What’s the Difference Between Secured and Prepaid Cards?

Quick Answer

A secured credit card is best for those who need to build credit. Much like a regular credit card, a secured card helps you build credit by making on-time payments each month.

A prepaid card is best for those who simply want a convenient way to pay without cash. Since prepaid cards aren’t a form of borrowing, you won’t see an impact on your credit score.

If you have a limited credit history or a low credit score, getting approved for a credit card can be challenging. As a result, you might be considering a secured credit card or a prepaid card as a way to pay. Both cards are a good option for making secure, convenient payments, and both require you to deposit funds to start using the card. But their similarities just about end there.

In a nutshell, a secured credit card is best if you want to build your credit history, whereas a prepaid card is primarily a way to prepay for purchases—and has no positive or negative impact on your credit score. Here's a rundown of both types of cards and how to decide which is best for you.

What Is a Secured Credit Card?

A secured credit card is a type of credit card that requires the borrower to pay the lender a refundable security deposit. The card's credit limit is then typically equal to that security deposit.

As is the case with any credit card, you'll need to apply for a secured credit card. But unlike most unsecured credit cards, secured cards are designed specifically to be accessible to those with a limited borrowing history or poor credit.

You can think of a secured credit card as similar to a loan that requires collateral, where the amount you can borrow is backed by a security deposit. Their biggest advantage is that secured credit cards allow you to build your credit history over time (more on this below). Depending on the card, it may also offer credit card benefits such as zero liability protection against fraudulent charges.

What Is a Prepaid Card?

A prepaid card is a type of debit card that's not attached to a bank account. You don't need a bank account to get a prepaid card, and using one is as simple as loading money onto the card and then making purchases or withdrawals up to the amount of your deposit on the card.

Like a secured card, a prepaid card requires you to make a deposit before you can use it for payment. However, unlike a secured credit card, you won't need to undergo a credit check for a prepaid card. That means you won't have to worry about being turned down on the basis of a limited or negative credit history. But by the same token, a prepaid card can't help you build credit.

What's the Difference Between Secured Credit Cards and Prepaid Cards?

To understand the key differences between secured credit cards and prepaid cards, first take note of their similarities: Both require you to deposit money before you can use the card to make payments, and both allow you to make purchases online and at in-person stores.

But beyond that, secured credit cards and prepaid cards differ in these major ways.

Building Credit

Secured credit cards allow you to start building up your credit history. As long as you keep using the card and making at least the minimum payment each month, you won't forfeit your deposit, and you'll build up your payment history over time. Eventually, this strategy can help you qualify for a credit card without a security deposit.

In contrast, prepaid cards don't impact your credit. Since you can only spend money you've got on the card and you aren't borrowing any money, there isn't any payment history to report to the credit bureaus and there won't be any impact to your score.

How You Pay

Apart from the required security deposit, a secured credit card works the same as any other credit card. Each month, you'll receive a monthly statement detailing your transactions and showing your total statement balance and minimum payment due. You'll need to pay at least the minimum to avoid doing damage to your payment history and thus your credit; however, it's even more beneficial to pay off your balance in full to avoid interest charges.

A prepaid card allows you to load money onto the card, make purchases with the funds and continue to do so until you've exhausted your deposit. At that point, you would need to deposit more funds onto the card before you can use it again. But you'll never owe monthly payments on your transactions—you've already paid for them.

Fees

As is the case with any type of credit card, it's important to read the cardholder agreement and understand the card's terms before you apply. Secured credit cards can charge a number of fees, such as annual fees and interest.

When you're comparison shopping for a secured credit card, compare the fees to find the best card for you. Remember that paying your balance in full each month can help you avoid paying any interest.

When it comes to prepaid cards, fees can vary. Some don't assess any fees, but others may charge a small fee every time you make a purchase. Some charge activation fees, monthly fees or even fees when you load more money onto your card. Read the fine print to see how these fees would eat into your funds and then make the best decision for you.

Should I Get a Secured Card or a Prepaid Card?

Ultimately, deciding whether to get a secured credit card or a prepaid card comes down to your personal needs and goals for the card.

When to Consider a Secured Card

Between a secured card and a prepaid card, a secured credit card is the clear choice if your aim is to build credit. Making on-time payments and keeping your credit utilization rate low will help you add positive information to your credit history.

But before you decide to go this route, consider alternatives. If building credit is your aim, other options include becoming an authorized user on a family member's card or trying Experian Boost®ø, a feature that allows you to get credit for on-time rent, utility, phone and streaming service payments—all of which may help you increase your credit score within minutes.

When to Consider a Prepaid Card

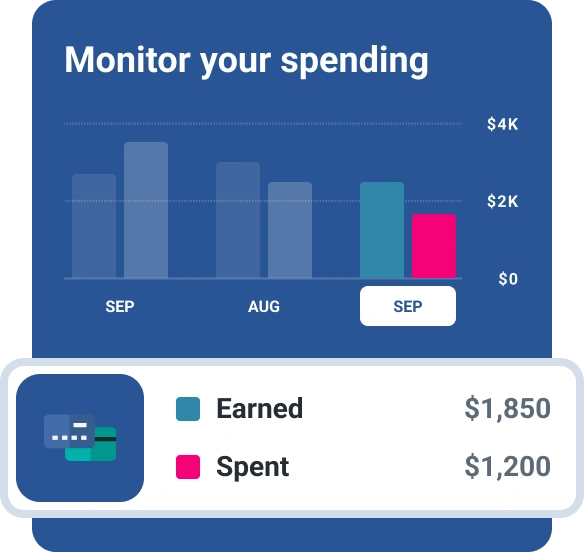

A prepaid card may be the best choice for you if you simply want an alternate method of payment, are trying to allocate a set amount of funds toward budgeting or are giving the prepaid card to someone else, such as for a child's allowance. You won't risk going into debt or incurring any interest charges, but you'll still need to be mindful of fees and read the card's terms.

Know Your Score First

Both secured credit cards and prepaid cards have their perks, but which one you should pick comes down to your needs. While they can both be used to make purchases, they're otherwise different and best fit to different goals. Know the strengths and weaknesses of both before you proceed with either.

Keep in mind that you aren't necessarily limited to these two options. To see where you stand, first check your credit score for free through Experian. Your credit score can give you an indication of how likely you are to qualify for an unsecured credit card. Consider Experian's credit matchmaking service to view a snapshot of what cards you're likely to qualify for based on your credit profile.

Looking to build credit?

Discover secured credit card offers matched to you, so you can apply with confidence. Get started with your FICO® Score for free.

See your offersAbout the author

Evelyn Waugh is a personal finance writer covering credit, budgeting, saving and debt at Experian. She has reported on finance, real estate and consumer trends for a range of online and print publications.

Read more from Evelyn