What Is Asset Allocation?

Quick Answer

Asset allocation is a strategy that can help diversify your investment portfolio and ensure that you’re investing in a way that supports your financial goals, time horizon and risk tolerance.

Every investor has their own unique goals, risk tolerance and time horizon, which is why no two investment portfolios look exactly alike. Asset allocation refers to the way your portfolio is divided between stocks, bonds and other securities. Staying diversified and holding a variety of assets can help mitigate risk while positioning your portfolio for growth. Choosing the right asset allocation is somewhat of a balancing act. Here's how it works, why it's important and how to go about doing it.

What Is Asset Allocation?

Your asset allocation is how you divide your portfolio between different asset classes like stocks, bonds and cash. Each one of these investment categories comes with risks and potential rewards. The right asset allocation for you will depend largely on your age and your appetite for risk.

The 60/40 portfolio, which consists of 60% stocks and 40% bonds, is considered a moderately conservative asset allocation. That could help protect you from losses over time and deliver steady long-term gains. But nothing is guaranteed—and some investors might find this allocation too conservative, especially if they're younger. The way you structure your portfolio should be tailored to you.

Learn more: Steps to Choosing the Right Asset Allocation Mix

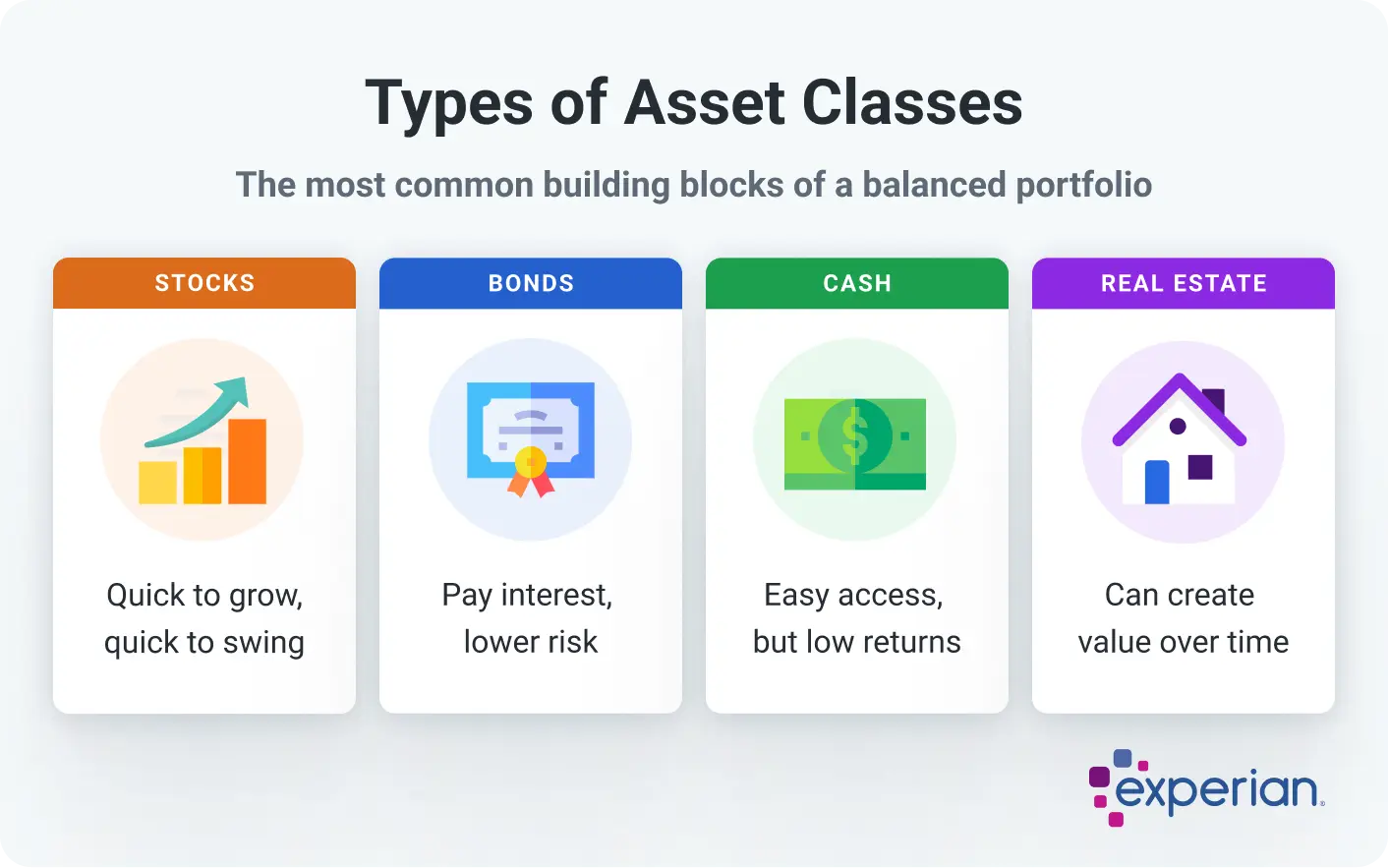

Types of Asset Classes

When deciding which assets to include in your portfolio, it's wise to keep diversification in mind. Below are the main asset classes to choose from:

- Equities (stocks): Investing in the stock market allows you to buy shares of publicly traded companies. If you eventually sell your shares for more than you paid for them, you'll turn a profit (minus your tax liability). Purchasing individual stocks generally carries more risk than investing in a stock fund, such as a mutual fund or exchange-traded fund (ETF).

