More than 44 million Americans have student loan debt and they owe a collective $1.52 trillion. So what better way to tackle this massive, intergenerational crisis than with a game show! Yes, a game show!

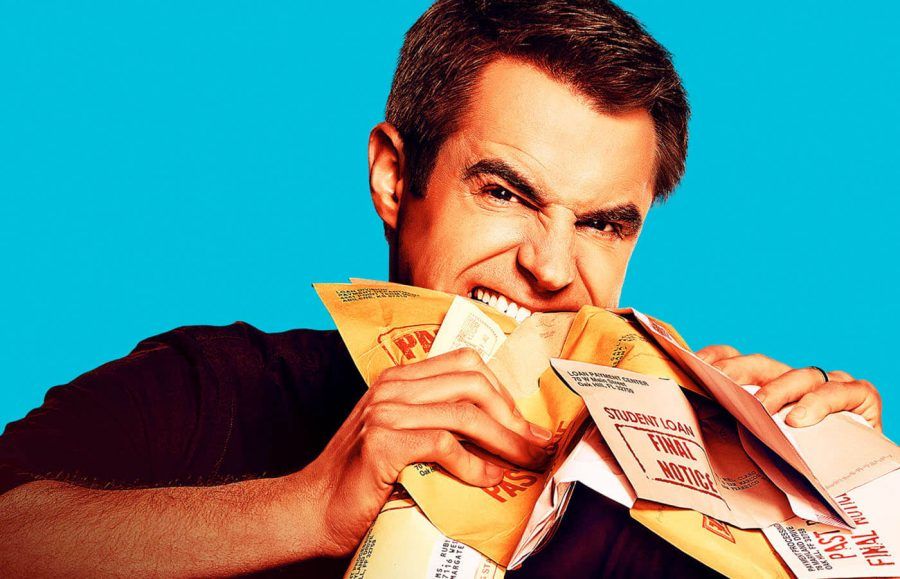

Paid Off, which debuted on TruTV this month, addresses the student loan debt crisis by giving contestants the chance to compete and win money to pay off their loans—entirely!

The show was conceived by its host, comedian Michael Torpey, previously known for his work on Netflix's Orange Is the New Black, HBO's VEEP, and Comedy Central's Inside Amy Schumer.

We recently spoke with Torpey about Paid Off and what he hopes the show can accomplish for those still struggling with student loan debt. The following is an excerpt from that conversation, edited for length and clarity.

Q&A with Paid Off Host Michael Torpey

Experian:

So tell me how exactly did you come up with the idea of this show?

Michael Torpey:

Well, my personal debt story is that I was very lucky and I didn't have any. I mean I came from a real place of privilege. My parents told me, 'Go get into the best school that you can possibly get into and we'll figure out how to pay for it.' And that's what they did. They took out a second line of equity on their home and they paid for my college education.

And that freed me up to really use college to explore and to follow a passion, take whatever class interested me the most. I ended up being a theater major, which I would definitely not have done if I knew I was gonna owe $120,000.00 on the other end of school.

I would have felt like... I had friends doing econ. and doing their internships in the city with J.P. Morgan and they were looking at like getting bonuses out of college to sign with places. And I think I would have gotten sucked into that mindset if I knew I was going to owe a ton of money.

Michael Torpey:

And so I was...incredibly lucky. I really learned about student debt when I met my wife. She owed around $40,000.00 when we met... but she was making it work, she was hustling, she was babysitting, she was doing all the things you gotta do when you've got this extra monthly payment.

Around the time we got engaged, I booked my first large commercial. I did a job for Hanes and it was the first time I made really any money in my career. And we get to the end of that year, I've got money in my savings account, we're talking about combining our finances when we get married and we look at her loans and she's paying seven, eight percent on these.

And I'm far from a Wall Street guru, but I know I'm not going to all of a sudden luck into some investment that's going to beat that. So, in my mind, just from a mathematical standpoint, I say, "Let's wipe these out. Let's write a big check, take out these debts, and then we can just have a clean slate moving forward."

And we write the checks, we put 'em in the envelopes and my wife just starts crying. And I felt really embarrassed that I didn't appreciate everything that goes into debt. The non-financial side. The emotional burden of carrying around this invisible debt that affects every decision that you make in your life.

