What Is a Good Credit Score for an Auto Loan?

Quick Answer

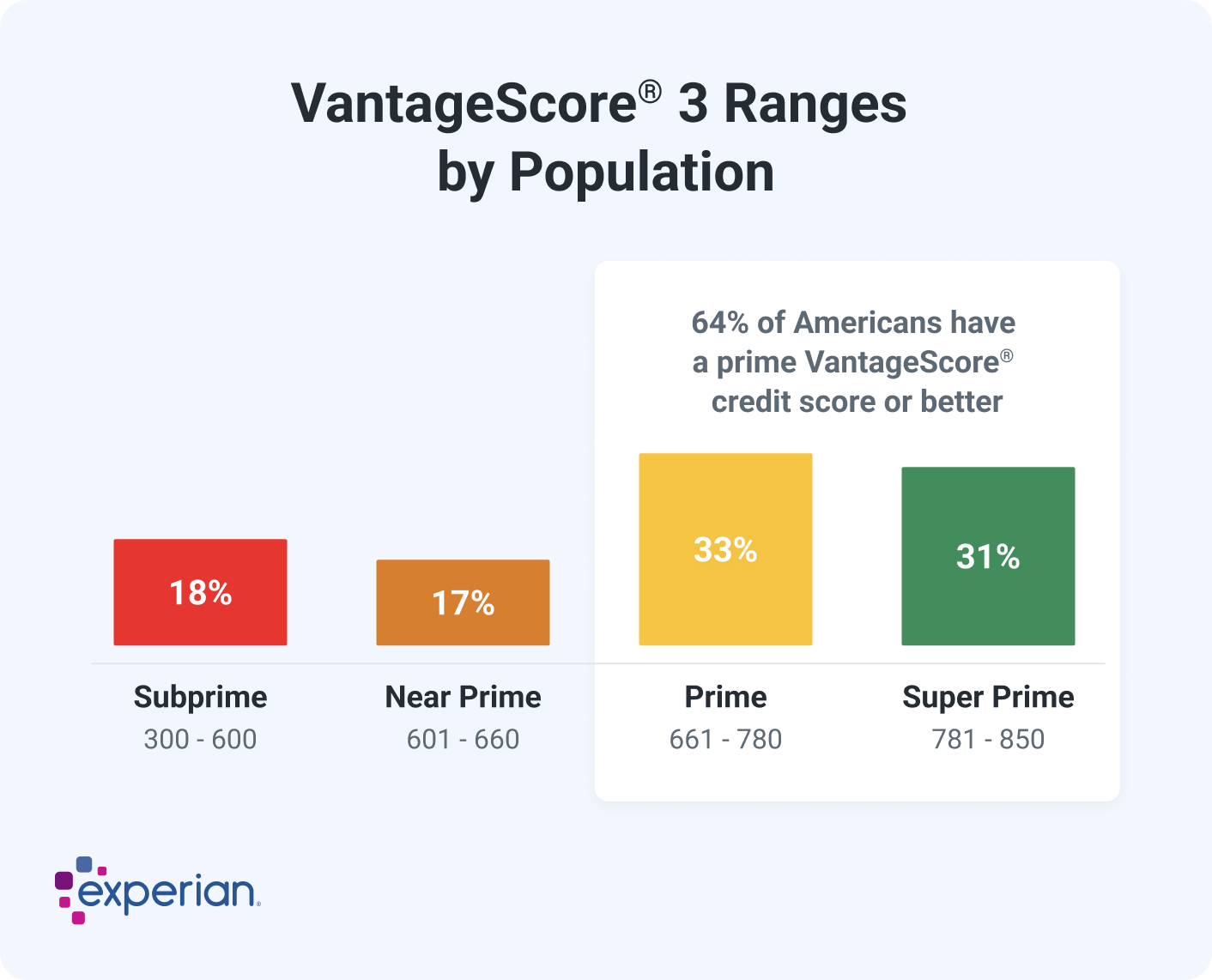

While it's possible to get an auto loan with nearly any credit score, most lenders are looking for buyers in the prime credit score range with a credit score of 661 or above for the best terms and rates.

