Will Paying Off My Student Loans Affect My Credit Score?

Quick Answer

Your credit score may dip temporarily after paying off a student loan, but it will typically rebound and can continue to increase as you practice good credit habits.

When you pay off a student loan, it's possible that your credit score will go down temporarily. That said, it'll typically recover and may continue to increase over time as you use credit responsibly.

Here's what you need to know about why your credit score may go down upon paying off student loans and why it's not as important as the long-term benefits of eliminating student debt.

Does Paying Off Student Loans Help Your Credit Score?

Paying off student loans not only frees up more cash for other important financial goals, but it can also potentially help your credit score in the long run. Here's how:

- Payment history: Your payment history is the most important factor in your credit scores, so paying off your student debt as agreed ensures a positive mark on your credit reports. What's more, if your account is closed in good standing, its positive information will remain on your reports for 10 years after it's closed.

- Amounts owed: Paying off your loans reduces your total amount owed, which can help your credit. Additionally, freeing up some cash flow in your budget could help you tackle other balances, such as credit card debt, which can help reduce your credit utilization rate and possibly boost scores.

While your debt-to-income ratio (DTI) isn't included in your credit score, it's an important factor lenders consider when you apply for credit. Paying off student loans and lowering your DTI could improve your chances of getting approved for affordable credit in the future.

Learn more: Will My Credit Improve After Paying Off My Student Loans?

Will Paying Off My Student Loans Hurt My Credit?

In the short term, paying off student loans can potentially cause your credit score to dip temporarily. Here's why:

- Credit mix: Student loans appear on your credit report as installment loans, and managing a blend of installment loans and revolving credit accounts can benefit your credit mix. Paying off a loan can result in a slightly less diverse credit mix, which could cause your score to go down slightly.

- Length of credit history: When evaluating how long you've been using credit, FICO considers the age of your oldest account and newest account, and the average age of all of your accounts. When paying off student loans, you could be closing some of your oldest accounts, and your average account age could go down. Both of these factors can negatively impact your credit score.

Keep in mind, though, that your credit mix and length of credit history aren't nearly as important as your payment history and amounts owed. As a result, paying off a loan in full looks good on your credit history in the long run.

Can You Pay Off Student Loans Without Hurting Your Credit?

The specific impact paying off student loans will have on your credit score will depend on the makeup of your credit profile. But in general, you likely can't avoid the short-term dip that typically occurs after paying off a loan.

If your score decreased after your last student loan payment, it will likely bounce back within a few months as long as there are no other negative issues in your credit history and you continue to make all your other debt payments on time.

Pros of Paying Off Your Student Loans Early

There are several reasons to work on paying off your student loans as quickly as possible:

- More cash flow: Once you've eliminated your student debt, you can put the monthly payment amount toward other important financial goals, such as building your emergency fund, paying down high-interest debt, saving for retirement or establishing a down payment for a home.

- Interest savings: Student loans incur interest based on your interest rate and balance, so if you pay off your loans early, you could save hundreds or even thousands of dollars in interest charges.

- Improve your DTI: By removing your student loan payment from your DTI calculation, you may have an easier time getting approved for a car loan or mortgage loan.

Cons of Paying Off Your Student Loans Early

While there are some clear advantages to paying off student loans early, it's also important to consider the potential downsides:

- Opportunity costs: The more money you put toward your student loans to pay them off early, the less you'll have to contribute to other financial objectives. If you don't have an emergency fund, for instance, you may be financially vulnerable if something unexpected happens. Also, the longer you wait to save for retirement, the more money it'll require to achieve your goals.

- Higher payments: If your budget is already tight, adding more to your student loan payments could create a stressful situation.

- Lose out on forgiveness: If you qualify for a federal student loan forgiveness program, you could ultimately save more money by lowering your monthly payments and focusing on qualifying for forgiveness.

How to Pay Off Your Student Loans Faster

If you want the long-term benefits of paying off your student loans early, here are some approaches you could take to accomplish your goal:

- Make biweekly payments. If you pay half your monthly amount every two weeks, you'll end up making an extra month's worth of payments every year (26 payments, or the equivalent of 13 monthly payments versus 12 monthly payments).

- Pay more than the minimum each month. Even if you can't afford to add much to your minimum amount due, even small amounts can add up over the course of several years.

- Use windfalls to pay down larger chunks. If you receive a tax refund every year or regular performance bonuses at work, consider using some of those funds to pay down some of your principal balance.

- Consider refinancing your loans. If you have great credit and don't anticipate needing access to federal student loan relief options, you may be able to get a lower interest rate and shorter repayment term by refinancing your debt with a private lender. Just be sure to weigh the pros and cons before refinancing.

Monitor Your Credit Score to Track Your Progress

Before and after you pay off your student loans, it's important to regularly monitor your credit score to understand how your actions impact your credit health and identify areas where you can improve.

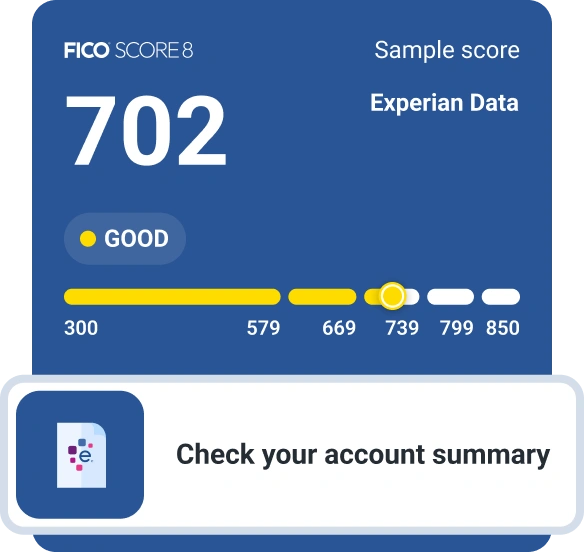

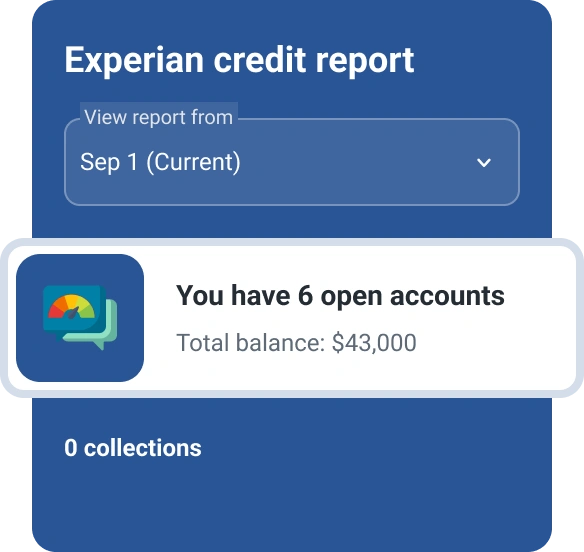

With Experian, you can get free access to your FICO® ScoreΘ and Experian credit report and Experian credit report, making it easy to stay on top of your score and keep an eye on new developments as they arise.

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

Ben Luthi has worked in financial planning, banking and auto finance, and writes about all aspects of money. His work has appeared in Time, Success, USA Today, Credit Karma, NerdWallet, Wirecutter and more.

Read more from Ben