What Is Creditworthiness?

Quick Answer

Creditworthiness is a lender’s appraisal of how likely you are to repay your debts. Lenders assess your creditworthiness by taking into consideration your income and looking at your history of borrowing and repaying debt.

Creditworthiness is a lender's appraisal of a potential borrower's ability and willingness to repay debts. A borrower deemed creditworthy is someone a lender considers willing, able and responsible enough to make loan payments as agreed until a loan is repaid.

What Factors Determine Creditworthiness?

To evaluate your creditworthiness, lenders typically look for proof that your income will enable you to cover your loan payments, and evidence that you pay your bills and can manage debt responsibly. They may use the following information to determine your creditworthiness:

- Credit report: Credit reports maintained by the three national credit bureaus (Experian, TransUnion and Equifax) log your current debts and credit accounts you've paid off or closed in the past 10 years. Payments on those accounts are logged as well, and marked as paid on time or paid 30, 60 or 90 days late. If you've had a bill turned over to a third-party collection company in the past seven years, that will likely be noted as well, as will vehicle repossessions, property foreclosures and bankruptcies. On-time payments are viewed as signs of creditworthiness; negative entries, especially recent ones, detract from creditworthiness.

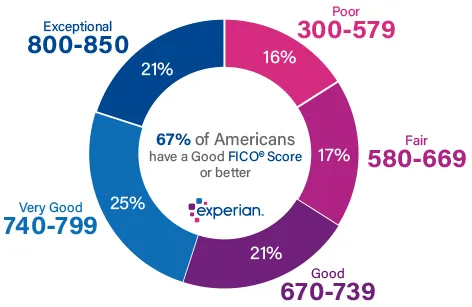

- Credit score: Credit scoring systems such as the FICO® ScoreΘ and VantageScore® analyze the contents of your credit report to predict how likely you are to fail to repay a loan. Their forecasts are encapsulated in three-digit scores, usually between 300 and 850. Higher credit scores indicate lower risk of default, and therefore denote greater creditworthiness.

- Income: When you apply for a loan or other form of credit, the lender typically requires proof of income with a recent pay stub, tax return or other evidence that you have a source of available cash.

Factors used to evaluate creditworthiness—your earnings, your history of borrowing and repaying debt, and your track record of credit management—can change over time. As your earnings improve and as you continue to manage your credit responsibly, your creditworthiness can improve. Conversely, if you miss payments or fail to repay your debts, your creditworthiness can decline.

Why Does My Creditworthiness Matter?

If you're considered creditworthy, it will be easier to borrow money or otherwise obtain credit to purchase goods or services you cannot (or don't want to) pay for with cash. Creditworthiness is especially helpful for financing large purchases, such as a car, a home or a college education.

That said, creditworthiness is not an all-or-nothing condition. Each lender has minimum requirements you must meet to qualify for credit, but they also recognize degrees of creditworthiness among borrowers they are willing to work with. Applying a method known as risk-based-pricing, lenders typically offer their best borrowing terms—their lowest interest rates and fees— to borrowers they deem most creditworthy; other qualifying borrowers are typically charged higher rates and fees in accordance with lesser creditworthiness.

Lenders can match their products and interest rates to borrowers within any credit score ranges they choose, but these segments, defined by the makers of the FICO® Score, give an idea how lenders might view scores that fall within certain ranges:

Creditworthiness doesn't just matter when you're borrowing money. Strong credit can help with:

- Renting: Landlords often use credit checks to check potential tenants' reliability and to decide how large a security deposit to require.

- Insurance: Auto insurers in most states can use credit scores to help set your premiums.

- Utilities: Cable and utility companies often perform credit checks before letting you open an account or lease equipment.

- Employment: Prospective employers may check credit reports as part of a pre-hiring background checks.

How to Check Your Creditworthiness

You can get a decent idea of how a lender will judge your creditworthiness by reviewing the same information they'll consider when evaluating your credit application:

- Credit report: You can check your credit reports for free each week at AnnualCreditReport.com, and should review them carefully for accuracy. You have the right to dispute any entries in your credit report that you believe are incorrect. If inaccurate negative entries are removed, your credit scores could improve.

- Credit score: You can check your FICO® Score based on Experian data for free and may be able to check your FICO® Scores from other credit bureaus via your bank or credit union, credit card issuer or online subscription services. You can also check your VantageScore credit score from a number of sources. There's no way to know which score a given lender will use when processing your application, but these can give you a pretty good idea of where you stand.

- Available income: Lenders want to know you have reliable income or, if you're retired or not employed full time, that you have savings or investments. But often they're even more concerned about how much of your money is available each month after you've paid your other financial obligations. This is measured by calculating your debt-to-income ratio (DTI). The lower your DTI, the greater your perceived creditworthiness.

How to Improve Your Creditworthiness

Increasing your income and building your credit scores are both pursuits that can lead to greater creditworthiness. Both may also be steady, gradual processes. Your career path may lead in a host of different directions, but the steps that lead to healthy credit reports and promote credit score improvements are well-known. They include:

- Pay bills on time. Making debt payments on time every month will promote credit score improvement and spare you annoying and expensive late fees.

- Reduce debt and high credit card balances. The lower your outstanding credit card balances, the better. A balance that exceeds about 30% of a card's borrowing limit can hurt your credit scores. Reducing outstanding debt can lower your DTI ratio as well.

- Seek new credit only as needed. Applying for and opening new credit accounts will tend to lower your credit scores, so avoiding multiple applications over a short time frame can prevent a cumulative negative effect.

- Cultivate a variety of credit. Without borrowing too much too fast, you can help improve your credit scores by showing you can manage multiple credit accounts, including a mix of installment loans (such as student loans, car loans and personal loans) and revolving credit accounts (such as credit cards).

- Consider Experian Boost®ø. Enrolling in Experian Boost lets you apply your history of eligible rent, insurance, utility, streaming and cellphone payments to your Experian credit report, where they could improve your scores based on Experian credit report data.

The Bottom Line

Creditworthiness is a form of trust. It can take time and effort to earn, and mistakes and poor judgment can do it serious harm. It's never irreparable, but nurturing it by adopting and sticking with sound credit habits is easier by far than rebuilding it. Whether you're establishing it as a new borrower, building on years of steady improvement, or recovering from a misstep, a great way to track your creditworthiness is by checking your FICO® Score free from Experian.

What’s on your credit report?

Stay up to date with your latest credit information—and get your FICO® Score for free.

Get your free reportNo credit card required

About the author

Jim Akin is freelance writer based in Connecticut. With experience as both a journalist and a marketing professional, his most recent focus has been in the area of consumer finance and credit scoring.

Read more from Jim