What to Do When Your Credit Card Application Is Denied

Quick Answer

If you're denied a credit card, you should receive a letter stating the reasons for the denial. Using this information, you can take steps to improve your credit and other areas of your finances to have better odds of approval in the future. In some situations, you may even be able to ask the card issuer to reconsider its decision.

If you apply for a credit card and get denied, you should receive a letter explaining the reasons for the denial. In some situations, you can ask the card issuer to reconsider its decision. If that doesn't work, use the letter to determine your next steps, which may include improving your credit or increasing your income.

Reasons Your Credit Card Application Can Be Denied

There are several different reasons why a credit card company may deny a credit card application, including:

- Too much debt: You can be denied for having too high of a credit utilization rate, also known as your debt-to-credit ratio. This is the total amount of revolving debt you have divided by the total amount of credit you've been extended. And while there's no strict rule on what constitutes too much credit card debt, experts recommend keeping your credit utilization ratio below 30%.

- Too many recent credit applications: When you've applied for multiple new lines of credit in a short period of time, lenders can interpret this as a possible sign of financial trouble. This can even apply to those with excellent credit.

- Credit score is too low: Most of the top credit cards require good or excellent credit, which generally means a FICO® ScoreΘ of 670 or higher. If you check your credit score and it's lower than that, you'll want to expand your search to cards that accept lower scores.

- Limited credit history: Lenders like to see a long credit history showing you've made loan and credit card payments responsibly for many years. This can be a problem for young adults, recent immigrants and those who have avoided credit in the past. If you have a "thin file," lenders may avoid extending you credit.

- Negative account information: Your payment history is the most important factor on your credit report, and having negative payment information, such as missed bill payments, can severely damage your credit. Negative information can also include charge-offs, bankruptcies and foreclosures.

- Recent late payments: Even though late payments stay on your credit report for seven years, the more recent the late payment, the more it will hurt your credit score.

- Not enough income: Under the Credit CARD Act of 2009, credit card issuers are required to assess an applicant's ability to repay any debt they incur. If your income doesn't meet the credit card company's minimum requirement or your debt-to-income ratio (DTI) is too high, you may not qualify.

- Being between ages 18 and 21: The Credit CARD Act also states that young adults must be able to show that they can repay their credit lines using their own income, limiting their ability to be approved for new accounts.

- Too much existing credit with the card issuer: If you already have a lot of available credit with the card issuer you're applying with, it may not be willing to extend more.

What Happens When Your Credit Card Application Is Denied?

If a credit card company denies your application, it's easy to find out why. This is because lenders are required by law to provide you with an adverse action letter explaining why they denied your application.

The letter may provide up to five reasons for the denial and should also provide information about how to get a free copy of your credit reports. You can typically expect to receive this letter within seven to 10 business days of the lender's decision.

What to Do When You Get Denied for a Credit Card

The steps you take after a credit card denial will depend largely on the reasons for the denial. That said, here are some actions to consider based on your situation:

- Ask the card issuer to reconsider. In some cases, you may be able to get approved by providing more information to the card issuer. For example, you may not have included all eligible sources of income, such as retirement savings, alimony, child support and government benefits. Furthermore, spouses who don't work can include income from their working spouses. If you already have an account with the credit card issuer, you can request that a portion of your credit line be moved from the existing account to the new one.

- Understand your credit reports. Review your credit reports to get an understanding of the information that's influencing the card issuer's decision. This will also help you determine which areas you can target for improvement.

- Pay down credit card balances. If your credit utilization rate is too high, take some time to pay down some of your balances to get them to a more manageable level.

- Pay off other debt. If you were denied because your DTI ratio is too high, consider paying off some of your other loans or credit cards that have lower balances. Once the debt is paid off, its monthly payment will no longer count against you.

- Wait to apply again. If you've been denied for too many recent hard inquiries, you may simply need to wait a while before you apply again. Inquiries remain on your credit reports for 24 months, but their influence will fade over time. The same can be true if you have other negative items on your credit report, although you may need to wait longer with late payments, foreclosures, bankruptcies and other negative items.

