What Is a Credit Card Network?

Quick Answer

The biggest credit card networks are American Express, Discover, Mastercard and Visa. They work behind the scenes to facilitate credit card transactions and set fees charged to merchants in exchange for processing transactions. Some also issue credit cards.

Credit card networks make credit card transactions possible by connecting the merchant with the financial institution that issued a customer's credit card. They operate either by moving money from the customer's bank to the merchant's bank, or by performing the banks' function and authorizing transactions themselves.

When you use a credit card to buy something in a store or online, these networks work quickly to complete the transaction. It might get approved within a second, or it could be denied if you don't have enough available credit or the transaction looks suspicious.

Here's what to know about credit card networks and how they work.

What Are Credit Card Networks?

Credit card networks work to transfer funds from a cardholder to a merchant. When you make a purchase using a credit card, the network communicates transaction information between the merchant's bank (also called the acquiring bank) and the financial institution that issued your card (the issuing bank).

The major U.S. credit card networks, also called card associations, are American Express, Discover, Mastercard and Visa. Credit card networks don't determine your annual percentage rate (APR) or rewards; that's up to the credit card issuer, such as Capital One or Chase. American Express and Discover, however, are issuers that also run their own networks. So these companies both provide consumer credit cards and operate the networks that enable transactions.

Tip: You can't choose your own network when you apply for a credit card. But if you have a preferred network in mind, you can seek out cards on that network and apply only for those. You can find the card network's logo either on the credit card itself or see it listed in the credit card agreement.

Types of Credit Card Networks

There are two types of credit card networks:

- Open, also known as four-party networks

- Closed, or three-party networks

Networks dictate where your card is accepted. Closed networks such as American Express and Discover are less widely accepted internationally than open networks like Mastercard or Visa.

| Open credit card networks | Closed credit card networks | |

|---|---|---|

| Alternate name | Also known as four-party networks | Also known as three-party networks |

| Issuers | Other financial institutions may issue cards that utilize these networks | Other financial institutions don't typically issue cards that utilize these networks |

| Examples | Examples include Mastercard and Visa | Examples include American Express and Discover |

| Acceptance | More widely accepted internationally | Less widely accepted internationally |

Open Networks

In an open network, the four parties usually involved in a transaction are the merchant, the cardholder, the merchant's bank and the cardholder's bank. Banks such as Wells Fargo or Bank of America can issue their own credit cards and use these networks during the transaction process. Mastercard and Visa are examples of open networks.

Closed Networks

In a closed network, three parties are involved: the merchant, the cardholder and the network, which both issues the card and facilitate transactions. American Express and Discover are closed networks, as they authorize payments for their own credit cards, and other banks don't typically offer credit cards that use these networks. An exception is Credit One Bank, which issues American Express cards.

Credit Card Network vs. Credit Card Issuer

While credit card networks facilitate the transfer of information, credit card issuers are the companies that offer credit cards to consumers and businesses. The card issuer is the company that determines who qualifies for the card as well as its fees and its rewards.

As a cardholder, you'll typically deal with your card issuer, not the card's network, when taking actions such as paying your bill or reporting your card as missing.

Some large credit card issuers aren't household names, even if they issue a lot of credit cards. For example, Synchrony Financial and Comenity Bank are the two issuers behind many store credit cards. The retailer's name might be printed on the front of your card, but the card issuer will manage your account, collect payments and may report the account's status to the credit bureaus.

| Credit Card Network | Credit Card Issuer |

|---|---|

| Links merchant's bank and customer's bank to facilitate credit card payments | Makes credit cards available to customers |

| Provides information that determines whether transaction will be approved or denied | Determines credit card eligibility rules and manages the application process |

| Helps monitor and prevent fraud | Specifies each credit card's unique features such as fees, credit limits, APRs, rewards and benefits |

| Connects merchants with providers who can install hardware and software allowing acceptance of card payments | Accepts credit card bill payments from customers |

| Creates rules for the cards that are part of its network, such as phasing out magnetic stripes in favor of chip or contactless cards | May report customers' payment history, credit limits and other data to credit bureaus |

| Sets interchange fees, which are charged to merchants in exchange for processing transactions | Confirms customer's available credit, verifies their identity and approves or denies a purchase during the transaction process |

