What Does “Good Standing” Mean on My Credit Report?

Quick Answer

Accounts on your credit report are in good standing if you’ve never missed a payment and you haven’t settled a closed account for less than you originally owed. Keeping accounts in good standing can help your credit scores.

An account could be considered in good standing on your Experian credit report if you've made all your payments as agreed. That means that your account is current or paid off, and the account doesn't have any late payments or other negative marks in its history. Accounts in good standing could be open or closed, and they can affect your credit scores in various ways.

What "Good Standing" Means on Your Credit Report

Your credit report may word things differently depending on where you obtain a copy of your report. However, an account is in good standing if you're making your payments on time, or you paid off the account in full and you haven't missed any payments.

Generally, if you miss a payment by at least 30 days, the creditor will report your account as past due to the credit bureaus (Experian, TransUnion and Equifax). Bringing your account current can help your creditworthiness, and your account's status on your credit reports will change from past due to current. But your credit report may have an account that is "potentially negative" rather than in "good standing" because there's a negative mark in the payment history.

The account could also be potentially negative if it was settled for less than the full amount you owed. If you're struggling to afford your payments, reach out to your creditor before missing a payment. The company might work with you to offer a temporary or permanent adjustment or modification to your account. Depending on how the creditor reports these changes to the bureaus, this could alter the loan agreement while keeping the account in good standing.

Below are instances when an account may be considered in good standing or potentially negative on your credit report.

| Good Standing | Potentially Negative |

|---|---|

|

Open/Never late Closed/Never late Refinanced, closed/Never late |

Past due Account charged off Collection account Repossession Voluntary surrender Foreclosure Settled Bankruptcy Discharged |

Be mindful that your creditor may have a different definition of good standing, which could affect your account. For example, missing a payment by just one day might make your account delinquent, which could lead to a late payment fee and lost benefits, discounts and rewards.

How Do Accounts in Good Standing Affect Your Credit?

Accounts in good standing could have a positive or neutral effect on your credit scores.

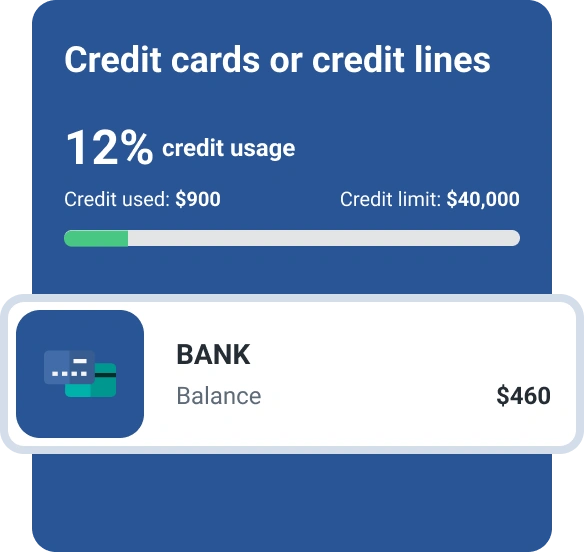

An account in good standing shows that you've been managing and repaying a loan or line of credit as agreed, which is a good indicator that you'll repay a new credit account as agreed. However, the exact impact on your credit scores could depend on more specific factors, such as the type of account, its credit utilization ratio and what else is in your credit report.

Closed and paid off accounts can also affect your credit scores as long as they're listed in your credit report.

- Open accounts in good standing: Stay in your credit report indefinitely

- Closed accounts in good standing: Stay in your credit report for up to 10 years

However, the credit scoring factors may be slightly different for closed accounts. For example, closed accounts still count toward age-related metrics, such as the average age of your credit accounts. But paid off and closed accounts in good standing won't affect your credit utilization ratio and might not affect your credit mix.

Learn more: What Does "Closed Account" Mean on Your Credit Report?

Monitor Your Credit Score for Changes

You can get a free copy of your credit report from Experian, and track your credit score and credit report for free to monitor changes. Your free Experian account could also show you what information is helping and hurting your score the most, which can be helpful when you're trying to improve your credit scores.

What’s on your credit report?

Stay up to date with your latest credit information—and get your FICO® Score for free.

Get your free reportNo credit card required

About the author

Louis DeNicola is freelance personal finance and credit writer who works with Fortune 500 financial services firms, FinTech startups, and non-profits to teach people about money and credit. His clients include BlueVine, Discover, LendingTree, Money Management International, U.S News and Wirecutter.

Read more from Louis