- Apply for a more suitable card. If your credit score is too low to qualify for the card you want, you may consider looking at credit cards for fair or even poor credit. Consider using a tool like Experian's card comparison tool to see offers based on your credit profile.

- Get added as an authorized user. If your credit history is limited, you may need more history before you can get approved for the card you want. One way to do this is to have a parent or close relative add you as an authorized user on one of their credit cards. Once this happens, the full history of the account will be added to your credit reports. Just make sure that the primary cardholder uses the card responsibly to get the full benefit.

- Dispute inaccurate credit information. As you review your credit reports, watch out for tradelines and details that are inaccurate. You can dispute these items with the credit bureaus and have them removed from your credit reports.

- Develop good credit habits. While there are some steps you can take that can help you get approved for your next credit card, it's important to also look into the future and how your current credit situation can impact other credit applications. Take steps to develop good credit habits so that you don't have to deal with the problem again.

Does Getting Denied for a Credit Card Hurt Your Credit Score?

By itself, a denied credit card application won't have any impact on your credit scores. However, every time you apply for any type of new credit, it results in a hard inquiry on your credit report. While a single hard inquiry may have a small, temporary effect on your credit report, several hard inquiries within a short period of time will have a more significant effect. So, if you get denied, avoid new applications until you can figure out your next steps.

How to Apply for a Credit Card With Bad Credit

If you've struggled with credit or have a thin credit file, you won't have as many options for credit cards. But you can still find cards that may work for you. Here are some steps you can take:

- Search for secured credit cards and unsecured credit cards for bad credit.

- Make sure you compare fees and interest rates—some unsecured cards for bad credit can charge exorbitant rates and fees, making secured cards an attractive alternative.

- Compare cards based on other factors, such as rewards, when the card issuer returns the deposit (if applicable) and which credit bureaus (Experian, TransUnion and/or Equifax) payments get reported to.

- See if you can get prequalified before you submit an official application—some card issuers have prequalification tools that can give you a good idea of your approval odds.

- Ask the card issuer about disqualifiers, such as bankruptcy, foreclosure, credit card-related charge-offs and other negative items.

Monitor Your Credit as You Take Your Next Steps

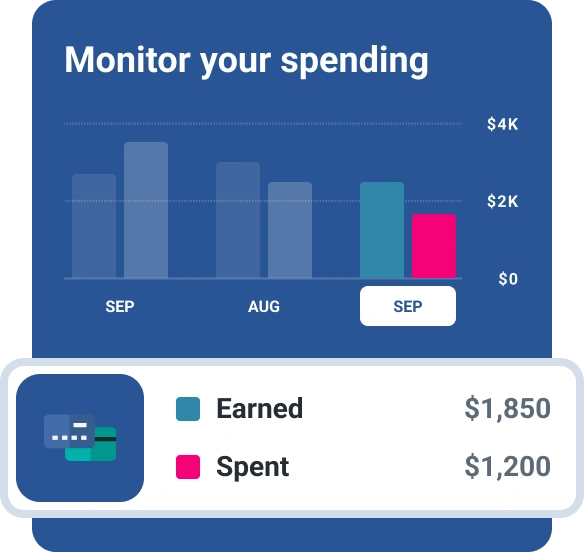

Regardless of how you respond to your credit card denial, it's important to monitor your credit to track your progress and to keep an eye out for potential identity theft issues.

Experian's free credit monitoring service offers access to your Experian credit report and your FICO® Score and also provides real-time alerts with updates to your credit report and your credit score.

Don’t apply blindly

Apply for credit cards confidently with personalized offers based on your credit profile. Get started with your FICO® Score for free.

See your offersAbout the author

Ben Luthi has worked in financial planning, banking and auto finance, and writes about all aspects of money. His work has appeared in Time, Success, USA Today, Credit Karma, NerdWallet, Wirecutter and more.

Read more from Ben