What Does “Not Enough Activity to Generate a Credit Score” Mean?

Quick Answer

You may not have enough information in your credit file to generate a score. This can happen if you have little or no recent credit activity or if your accounts are too new to score.

If you check your credit and don't receive a credit score, that means there is not enough recent activity on your credit report to generate a traditional credit score. This doesn't mean you have bad credit—it simply means the credit bureaus don't have sufficient information to calculate a score.

Understanding why you didn't see a credit score and what you can do about it can help you take the right steps toward building a solid credit history.

What Does It Mean to Not Have Enough Activity to Generate a Credit Score?

When your credit report fails to meet the minimum requirements for credit score calculation, you will not see a traditional credit score. This means your profile doesn't contain tradelines (credit accounts) that satisfy two key criteria: a status date or balance reported within the past six months.

This situation can occur when you have older credit accounts that are no longer reporting recent activity. You may have had credit accounts in the past, but if those accounts haven't shown any updates, such as payments or balance changes, in the past six months, the scoring model can't generate a traditional credit score.

Think of it this way: Credit scoring models need recent information to evaluate how you manage credit. Without current data, though, they simply don't have enough to work with.

How to Check Your Credit Report

Before you can address not having enough credit activity for a credit score, you need to see what's actually on your credit report. Fortunately, checking your credit report is free and straightforward.

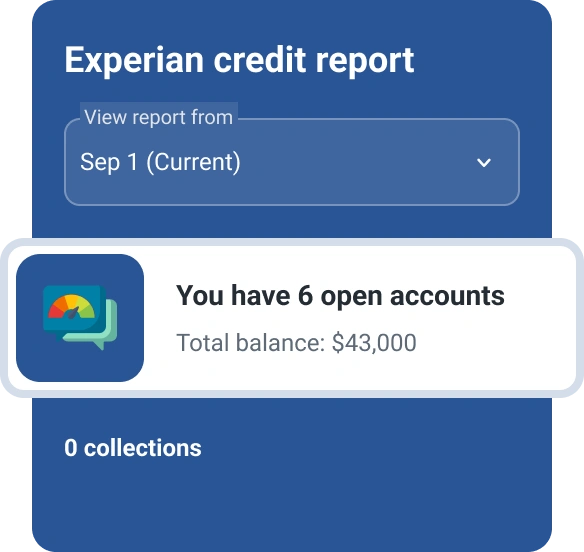

With Experian, you can get free access to your Experian credit report anytime. Alternatively, you can get free reports weekly from all three consumer credit bureaus—Experian, TransUnion and Equifax—through AnnualCreditReport.com.

When reviewing your credit reports, look for:

- Any accounts that may not be reporting activity

- Information you believe may have been reported in error or as a result of fraud

- The age and status of your credit accounts

- Whether your accounts are being reported to all three credit bureaus

Read more: What Is AnnualCreditReport.com?

How to Build Credit History

If you don't see a traditional credit score when you check your credit, the solution is to establish consistent, recent credit activity. Here are proven strategies to build or rebuild your credit history:

- Become an authorized user. Ask a family member or trusted friend who manages credit responsibly to add you as an authorized user on their credit card account. Their account history, including payment history and credit limit, will appear on your credit report and can help you establish credit even if you don't use the card.

- Pay all bills on time. Payment history is the single most important factor in your FICO® ScoreΘ, accounting for 35% of your score. As you start using credit again, it's crucial that you make it a priority to pay on time every month. It may help to set up automatic payments or reminders to ensure you never miss a due date.

- Keep credit balances low. Your credit utilization rate—the percentage of available credit you're using on your credit cards—is an important factor in your FICO® Score. While some credit experts recommend keeping your utilization rate below 30%, there's no hard-and-fast rule; the lower it is, the better.

- Use credit regularly but responsibly. Make small purchases with your existing credit cards each month and pay the balance in full by the due date. Even minor transactions create recent activity that credit scoring models need to generate a score.

- Consider a secured credit card. If your credit history is too limited to qualify for a traditional card, a secured credit card can help you create a foundation to help you get started.

- Build a mix of credit over time. Having different types of credit, such as a credit card, an auto loan and a mortgage, can strengthen your credit profile over time.

It's also a good idea to sign up for free credit monitoring to track changes to your credit report and catch potential errors or signs of identity theft early. When you see accounts reporting activity and your credit score being calculated, you'll know your efforts are working.

Learn more: How to Establish Credit if You're Unscoreable

Start Building Your Credit Today

Building credit takes time, and FICO scoring models require at least six months of credit history before they can calculate a score. The tips outlined above can help you address your lack of credit activity and establish a good credit score over time.

When you're ready to get started, register for a free Experian account to access your credit report, monitor your progress and see when your credit score becomes available.

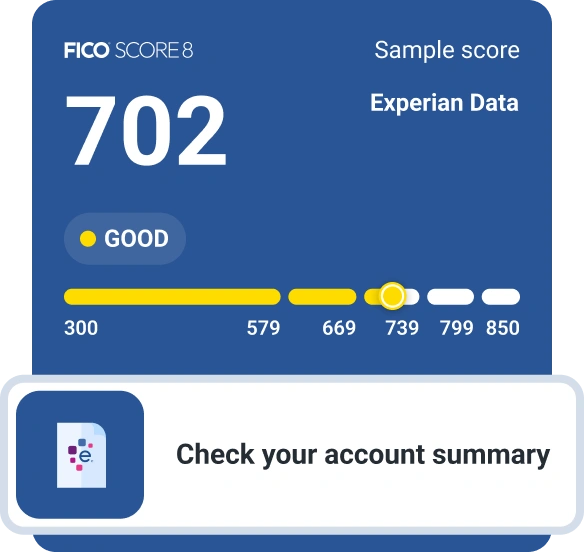

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

Ben Luthi has worked in financial planning, banking and auto finance, and writes about all aspects of money. His work has appeared in Time, Success, USA Today, Credit Karma, NerdWallet, Wirecutter and more.

Read more from Ben