What Is Debt-to-Income Ratio and How Do I Calculate It?

Quick Answer

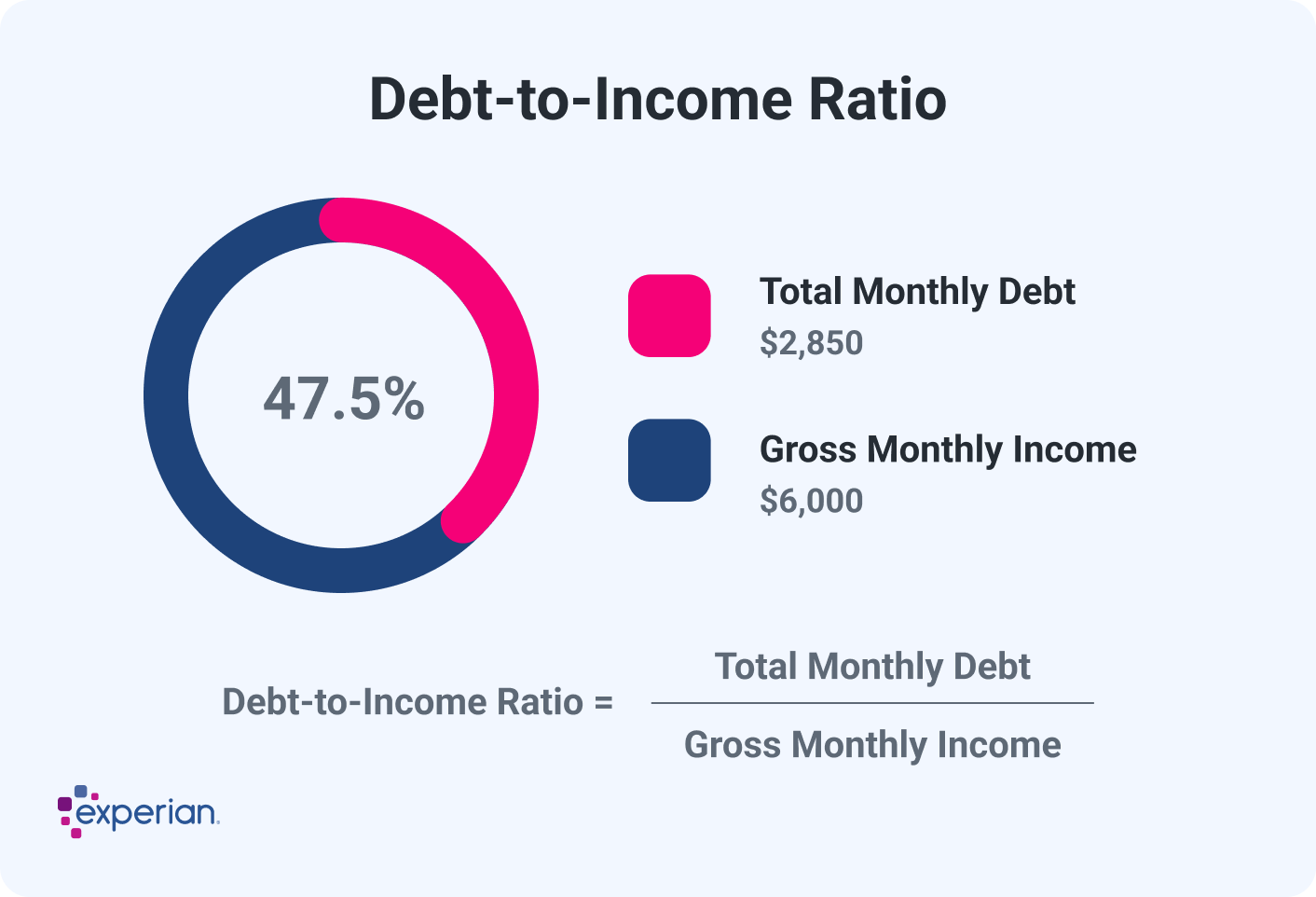

Debt-to-income ratio (DTI) is the measure of how much of your monthly income goes to paying debt, including housing costs, loans and credit card payments. To calculate your DTI, divide your total monthly debt payments by your gross monthly income.

Your debt-to-income ratio (DTI) is an important measurement of your financial health. Alongside your credit score, your DTI plays a big part in determining whether or not you're likely to qualify for a new loan, such as a mortgage. To calculate your DTI, add up all of your monthly debt payments and divide them by your gross monthly income.

A high DTI signals to lenders that you have significant debt payments and that you may struggle to afford your monthly payments. On the other hand, a low DTI can be a sign—both to you and to potential lenders—that you're on firm financial ground and are in a good position to consider a new loan.

Here's more on what DTI is, how to calculate yours and what ratio to aim for.

What Is Debt-to-Income Ratio?

Your debt-to-income ratio, often called DTI, is how much of your gross income goes toward debt payments every month. From a lender's perspective, it shows how much more debt you can reasonably take on, given your current income and debt situation.

If your DTI is relatively high, a lender may charge a higher interest rate to compensate for their added risk. You may even be denied because your DTI is too high.

There are two types of DTI that you may run into.

