Will a 700 Credit Score Affect How Much I Can Borrow?

Your credit score can impact your maximum loan amount and the interest rate you receive on a loan or line of credit. However, even with a score of 700—considered a good score—other factors, including your income and current debt payments, are important in determining your maximum loan amount or credit limit.

Is 700 a Good Credit Score?

Creditors set their own criteria and credit standards, and a credit score of 700 is generally considered a good, but not exceptional, score.

Commonly used credit scoring models use ranges that go from 300 to 850. Within that range, there are different score bands, and where you fall within these bands can determine if a creditor views you as someone with bad or good credit. In general, for FICO® ScoresΘ, the bands are:

- Very poor: 300 to 579

- Fair: 580 to 669

- Good: 670 to 739

- Very good: 740 to 799

- Exceptional: 800 to 850

You may also hear these score ranges or bands in relation to someone being a "prime" borrower. Prime borrowers are those who are statistically less likely to miss payments or default, and are generally offered some of the best rates and terms on credit products. Very poor credit is also called deep subprime, while exceptional credit might be labeled super prime. A 700 falls in the middle, as good or "prime" credit.

How Does My Credit Score Affect How Much I Can Borrow in Loans?

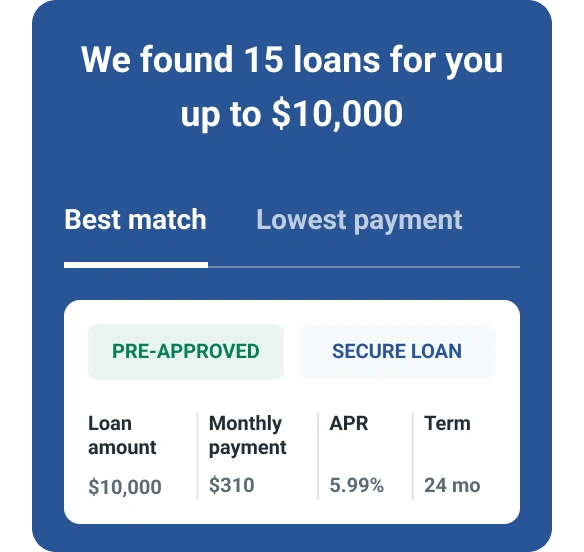

With a 700 score, you'll likely be above creditors' minimum score requirements. This means your application probably won't be denied based on your credit score, but it won't necessarily be possible to secure the highest loan amount or the best terms even with a good score.

For example, you can qualify for many different types of mortgages with a 700 credit score. But the myFICO mortgage comparison tool shows that the best interest rates go to borrowers who have a score of 760 or higher.

Not only that, creditors will be considering more than just your credit score when determining how much to lend you and what to charge. Other factors may include:

- Your income, your monthly debt obligations and how they compare (debt-to-income ratio, or DTI) before and after you take out a new loan

- Your credit history

- How you plan to use the loan

- The collateral's value (when you're applying for a secured loan)

- Your history with the lender

Sometimes, other factors are more important than your score. For example, even with a good score of 700—or a perfect score of 850��—you might not get approved for a large loan if you don't have a steady income, have a high DTI or you've defaulted on a previous loan from the company.

How Does My Credit Score Affect My Credit Limit?

Your credit score can also impact your credit limit on revolving credit accounts, such as credit cards. Generally, a higher score can help you qualify for a higher credit limit.

But similar to installment loans, creditors will consider more than just your credit score when setting your credit limit. Your income, DTI, history with the creditor, current economic conditions and the company's goals can all play into the decision.

Your credit score can continue to impact your credit limit on your revolving account after you open an account. If your credit (or other factors) have improved since you got a credit card, you may be able to request a credit limit increase. Conversely, if your score or income drops, the credit card issuer may lower your card's credit limit.

How to Improve Your 700 Credit Score Before Applying for Credit

If you've got a 700 credit score, you're on your way to having excellent credit, but here are a few things you can do to improve your credit score:

- Continue paying your bills on time. On-time payments are an important part of improving your credit. While the damage from a missed payment diminishes over time, even one missed payment can be a big setback and impact your score for years.

- Pay down credit card balances. Your credit utilization ratio, a measure of your credit cards' reported balances versus their credit limits, is another important scoring factor. Focus on paying down credit card debt or using a debt consolidation loan to lower your revolving balance and improve your utilization rate. Or, if you use your cards frequently and don't carry a balance, you may want to make payments during your statement period to reduce the balance that's reported to the credit bureaus.

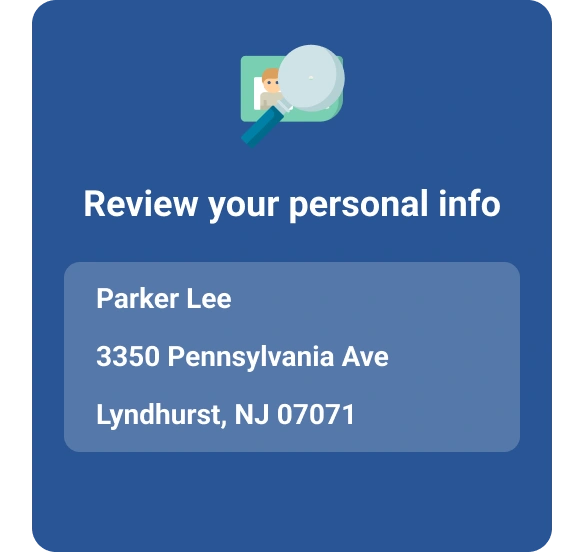

- Get prequalified. A new credit application can lead to a hard inquiry, which can lower your credit score slightly even if you don't get approved. While credit scoring models allow for rate shopping and may ignore some hard inquiries, you can avoid unnecessary hard inquiries by getting prequalified or preapproved for a loan with a soft inquiry—which never hurts your score. The credit score harm, if any, that can result from a hard inquiry is small, and temporary, however, so it's not something you should lose sleep over.

While a higher credit score may help you qualify for a larger loan and better rates, remember that your score is only one of the many factors that creditors consider. Whether you're trying to buy a home, car, take out a personal loan or open a new credit card, look for ways to improve your overall creditworthiness—not just your score.

Check Your Credit Before Applying

If you're not sure where you stand, you can check your FICO® Score for free with Experian. You'll also see which factors are helping or hurting your score, and can track your score over time. Additionally, you may be able to see which credit card or loan offers you're a good match for, or get prequalified for offers from Experian's lending partners through Experian CreditMatch™.

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

Louis DeNicola is freelance personal finance and credit writer who works with Fortune 500 financial services firms, FinTech startups, and non-profits to teach people about money and credit. His clients include BlueVine, Discover, LendingTree, Money Management International, U.S News and Wirecutter.

Read more from Louis