO® Scores to align with Fannie Mae and Freddie Mac guidelines. However, there's a transition underway that could lead to most mortgage lenders using FICO 10 T and VantageScore 4.0 scores instead.

Where to Check Your Credit Scores

There are many free ways to check your credit scores:

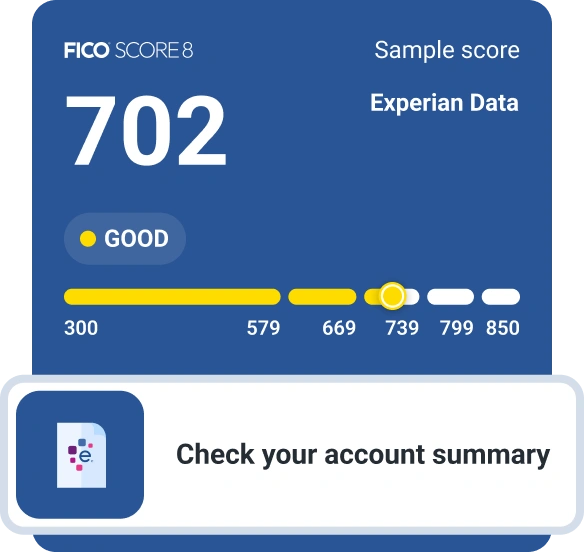

- Experian: You can create a free Experian account to get your FICO® Score 8 for free. You'll also receive ongoing credit report and FICO® Score tracking, and insights into what's hurting and helping your credit score the most.

- FICO® Scores: Credit card issuers, lenders and credit counseling organizations that use FICO® Scores might give you free access to your score if you're a customer.

- VantageScore scores: The VantageScore website lists companies that offer free VantageScore credit scores and it specifies the VantageScore credit score version and which credit report the score is based on.

Many paid services also let you check one or more of your credit scores. The scores you receive don't depend on whether you're using a free or paid service. However, the paid services might come with additional features, such as access to more types of credit scores or identity theft monitoring.

How to Improve Your Credit Scores

Although there are many credit scoring models, they all tend to use similar credit report data to determine your score. If you can improve your credit by focusing on what's in your credit report, you might see all your scores rise at the same time. Here's how:

- Pay your bills on time. Having several credit accounts with a long history of on-time payments can help you achieve a good credit score, and missing a payment or having an account sent to collections can hurt your scores. Late payments can stay on your credit report for up to seven years, although the impact they'll have on your scores will diminish over time.

- Don't max out your credit cards. Your credit utilization rate, or your credit cards' reported balances relative to their credit limits, can be an important scoring factor. Try to only use a small portion of your credit limit and then pay the bill in full to avoid interest charges. If you regularly use your credit card, you can also make early payments before the end of each billing cycle to lower the balance that the card issuer reports and possibly the resulting utilization ratio.

- Use different types of credit. Responsibly manage different types of credit accounts by using revolving and installment credit accounts, such as a credit card and loan, and making your payments on time.

- Add additional payments to your credit report. You can use features like Experian Boost®ø to add different types of accounts—and your history of on-time payments—to your credit report without opening a new loan or credit card. Connect your accounts and see if you can boost your credit score with eligible utility, phone, streaming service, insurance and rent payments.

- Strategically apply for new credit. Each new credit application you submit can lead to a hard inquiry, which might hurt your credit scores temporarily by a small amount. However, credit score models have specific rules that allow you to get multiple offers for certain loans without doing more damage to your credit.

If you're struggling to afford your bills, contact your creditors to see if they have any hardship plans. Asking early could be better than missing a payment, having to pay fees and winding up with a past-due account in your credit report. If you're already behind, try to bring your accounts current and contact 211 or a nonprofit credit counseling organization to ask for advice.

Frequently Asked Questions

Monitor Your Credit Reports and Scores

Knowing that your credit scores are created based on what is contained in your credit reports, you may want to regularly check—and monitor—your credit report for changes. Experian offers free credit report monitoring with real-time notifications when there's an important change. You also get FICO® Score tracking based on your report, a breakdown of the scoring factors that have the largest impact on the score, and access to other free features for improving and using your credit.

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

Louis DeNicola is freelance personal finance and credit writer who works with Fortune 500 financial services firms, FinTech startups, and non-profits to teach people about money and credit. His clients include BlueVine, Discover, LendingTree, Money Management International, U.S News and Wirecutter.

Read more from Louis