- Fixed-income securities (bonds): These assets pay interest on a regular basis, so risk is much lower. Returns typically lag behind high-risk assets like stocks, but they can provide your portfolio with some stability. Fixed-income securities include bonds, certificates of deposit (CDs) and money market funds.

- Cash: Holding too much cash could rob you of investment returns and make it hard to keep up with inflation over time, but you'll want to have some cash reserves on hand. If you run into a financial emergency, pulling money from investments can have tax repercussions—and you might end up selling investments at a loss. The rule of thumb is to keep three to six months' worth of expenses in an emergency fund such as an easy-to-access high-yield savings account.

- Real estate: This might involve buying fix-and-flip houses or investing in a rental property. That could provide a consistent stream of passive income, but the real estate market can be a volatile place. A lower-risk alternative is investing in a real estate investment trust (REIT). This allows you to buy shares of a company that invests in income-producing properties.

Learn more: Diversification in Investing: What It Is and How to Do It

Why Is Asset Allocation Important?

Asset allocation is what allows you to stay diversified, and that's one of the golden rules of investing. Having a lopsided portfolio could expose you to more risk than you're comfortable with—or be so conservative that you miss out on potential returns. Asset allocation can help you strike a balance that's aligned with your goals and provides the right level of risk and potential rewards.

It's also important to diversify further within each asset class. For example, if all the stock you own is within the same sector, what will happen if that industry declines or underperforms? Similarly, you might choose to hold a mix of government bonds, corporate bonds and bond funds.

Factors That Influence Asset Allocation

Here are some important things to consider when choosing an asset allocation strategy:

- Your risk tolerance: This is the amount of financial risk you're comfortable assuming. You won't secure any returns sitting on the sidelines, but going all in could lead to significant losses. Your age, financial goals and personality usually factor into your risk tolerance.

- Your investment timeline: If you're in your 20s and saving for retirement, you might be comfortable holding a higher percentage of stocks since you have more time to recover from stints of market volatility. But if you're investing for a more immediate goal, like buying a home in the next few years, you might choose a more conservative asset allocation.

- Your financial goals: This comes back to why you're investing in the first place. If one of your goals is to build a college fund for your child, you could explore a tax-advantaged 529 plan. Meanwhile, you may opt for a 401(k) or IRA to maximize your retirement savings. Either way, you'll want to diversify within each account and choose an asset allocation that supports your timeline.

Learn more: Should I Invest if I Have Credit Card Debt?

Invest Your Money Smarter

Browse top brokerages

Find a brokerage to start investing today. Compare offers with sign up bonuses and low or no fees.

How to Allocate Assets

Now that you have a big-picture understanding of asset allocation, let's talk about how to put it into practice.

Lead With Your Age

This asset allocation strategy applies to all investors, whether you're just starting your career or getting ready to retire. According to T. Rowe Price, here's what your allocation might look like based on your age:

| Age | Stocks | Bonds | Cash |

|---|---|---|---|

| 20s and 30s | 90% to 100% | 0% to 10% | 0% |

| 40s | 80% to 100% | 0% to 20% | 0% |

| 50s | 65% to 85% | 15% to 35% | 0% |

| 60s | 45% to 65% | 30% to 50% | 0% to 10% |

| 70s and beyond | 30% to 50% | 40% to 60% | 0% to 20% |

Source: T. Rowe Price

These guidelines recommend dialing back your risk as you age. Again, the right asset allocation for you will also depend on your financial goals and risk tolerance.

Learn more: Best Ways to Invest Your Money at Every Age

Consider Target-Date Funds

With target-date funds, your asset allocation will automatically become more conservative as you get closer to retirement. These funds rebalance on their own, which could be appealing to investors who prefer a hands-off approach. Rebalancing involves readjusting your investments to match your desired risk tolerance and asset allocation. Over time, the values of your investments will likely change with regular market activity. Rebalancing brings things back into alignment.

Rebalance Your Portfolio

It's generally advised to review your asset allocation annually. While a target-date fund rebalances the investments within that particular fund, it's also possible to rebalance your overall portfolio. That may be a good option if your asset allocation could use a tune-up. You can do this by:

- Selling high-performing investments and using the returns to bump up certain asset classes

- Investing more money in asset classes that you'd like to increase

- Using stock dividends to purchase more investments within specific asset classes

Learn more: How to Rebalance Your Investment Portfolio

Frequently Asked Questions

The Bottom Line

When an investor talks about their asset allocation, they're referring to the way their portfolio is invested—more specifically, the percentage of securities they're holding in different asset classes. Stocks can help grow your wealth, while fixed-income securities can provide stability. The goal is to find the right balance based on your risk tolerance, goals and time horizon.

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

Marianne Hayes is a longtime freelance writer who's been covering personal finance for nearly a decade. She specializes in everything from debt management and budgeting to investing and saving. Marianne has written for CNBC, Redbook, Cosmopolitan, Good Housekeeping and more.

Read more from Marianne