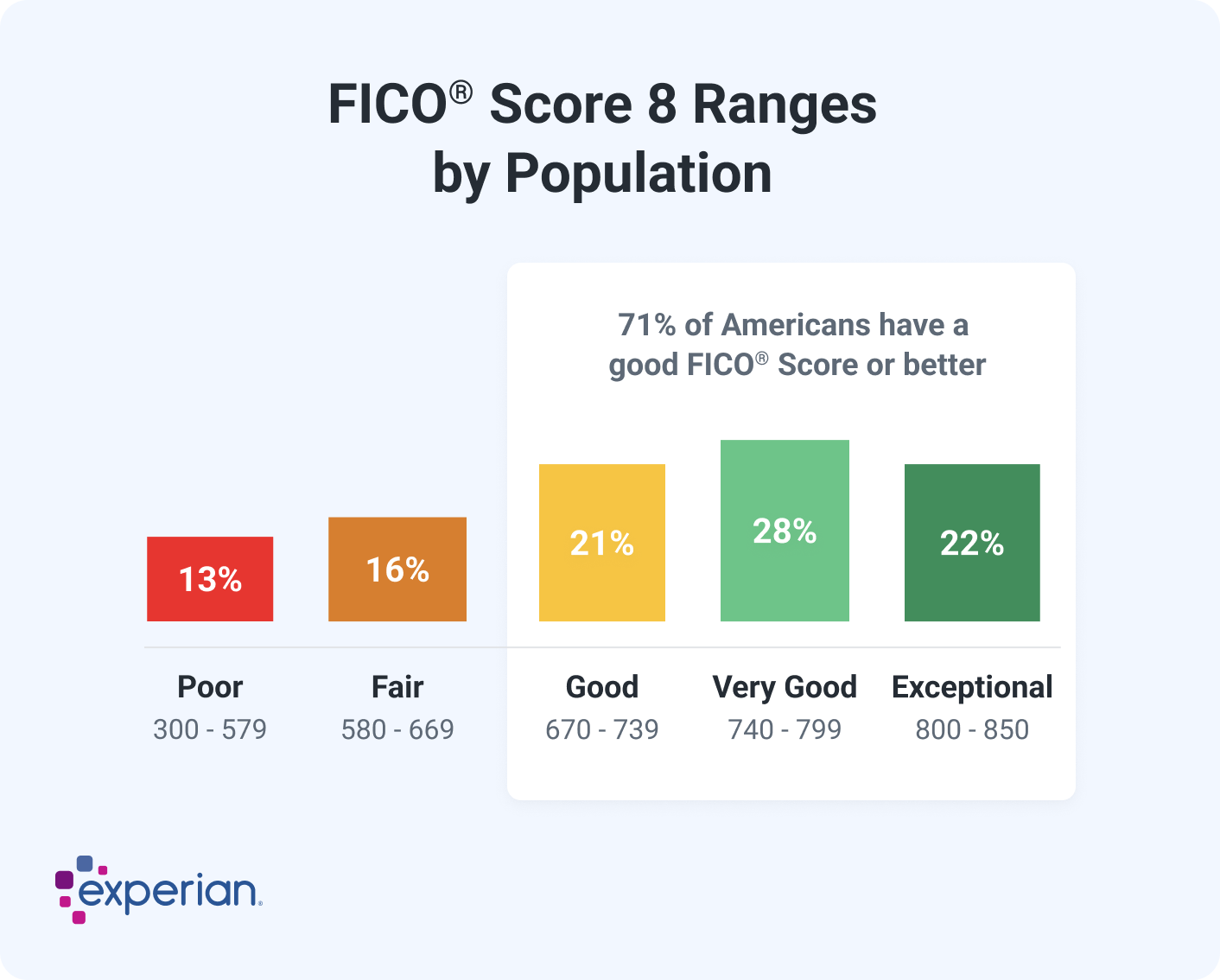

There's no minimum credit score required to get an auto loan. However, a credit score of 661 or above—considered a prime VantageScore® credit score—will generally improve your chances of getting approved with favorable terms. For the FICO® ScoreΘ, a good credit score is 670 or higher.