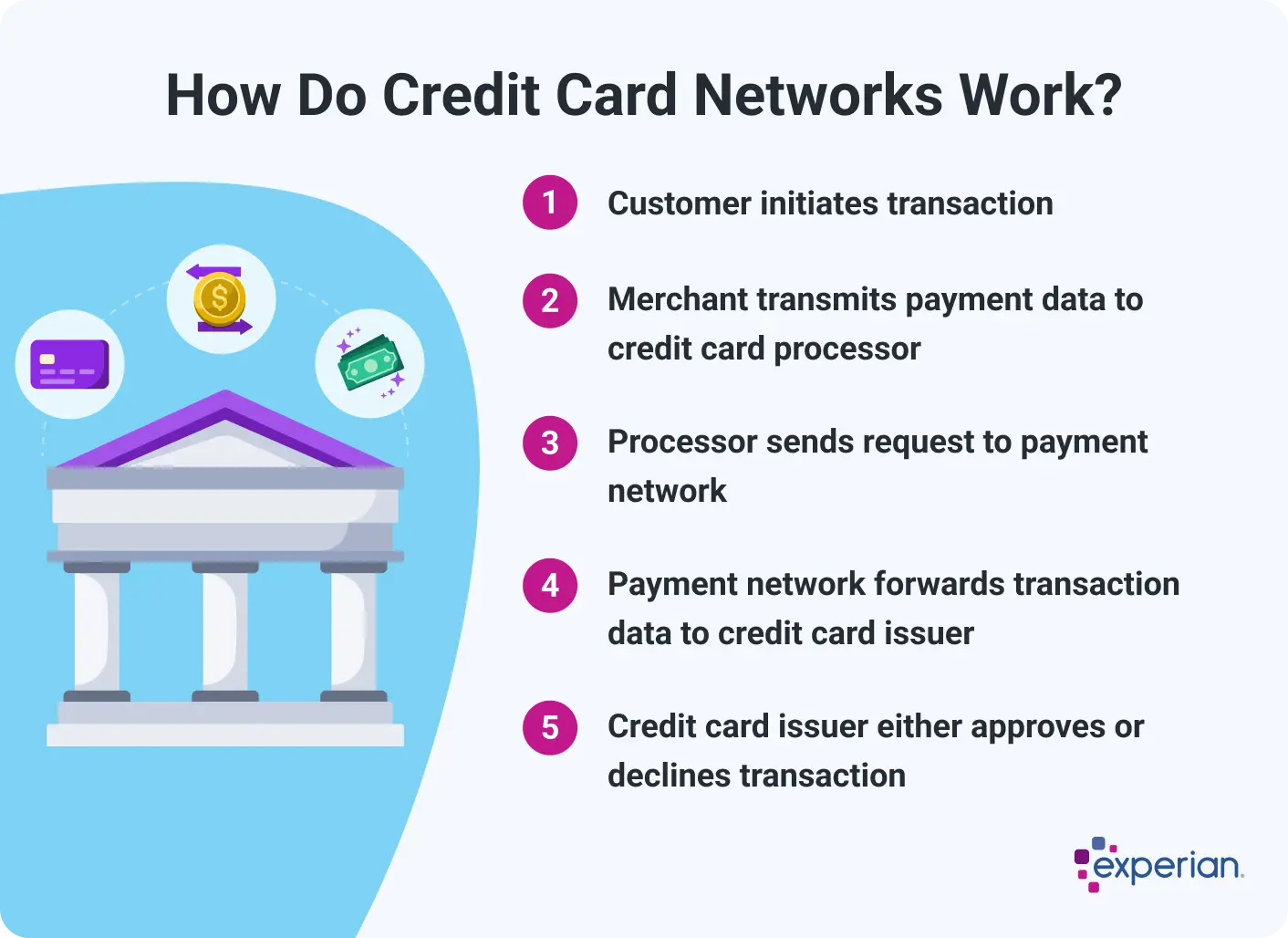

How Do Credit Card Networks Work?

Here are the general steps that take place during the transaction process.

1. Initiation

A customer initiates a credit card payment by swiping, inserting the card into a merchant's chip reader, tapping a contactless card at a terminal or completing a payment online.

2. Transmission to Processor

The merchant's payment system then transmits the payment data to the credit card processor, a company that works as an intermediary between the merchant, the banks involved and the credit card network. Small businesses in particular rely on credit card processors because they may not have the technology in place to link to credit card networks directly.

3. Request to Network

The credit card processor then sends the transaction information to the credit card network. Credit card processing is the reason for credit card surcharges, or swipe fees. The networks set interchange fees—such as a flat fee plus a percentage of the transaction amount—that are charged to merchants to process the transaction. These fees are split by different parties involved in the processing of the transaction, and merchants must pay them if they accept payments from cards belonging to a credit card network. Some merchants pass these fees on to customers.

4. Request to Issuer

Next, the network sends a request to the customer's credit card issuer and the issuing bank that provided the card. The issuer takes steps to confirm that the customer has enough available credit to make the purchase, and that they are the rightful owner of the account.

5. Approval or Decline

Finally, the issuer sends this data to the credit card network, which then communicates with the credit card processor. The purchase will be either approved or declined.

The Bottom Line

Credit card networks play an important role in the credit card transaction process, though their involvement is often invisible to the average consumer. You may only take note of your card's network if your card isn't accepted in certain places, especially internationally.

Understanding how credit card networks operate is important when choosing a credit card, as it can help you determine which credit card issuers and networks to zero in on—or avoid.

Don’t apply blindly

Apply for credit cards confidently with personalized offers based on your credit profile. Get started with your FICO® Score for free.

See your offersAbout the author

Brianna McGurran is a freelance journalist and writing teacher based in Brooklyn, New York. Most recently, she was a staff writer and spokesperson at the personal finance website NerdWallet, where she wrote "Ask Brianna," a financial advice column syndicated by the Associated Press.

Read more from Brianna