What Is a FICO® Auto Score?

Quick Answer

A FICO® Auto Score is a credit score auto lenders use to assess auto loan risk. Learn what is considered a good FICO Auto Score, how to check your scores and how to improve your credit.

A FICO® Auto Score is a credit score that auto lenders use to evaluate your creditworthiness when you apply for a car loan. A good FICO Auto Score could help improve your chances of getting favorable auto loan terms. There are several different FICO Auto Score versions, and you usually can't know which one your lender will use. However, the same good credit habits that can improve your base FICO® ScoreΘ generally help improve your FICO Auto Score as well.

What Is a FICO Auto Score?

A FICO Auto Score is an industry-specific credit score that auto lenders use to predict how likely you are to miss a car payment. There are many different FICO® Score versions, and it's up to lenders which ones they choose to use.

Base FICO® Scores are designed for any type of lender and include the FICO® Score 8, 9, 10 and 10T. FICO Auto Scores use the same underlying data as base FICO® Scores but are tailored to focus on auto loan risk. For example, how you've handled auto loan payments in the past could matter more to your FICO Auto Score than it does to your base FICO® Score.

Learn more: Which Credit Score Is Used for Car Loans?

What Is a Good FICO Auto Score?

What's considered a good FICO Auto Score can vary from one lender to another, but in general, a score of 670 or higher can improve your odds of qualifying for favorable loan terms.

There are several different versions of the FICO Auto Score, including FICO Auto Score 2, FICO Auto Score 4, FICO Auto Score 5, FICO Auto Score 8, FICO Auto Score 9 and the newest version, FICO Auto Score 10. The version of the FICO Auto Score used when you apply for an auto loan can vary depending on your lender and on which of the three consumer credit bureaus (Experian, TransUnion or Equifax) provides the score.

Unlike the base FICO® Score, which ranges from 300 to 850, FICO Auto Scores range from 250 to 900. A higher score predicts you're less likely to miss a car payment.

Be aware: Applying for a car loan triggers a hard inquiry, which can temporarily ding your credit score. Keep all your auto loan applications within a 14-day window and they'll be treated as a single inquiry, minimizing potential harm to your credit.

Learn more: FICO® Score vs. Credit Score: What's the Difference?

How to Check Your FICO Auto Score

You'll typically need to pay to check your FICO Auto Score. For example, Experian's paid premium membership gives you access to your FICO Auto Score 2 and FICO Auto Score 8 (as well as other credit score versions).

However, checking your FICO Auto Score isn't crucial, because your credit scores usually won't vary widely from one version to another. Checking your base FICO® Score will typically give you a good idea of your FICO Auto Score and whether you should try to improve your credit before you apply for an auto loan.

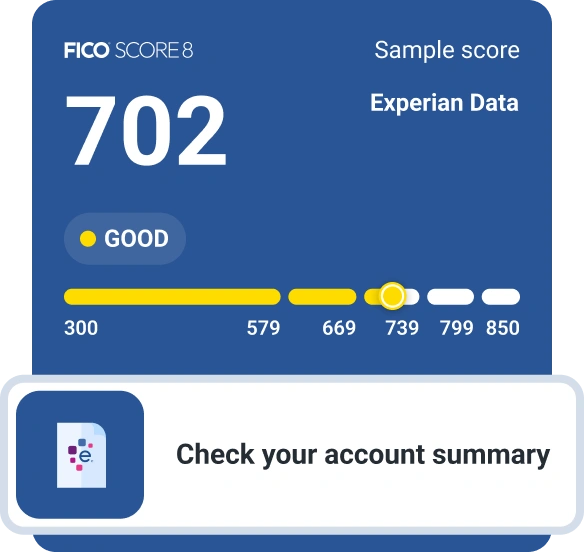

A free Experian membership gives you access to your FICO® Score 8, the most widely used credit score by lenders and a good indicator of the score auto lenders are likely to see. You can also check your FICO® Score for free with a variety of sources, including your bank or credit union, your credit card company and credit counseling organizations.

Learn more: How Do I Check My Credit Score?

How to Improve Your FICO Auto Score

The same actions that can help improve your base FICO® Score can also help increase your FICO Auto Score.

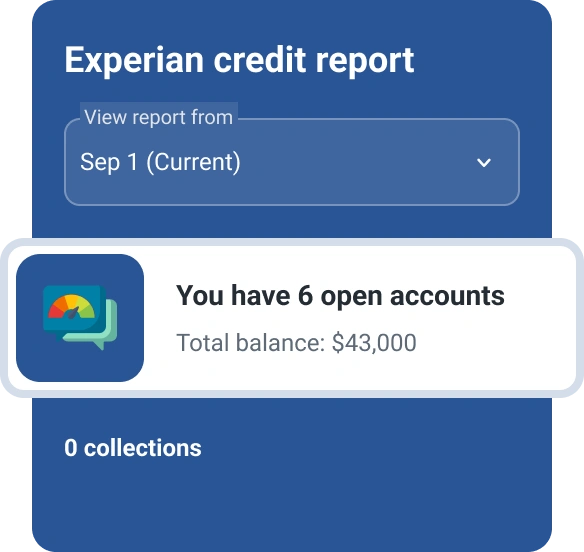

- Check your credit reports. You can get your credit reports from the three major consumer credit bureaus for free at AnnualCreditReport.com. If you believe any information is in error, you have the right to file a dispute with the appropriate bureau.

- Pay your bills on time. Your debt payment history is the biggest factor in your FICO® Score. Consider setting up automatic payments to avoid late payments that can lower your credit score.

- Pay down credit cards. Your credit utilization rate—how much credit you're using relative to total credit limits on revolving credit accounts such as credit cards—has a big impact on your FICO® Score. Paying down credit card balances reduces your utilization ratio and can be a quick way to boost your credit scores. People with the best credit scores typically have utilization rates below 10%.

- Keep unused credit cards open. Closing a credit card, especially one you've had for a while, shortens the average age of your credit accounts, reduces your available credit and can negatively impact your credit mix if it's your only revolving credit account. All of these factors can lower your credit score.

- Avoid applying for new credit. Whenever you apply for credit, the lender places a hard inquiry on your credit report, which can cause your credit score to drop temporarily. Avoid applying for new credit cards or loans while you're preparing to buy a car.

- Try Experian Boost®ø. Experian Boost is a free feature that adds your eligible utility, phone, streaming service, rent and insurance payments to your Experian credit report, which could help increase your credit scores.

Learn more: How to Improve Your Credit Score

The Bottom Line

Although you can't know exactly which FICO® Score version a lender will use, that usually doesn't matter. A good base FICO® Score generally indicates a good FICO Auto Score too. Positive credit habits can help improve all your credit scores, which may qualify you for lower interest rates on your next auto loan.

Experian's free credit monitoring service can be a useful tool as you prepare to apply for a car loan. You'll be able to track your credit score, monitor important changes to your credit and get tips to help improve your credit score.

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

Karen Axelton is Experian’s in-house senior personal finance writer. She has over 20 years of experience as a journalist and has written or ghostwritten content for a variety of financial services companies.

Read more from Karen