Here's what you need to know about how your credit score affects a car loan, what credit score you need to get approved and other things to consider before applying.

What Is the Minimum Credit Score to Buy a Car?

There's no specific minimum credit score for a car loan. Banks, credit unions, online lenders, dealerships and auto finance companies can choose their own minimum credit score requirement for borrowers.

Some lenders might have a hard cutoff point, while others may set a minimum based on other factors, such as how much you're borrowing and the size of your down payment.

Auto lenders can also choose from different types of credit scores, including VantageScore credit scores, base FICO® Scores and industry-specific auto FICO® Scores. Although most credit scores use a similar 300 to 850 range, the lender's minimum credit score might depend on the type of score they use.

Average Car Loan Interest Rates by Credit Score

The average VantageScore credit score for new auto loan applicants is 749, according to Experian's fourth quarter (Q4) 2024 State of the Automotive Finance Market report. For used auto loans, the average is 687.

Here's a quick look at how interest rates can vary depending on your VantageScore credit score range:

| Credit Score Range | New Car Loan | Used Car Loan |

|---|---|---|

| Super prime (781 - 850) | 4.77% | 7.67% |

| Prime (661 - 780) | 6.40% | 9.95% |

| Near prime (601 - 660) | 9.59% | 14.46% |

| Subprime (501 - 600) | 13.08% | 19.38% |

| Deep subprime (300 - 500) | 15.75% | 21.81% |

Source: Experian data as of Q4 2024; VantageScore 4.0 credit scores used

If your credit score is on the lower end, it can make sense to take steps to improve your credit before you get started on the car-buying process.

How to Build Credit Before Buying a Car

If you can put off the purchase for at least a few months, you might be able to improve your credit and qualify for a better car loan. Even if you can't wait, you could try to refinance with a lower-rate car loan after your credit score increases.

The exact steps you'll want to take to build your credit score could depend on what's affecting your credit today. You can review your Experian credit report for more insights into your specific credit history. However, here are some general guidelines to help you get started:

- Pay your bills on time. Your payment history is one of the most important credit scoring factors, and even one late payment can damage your credit significantly. Make it a goal to bring all your accounts current and make at least the minimum payments on your bills going forward.

- Decrease credit card balances. Paying down credit card balances can lower your credit utilization rate—a comparison of your cards' balances and credit limits. A lower utilization rate is best for your credit, and reducing credit utilization is one of the few things you can do that might quickly increase your credit score.

- Keep your credit cards open. Closing credit cards might make sense if the card has an annual fee or if you tend to overspend and accrue interest. Otherwise, consider keeping the cards open. Closing a card could decrease your overall available credit, which increases your credit utilization rate and might hurt your scores.

- Address collection accounts. If you've had bills sent to collections, settling or paying off the collection accounts might improve some of your credit scores.

- Get added as an authorized user. You might be able to improve your credit by asking a friend or family member with great credit to add you as an authorized user on one of their credit cards.

- Check your credit reports. Closely review your credit reports for inaccuracies that might be hurting your credit scores, such as fraudulent past-due accounts or incorrectly reported late payments. You have the right to file disputes with the credit bureaus and ask them to review and verify the information in your report.

- Delay other loan applications. Applying for and opening new credit accounts might hurt your credit scores, so it may be best to hold off until you have your new car.

- Add payments with Experian Boost®ø. The free Experian Boost feature lets Experian members add eligible utility, phone, streaming service, rent and insurance payments to their Experian credit reports. These payments can improve your credit history and may increase some of your credit scores.

