How to Freeze Your Credit at All 3 Credit Bureaus

Quick Answer

You can freeze and unfreeze your credit reports at Experian, TransUnion and Equifax online, by phone or by mail. The online option is the fastest and easiest.

You have the right to add a security freeze, more commonly called a credit freeze, to all of your credit reports for free. Doing so can limit access to your credit reports, which may help protect you from some types of credit fraud. There are several ways to freeze your credit at each of the three credit bureaus, but freezing your credit online might be the easiest option.

What Is a Credit Freeze?

A credit freeze is an action you can take to manage access to your consumer credit reports at Experian, TransUnion and Equifax. When you freeze your credit, the credit bureau won't release your report to creditors that want to check your credit as part of an application review process. As a result, creditors may deny applications for new credit accounts, such as credit cards and loans.

Although you'll need to remember to unfreeze your reports before applying for credit, keeping your reports frozen can help prevent someone from opening a new account in your name. You can additionally freeze other types of consumer reports, such as your National Consumer Telecom and Utilities Exchange (NCTUE) report and ChexSystems report, to help keep criminals from opening other types of accounts in your name, such as utility or bank accounts.

How to Freeze Your Credit

If you want to freeze your credit reports, you'll need to request and manage the freeze separately with all three bureaus. You can do this online, by phone or by mail. The fastest and easiest way tends to be online. Some bureaus also have a mobile app that you can use to freeze and unfreeze your report.

| Experian | TransUnion | Equifax |

|---|---|---|

|

Experian Security Freeze |

TransUnion |

Equifax Information Services LLC |

What Information Do You Need to Freeze Your Credit?

The information you need to freeze your credit includes personal details and possibly financial documents.

These typically include your:

- Full name

- Date of birth

- All addresses you've used in the past two years

- Social Security number

- Government-issued identification, such as a driver's license or state ID card

If you're freezing or thawing your credit reports online, you'll simply need to log in to your account with each bureau individually and go to the credit freeze management center. However, if you're freezing your report over the phone, you may need to verify your identity by entering your information or answering questions.

Tip: When freezing or unfreezing your credit reports by mail, you may need to download and fill out a form and include copies (don't send originals) of certain documents (ID, utility bill, bank statement, pay stubs or tax forms) to verify your identity and address.

How Long Do Credit Freeze Requests Take?

Credit freeze requests online and by phone tend to be processed immediately, although the credit bureaus technically have up to one business day to freeze your credit. It may take up to three days for a bureau to freeze your credit after they receive your letter.

Learn more: How to Keep Your Social Security Number Safe

What Does a Credit Freeze Do?

Freezing your credit limits access to your credit report. When your credit report is frozen, the credit bureau won't share your credit report, or a credit score based on the report, with companies that want to check your credit after you apply for a new credit account.

As a result, a credit freeze can help keep someone from:

- Getting a loan in your name

- Opening a credit card in your name

For example, when you apply for a credit card or loan, the creditor will usually check your credit history and score to determine if you qualify and what rates and terms to offer you on a new account. If your credit report is frozen, the creditor won't get access to your report or score and may automatically deny your application or tell you that the application is pending.

Take note that a credit freeze doesn't prevent fraud from occurring on your existing accounts. Fraudsters can still steal your physical credit cards, skim account numbers and take over your online accounts. Therefore it's important to routinely monitor your financial accounts and credit reports for signs of fraud.

Learn more: What Is Credit Card Fraud?

Who Can View Your Frozen Credit Report?

Although freezing your credit reports limits access to that credit report, it doesn't block access completely. The credit bureau could still send your report to people and companies when they request your credit report for a situation that doesn't involve opening a new credit account.

For example, you can always check your own credit reports whether or not they're frozen. Additionally, a credit bureau may create and send a credit report to:

- Your current creditors: Creditors may check your credit reports and scores while managing your account. For example, credit card issuers might raise your credit limit if your credit score increases.

- Companies responding to non-credit applications: Companies might want to check your credit when you apply for a job, insurance policy, apartment rental, phone account or utility account.

- Creditors and marketing companies: Some companies create credit-based filters to screen consumers and send them offers of credit. You can opt out of prescreened credit offers online or by phone.

- Government agents: Government agents might ask for your credit report to help them comply with a court order or warrant.

- Debt collectors: A debt collector or debt collection agency might use your credit report to find your contact information.

- Identity verification companies: Companies might verify your identity or work with a third-party identity verification company that uses the personal information in your credit report to help confirm your identity.

These types of credit checks are recorded as soft inquiries, which don't affect your credit scores.

How to Unfreeze Your Credit

If you want to apply for a new credit account, you'll need to remember to unfreeze, or thaw, your credit reports first. Similar to freezing your credit, you'll have to thaw each report separately, and you can do this online, by phone or by mail. You'll also be able to choose between a:

- Permanent thaw: Unfreeze the report indefinitely.

- Temporary thaw: Schedule when you want your report to be unfrozen and refrozen.

Unfreezing your report by phone or online might take a few minutes, although it often happens nearly instantaneously. Legally, the bureaus have up to an hour to lift a freeze.

Scheduling a temporary thaw could be the easiest option. You can schedule thaws for when you know you're going to apply for a new account, and then have your reports automatically refrozen the next day.

How to Freeze Your Child's Credit

Many children don't have a credit report unless their parents added them as an authorized user on a credit card. However, the lack of credit history and credit monitoring can actually make children a target for identity thieves.

In cases of child identity theft, a criminal might use the child's personal information to get services or open credit accounts in the child's name. And the fraud might go undetected if no one monitors the child's credit.

Similar to freezing your own credit reports, freezing your child's credit reports can limit access to the reports and protect them from fraud. If your child doesn't have a credit report, the credit bureau can create their report before freezing it.

You can go to Experian's Child Identity Theft Protection center to learn more about the process and check if your child has an Experian credit report.

Learn more: How Do I See if My Child Has a Credit Report?

Frequently Asked Questions

Continue Monitoring Your Credit Reports

Regularly monitoring your credit reports for changes can be important even if your reports are frozen. Some creditors might not review your credit reports during the application process but still report the opened account to the bureaus; looking for these new accounts could help you detect credit fraud. You can check your FICO® ScoreΘ and report for free and report for free from Experian and get real-time alerts about important changes to your credit.

Freeze your credit file for free

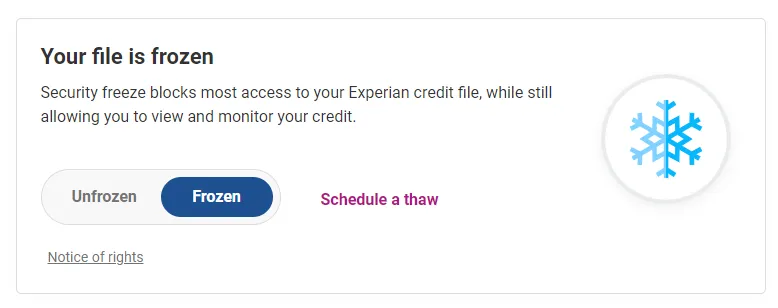

A security freeze, often known as a credit freeze, limits access to your Experian credit report—helping protect you against identity theft.

Create a free accountAbout the author

Louis DeNicola is freelance personal finance and credit writer who works with Fortune 500 financial services firms, FinTech startups, and non-profits to teach people about money and credit. His clients include BlueVine, Discover, LendingTree, Money Management International, U.S News and Wirecutter.

Read more from Louis