Front-End DTI

Front-end DTI represents only your monthly housing costs and how they relate to your gross monthly income. If you're a renter, it includes your monthly rent payment. But if you're a homeowner, it may include your loan payment as well as monthly costs for mortgage insurance, homeowners insurance and property taxes.

Back-End DTI

Back-end DTI includes all of your monthly debt obligations, including personal loans, student loans and credit card payments.

Most lenders use back-end DTI only, but mortgage lenders typically use both. The higher your ratio is, the more risk you pose to a lender because it may be more difficult for you to keep up with your payments compared with a low-DTI borrower.

Learn more: How to Manage Your Debt

How to Calculate Your Debt-to-Income Ratio

To calculate your debt-to-income ratio, establish what your total monthly debt obligation is and divide that figure by your gross monthly income.

For example, if each month you pay the following:

- Rent: $1,300

- Auto loan: $400

- Student loan: $100

- Other debt: $200

The sum of all your monthly payments is $2,000. To calculate your gross monthly income, take your salary before taxes and other deductions, and divide it by 12. So if your annual salary is $60,000, your gross monthly income would be $5,000.

Now take your total monthly debt obligations ($2,000) and divide them by your gross monthly income ($5,000). Then convert the resulting number (0.40) into a percentage by multiplying it by 100; in this case, 40% is your DTI.

If you're buying a house and applying for a mortgage loan, the lender will use the calculations above to calculate your back-end DTI but will also consider your front-end DTI. To calculate that, simply divide the proposed mortgage payment, say $1,800, by your gross monthly income ($5,000), and you'll get your back-end ratio—in this case, 0.36, or 36%.

What Is a Good Debt-to-Income Ratio?

Generally, the lower your DTI, the better, because this shows lenders you have the extra income after your current debt obligations to take on new loan payments.

The ideal DTI, however, depends on the type of loan you're applying for and the lender. Here are some guidelines:

- Mortgage loans: Lenders may look for a front-end DTI of 28% or lower—the maximum for an FHA loan is 31%—and a back-end ratio of less than 43% (though sometimes less than 36%). Conventional loan guidelines by Fannie Mae and Freddie Mac allow for back-end DTIs as high as 50% in some circumstances.

- Other loans: Other loan types are available to borrowers with a DTI of 50% or less, though that maximum can vary by lender.

While it's important to work to reduce your DTI, remember that it's not the only factor lenders evaluate. They'll also look at your credit reports and credit scores, your employment situation and other important factors.

As you consider how to improve your chances of getting approved for a loan with favorable terms, be sure to look at the whole picture and how you can present as low of a risk as possible to future lenders.

Learn more: What Factors Do Mortgage Lenders Consider?

How Does Debt-to-Income Ratio Affect Credit?

Your debt-to-income ratio has no direct impact on your credit. Credit scoring models do not factor in income information, so your DTI can't affect your credit scores.

That said, how much you owe in debt is the second-most influential factor in your FICO® ScoreΘ, with your credit utilization rate being a prime component.

Your credit utilization rate is your total credit card balances divided by total credit limits. It indicates how much of your available credit you're using. Credit experts recommend keeping your utilization rate below 30%, and the lower it is, the better.

But your DTI also includes how much you owe on other types of credit accounts, including installment loans and other revolving credit lines. The more debt you're carrying on credit cards and other loans, and the higher your utilization rate, the more negatively it can impact your credit scores.

Learn more: What Affects Your Credit Scores?

How to Lower Your DTI

Here are steps you can take to lower your DTI.

- Pay off debt. Lowering your debt is a direct way to lower your DTI. Start by taking inventory of all your debts, noting the balance and interest rate for each. Then consider implementing a debt repayment strategy to pay off your balances faster.

- Increase your income. Apart from reducing debt, boosting your income is the other direct way to lower your DTI. Consider asking for a raise, picking up a side gig or pursuing a higher-paying job in your field. To lower your DTI even faster, direct any extra money you earn into paying off debt.

- Avoid taking on more debt. Going into more debt will derail your efforts to lower your DTI. To stay on track, create a budget focused on supporting your payoff goals and avoiding overspending.

Learn more: How to Reduce DTI Before Applying for a Loan

Monitor Your DTI and Your Credit For Better Access to Credit

Even if you don't anticipate needing to apply for credit anytime soon, it's a good idea to keep an eye on your DTI and your credit score to make sure you're ready when you need it. To monitor your DTI, keep a running list of your debt payments and calculate your DTI whenever you pay off a loan or credit card or take on new credit.

For your credit score, you can use Experian's free credit monitoring service, which provides access to your Experian credit report and FICO® Score. You'll also get real-time alerts whenever changes are made to your credit report, so you can track your progress and spot potential issues before they wreak havoc on your credit health.

Find out what debts you owe

Your free credit report lists all your debts, such as credit card balances and loans, helping you create a plan to tackle your debt and improve your financial health.

Review your creditAbout the author

Ben Luthi has worked in financial planning, banking and auto finance, and writes about all aspects of money. His work has appeared in Time, Success, USA Today, Credit Karma, NerdWallet, Wirecutter and more.

Read more from Ben