Experian:

You're right and I think you brought up one of the unintended consequences that happen from debt and that's the emotional side of it. And it affects people in a lot of different ways that don't get discussed

Michael Torpey:

Yes... and, as we sat there reflecting on how fortunate we were, it felt crazy that the thing that had put us in this position was an underpants commercial. It's like, that shouldn't be what it takes to pay off someone's education. It's also not available to everyone.

I happen to work in an industry where you can walk in the door... frequently I walk in and the audition is for a radio commercial that would pay me $200.00 if I did it. This day I walk in the door and it happened to be for a television commercial that ended up playing like crazy with the greatest NBA player of all time. It was just completely lucky that I got this job. And if it hadn't been for that, we'd still be struggling with this debt.

Teachers don't have that opportunity. A teacher doesn't show up for class one day and all of a sudden someone's like, 'Hey, by the way, today if you play your cards right you're going to get a $50,000.00 bonus.' Other careers don't lead to this opportunity to fall into a large paycheck out of nowhere. So it just really made me reflect on how on earth are other people supposed to get out from underneath this debt?

"There are 45 million Americans out there struggling with 1.5 trillion dollars in student debt. This is the best idea I could come up with to do something about it."

That was like my awakening moment and then I had the great experience of working on Orange is the New Black and that made me appreciate what it's like to work on a show that is artistically so satisfying and also has a real social message, a goal... to be able to meet women who have spent time in prison, to hear them talk about what that show meant to them, what an incredible gift.

So I got this desire to create shows that could do this, that could be creatively satisfying and also have a real social goal. And the idea came about to do something about student debt. I had this personal experience with debt that we ended up being so lucky that we could get out from underneath it and the idea for making a game show really just kind of made sense.

The idea is to juxtapose this super-depressing topic with all the pomp and revelry of a game show to highlight that this is no more a ridiculous set of circumstances than what helped my family out.

Winning a game show is not that different than booking an underpants commercial. They're both highly unlikely. And yet it's what it takes right now. It's what it takes to get out from underneath this burden. So it felt like a real statement piece that we can put a show on TV that one, will immediately give money away to people who really need it and two, force those conversations every week.

Experian:

That's kind of the whole premise of this show, that underlying message of how crazy is it that we have to have a game show in order to address this growing student loan debt crisis, right?

Michael Torpey:

Absolutely. I mean, going on a game show... first of all, going on a game show is always a course of action for people with student debt. I don't want to ruin other shows for folks, but the producers on other game shows tell contestants not to talk about their student debt.

They're supposed to say 'I'm gonna go on a trip, I'm going get a boat, I'm gonna buy my mom a house.' They're not allowed to talk about their debt because the producers on other game shows think it's too depressing.

So I feel like I'm kind of lifting the veil of this whole thing that already exists and saying let's face that this is a reality. It already was happening, let's not hide from it anymore. Let's actually try to use this reality for something good, to raise awareness, to push it in people's faces.

Michael Torpey:

Yeah, I mean right now if you ask someone with student debt what are the ways they can picture themselves paying it off, I mean it's like a rich relative dies. And now, maybe it's I go on this stupid game show.

Experian:

I'm sure... so having filmed some episodes already, what are some of the more common struggles that you hear from contestants as a result of their debt?

Michael Torpey:

It's arrested development. I mean its people feeling stuck. Whether they... at a very early stage it prevents people from getting into relationships. They're ashamed of their situation.

We met a guy whose marriage fell apart because of debt because he didn't feel comfortable taking these next steps, like having children, and his wife didn't want to wait. And he felt like it was irresponsible when his finances were so poor to start having kids. So people get stuck. They're not doing the immediate stuff like having children or buying a home. And then they're not doing the long-term stuff like saving for retirement.

And it can make you feel like an outsider. If you don't have a good excuse for why you're not hanging out with your coworkers after work. Everybody's going out to dinner and you're picking up something at the corner store. It can lead to people being excluded and isolated because there's a stigma to it.

