How Do I Get My Credit Score Above 700?

Quick Answer

To get your credit score above 700, focus on paying your bills on time, reducing credit card debt, avoiding unnecessary debt and keeping an eye on your credit reports.

If you want to qualify for lower interest rates and better credit card features—and enjoy a host of other benefits—achieving a 700 credit score or better could help you do it.

To get your credit score above 700, it's important to understand which factors influence your score, and then focus on the ones that make the biggest impact. Here's what you need to know.

What Can You Do With a 700 Credit Score?

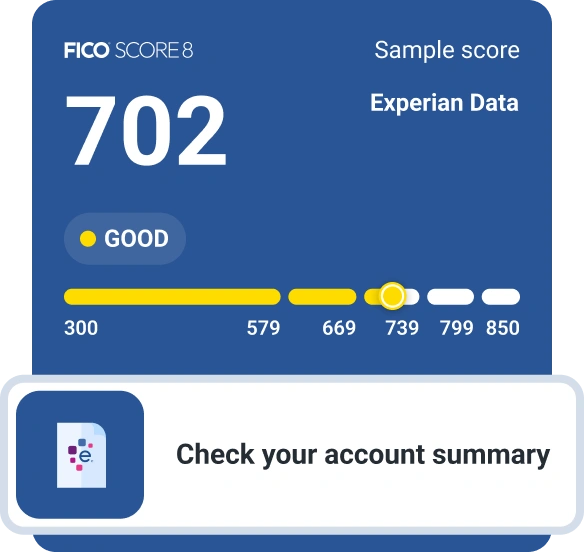

A good credit score ranges from 670 to 739, according to FICO, the scoring model used by 90% of top lenders. That means working toward a credit score above 700 could make your life easier and help improve your finances. Here's how:

- Better loan terms: Lenders look at your credit score to determine how likely you are to pay back your debts on time. The higher your score, the less of a risk you pose, typically resulting in lower rates and larger loan limits.

- Better credit card options: The best credit cards are typically reserved for consumers with good or excellent credit. If you want stellar rewards rates, a large welcome bonus, a high credit limit or premium perks, a credit score of 700 or above can give you a good chance of getting approved.

- Lower insurance rates: In most states, auto and homeowners insurance carriers use a credit-based insurance score to help determine your policy premium. While they typically can't use your credit as the sole reason for hiking your rates, it could become a factor if there are other negative factors at play.

- Better renting odds: If you're planning to rent an apartment, condo or house, the landlord will typically review your credit history to evaluate how likely you are to make your rent payment on time. With a credit score in the 700s or higher, it could give you an advantage over other prospective tenants.

Learn more: How Much Can I Borrow With a 700 Credit Score?

What Factors Affect My Credit Scores?

There are five factors that help determine your FICO® ScoreΘ. Here's a quick summary of what to focus on as you work to build your credit history:

- Payment history: This is the most influential factor in your FICO® Score and considers your track record of paying your bills on time. It also includes major negative items such as bankruptcies and collection accounts.

- Amounts owed: This element includes the total amount you owe across all of your credit accounts, as well as the amounts owed on different types of accounts and how many have balances. Another major component is your credit utilization rate, or the percentage of available credit you're using on your credit cards.

- Length of credit history: This considers how long you've been using credit, including the age of your oldest and newest accounts, as well as the average age of all of your credit accounts.

- Credit mix: Credit scoring models will look at how diverse your credit accounts are and typically reward you if you manage different types of credit, including installment and revolving credit.

- New credit: This credit scoring factor includes how long it's been since you've opened a new credit account, as well as how many recent hard inquiries and new accounts you have on your credit reports.

Learn more: The Complete Guide to Understanding Credit Scores

How to Get a 700 Credit Score

Ultimately, the steps you take may depend on the current state of your credit profile. But generally speaking, here are some of the best ways to take your credit score into 700 territory.

1. Pay on Time, Every Time

Your payment history is the most important factor in determining your credit score. Making on-time payments every month is crucial to getting your credit score above 700.

If you have some late payments on your credit report, it can take longer to achieve your goal, but know that the negative impact can diminish over time. You can also use Experian Boost®ø to get credit for other positive history for your phone, utilities, rent, insurance and streaming service payments.