How to Get a Car Loan With Bad Credit

You can get a car loan with bad credit, but you may have fewer options and end up paying more interest and fees than someone with a higher credit score.

If you have a low credit score, consider whether buying a car right now makes sense or if waiting to improve your credit is a better option. If you need to buy a car urgently, here are a few steps you can take to prepare and potentially improve your options:

- Check your credit. Although you likely won't know which credit score the lender will use, you can still check one of your credit scores and review your credit report. You might find that there are ways to quickly improve your credit score before applying.

- Get prequalified. Some auto lenders offer online prequalification, which can show you estimated loan offers using a soft credit inquiry. This process doesn't affect your credit scores. Try to get offers from several types of lenders so you can compare terms.

- Increase your down payment. A larger down payment might help you qualify for a lower interest rate. Even if it doesn't, borrowing less money will lead to paying less interest.

- Ask someone to cosign. You could see if a close friend or family member who has good credit is willing to cosign the loan. It could help you qualify and get a better offer, but they'll also be legally liable for the debt and the loan can affect their credit.

Buyers with very low or no credit might be tempted to head to buy here, pay here (BHPH) dealers, which finance their own sales and generally have more lax eligibility requirements.

However, these loans tend to be very expensive, and your on-time payments may not help you build a positive credit history. Try several banks, credit unions, online lenders and non-BHPH dealers first to see what they can offer.

Compare rates on a new auto loan

Find a good auto loan with today’s rates. Compare current rates and offers to find the best loan for you.

How to Apply for an Auto Loan

If you're looking to apply for a car loan in the near future, here are some steps you can follow to prepare yourself and ensure you get the best possible deal.

1. Check Your Credit Score

Check your FICO® Score with Experian to understand your chances of getting approved with certain lenders and what loan terms and costs you can expect. If your credit score is in poor shape and you're not in a rush to buy a new car, consider working on improving it before you apply.

And remember, if you have bad credit and need a car now, getting a cosigner or making a large down payment can help improve your chances of getting approved.

2. Research Lenders

Shopping around is one of the best things you can do to save money on your car loan. Different lenders have varying eligibility criteria and terms, so by comparing multiple lenders, you'll have a better chance of finding the loan that's the best fit for you and costs the least.

Getting prequalified with multiple lenders can allow you to compare options based on a soft credit inquiry. However, it may also help to get preapproved to get a firmer idea of your loan terms.

The preapproval process may involve a hard inquiry, but shopping around within a short period of time—45 days for newer FICO® Score models—will typically result in just one inquiry for scoring purposes.

3. Have a Good Down Payment or Trade-In

Putting money down or trading in a car on your loan can reduce how much you borrow, saving you money on interest charges over the life of the loan. Depending on the situation, it could also lower your interest rate because the lender is taking on less risk with a smaller loan.

It can take time to save money for a down payment, so start sooner rather than later. And keep in mind that selling a car to a private party could net you more cash than a trade-in.

4. Get Preapproved Before You Buy

Many banks and other auto lenders allow borrowers to get preapproved before they ever step foot in a dealership. This process doesn't take long—you can often do it online—and it can allow you to potentially get financing for less than what the dealer can arrange with its partner lenders.

Learn more: How to Save for a Car

Frequently Asked Questions

Build Credit for Lower Rates

The key to qualifying for a better auto loan rate is to start improving your credit well before you need to apply. To avoid getting caught with a high-interest loan, work on practicing good credit behavior all the time.

Even if you can't wait for better credit to buy a car, establishing a good credit score can help you qualify for better refinancing rates in the future. As you work to build credit, monitor your credit regularly to track your progress and address potential issues as they develop.

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

Ben Luthi has worked in financial planning, banking and auto finance, and writes about all aspects of money. His work has appeared in Time, Success, USA Today, Credit Karma, NerdWallet, Wirecutter and more.

Read more from Ben