And that is one of the goals of our show, to get people talking about it. 'Cause it's 44 million people and that's people in your office, that's people on your street, that's a ton of folks. It's too large a group to feel like they can't be talking about their financial situation.

Experian:

Besides just getting the conversation started around the topic, what are some other hopes that you have as a result of this game show and what it can possibly do when it comes to this?

Michael Torpey:

Well, the real hope is that it can keep the conversation on the front page. It comes and goes. It comes during an election cycle and then it fades immediately afterward. I personally think that debt-free college should be... we need it as a country.

Education is a human right. I think it's horrible to say to someone that they can't do it because they can't afford it. And that's decisions that people are making right now. They're saying I don't wanna take out all this money. I don't want to go borrow $100,000.00 for an education. So I think debt-free college is where this country needs to move. Yeah.

Experian:

I read that maybe you see yourself as the modern day Robin Hood for students, or even sort of a pseudo-Brewster's Millions, which was always a fun movie that I wish would happen to me. But how do you see yourself with this whole thing and what you're trying to do?

Michael Torpey:

Well, there is like this absurd element of, when you really look at it, we were able to create a game show that takes money from these gigantic corporations and gives it to people who really need it. So that's amazing. The fact that we convinced these corporations and sponsors, and everybody to give us the money to do this is great.

And to their credit, they didn't have to. They could have spent it on another programming. They could have done all different things with it. So I do think they're supportive of our cause, but I kind of gotta pinch myself to realize that we pulled this off.

We managed to take almost half a million dollars and give it away on a game show to people who really, really needed it. So that's amazing.

Michael Torpey:

The show exists because of the people that come on the show and the unfortunate situation that they're in. And I am incredibly appreciative of the fact that they're willing to come on and be on it. Because, like I said, people don't talk about this stuff.

They don't talk about finances. But I did an interview with Madeline, who made it to the final round of our first show when she talked about she was uncomfortable saying her debt amount, and she's there and she sees these other people are gonna do it -- and if they're comfortable doing it maybe I should feel comfortable doing it.

And that's what we need. We need people sharing their situation. Everybody's shocked, people are shocked to hear the numbers.

Experian:

And beyond just getting them to talk about it out loud, what other tips do you have... have you just kind of been filing away to share with viewers or our readers and how they can start to tackle student loan debt?

Michael Torpey:

Ah, man, I'm not a financial guru. I don't have any real tips on how to tackle it once you have it. Right now, we're working on ways to avoid it from continuing. There's a great group called Student Debt Crisis and they're the ones to talk about what to do once you already have your loan.

They work on all the federal protection programs that are in place to make sure you're taking advantage of all the programs that are out there in terms of getting an income-based repayment plan. They know all that stuff much better than I do.

Michael Torpey:

I mean yeah, I don't have any real tips. One of the tips is it's... the whole real point of the show is that it's almost impossible to get out from under it. Once you get stuck behind this huge number, it's really, really hard.

Experian:

Hey, I love how, on the show, you guys show the number. And, like you said it just kind of humanizes the whole thing because there are 44 million people out there, that includes me and obviously many others. It's such a huge crisis.

Michael Torpey:

Well, I think it's important that people understand also that a number is not indicative of how hard the situation is. So you can look at someone and say ‘oh, that person owes $50,000, that's gotta be way harder than the person that owes $12,000' and it's just not [always] true.

You don't know what's going on, you don't know everybody's individual story. The majority of people in default owe less than $15,000. So it's just apples and oranges. The goal of the show is not to compare these burdens, it's to have empathy for the entire population, to really feel for these people that have had to sacrifice so much just to get an education.

Experian:

Wow, that's great. Is there anything else that you'd like to say that we can share with our readers? Besides watch?

Michael Torpey:

Yeah, so, the show is designed to be provocative. We want people talking about this and we want people to take action. I hear over and over again from people who work in the offices of Congress, phone calls matter.

They have to report every phone call they receive. So watch an episode and then call your Representative and tell them that a game show is not the solution that we need.

Experian:

Thanks, Michael. I like the show and really do appreciate you taking the time.

Michael Torpey:

Of course. No problem Matt... thanks for taking an interest in what we're trying to do. I appreciate that.