2. Pay Down Credit Card Balances

Your credit utilization rate is another important factor in your credit score, so it's critical that you work to keep it as low as possible. Take some time to research different ways to pay off credit card debt to determine which approach works best for you. Then, make it a priority to keep your utilization rate low—preferably in the single digits.

3. Avoid Unnecessary Debt

The decision to apply for new debt is an important one, both for your credit score and your overall financial health. As a result, it's important to only borrow money when necessary to keep hard inquiries to a minimum and to keep your average age of accounts at a healthy level.

4. Dispute Inaccurate Credit Report Information

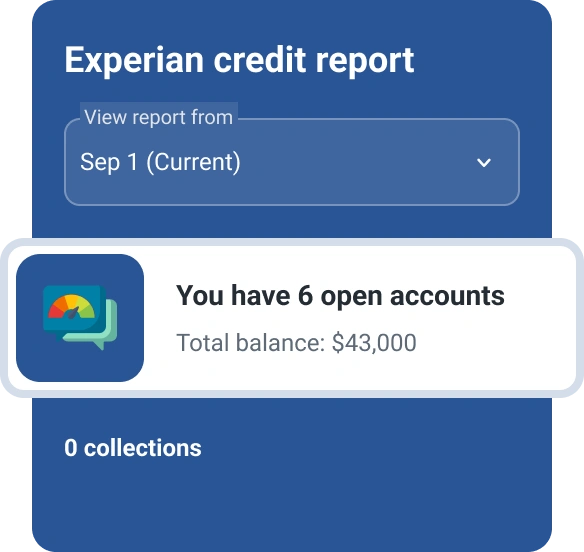

It doesn't happen often, but it's possible for your credit reports to contain inaccurate or even fraudulent information. If you find something that you don't recognize on your credit report from one or more of the three main credit bureaus (Experian, TransUnion and Equifax), you have the right to dispute the item with the credit bureaus.

The dispute process typically takes about 30 days, and if the bureaus find your claim to be correct, they will remove or modify the disputed item, which could help your credit.

5. Avoid Closing Old Credit Cards

Having old credit cards on your credit reports can help lift your credit score, so it's best to avoid closing them if possible. In addition to not canceling your old cards, consider using them now and then to avoid an involuntary closure due to inactivity.

That said, it could make sense to close an old credit card if you're paying a high annual fee you can't afford, you struggle with overspending, or if it's a secured credit card and the only way you can get your security deposit back is to close the account.

If the card has an annual fee that you no longer want to pay, check with the card issuer to see if you can downgrade your account to a card with a lower or even no annual fee.

Improving Beyond a 700 Credit Score

A perfect credit score isn't necessary to enjoy the best interest rates, terms and features that lenders have to offer, but if you want to take your credit score to the highest level, here's what you can do:

- Diversify your credit mix. Having a good mix of different types of loans and credit cards won't necessarily make a difference when you're applying for credit. However, it can help you turn a good credit score into an excellent one. That said, it's not a good idea to take out a loan simply to build credit. Your credit mix will likely get better as you naturally borrow money for different reasons.

- Keep your credit utilization rate as low as possible. According to Experian data, the average credit utilization rate for consumers with an 850 credit score is 4%, compared to 29% for all consumers. You can keep yours low by maintaining a low balance, paying your bill in full every month and asking for credit line increases when necessary.

- Keep paying on time. Even a single missed payment can drop your credit score significantly, so it's crucial that you always pay your monthly bills on time. If you happen to accidentally miss a payment, get caught up quickly—late payments typically don't get reported until you're 30 days past due.

- Be patient. Establishing excellent credit can take several years, and your score will likely fluctuate as you borrow money for different reasons and pay off loans. Instead of focusing on short-term changes, focus on long-term strategies to maintain good credit habits.

Learn more: How to Improve Your Payment History

Frequently Asked Questions

Monitor Your Credit Regularly to Track Your Progress

Building a 700 credit score and beyond doesn't happen overnight, so it's important to be consistent with your good credit habits.

Throughout the process, you can check your credit score for free through Experian, making it easier to understand how your actions influence your score and see what's working and what isn't. With ongoing updates, you can celebrate your milestones and address potential issues as they arise to protect your progress.

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

Ben Luthi has worked in financial planning, banking and auto finance, and writes about all aspects of money. His work has appeared in Time, Success, USA Today, Credit Karma, NerdWallet, Wirecutter and more.

Read more from Ben