Remove an Ex-Spouse’s Name from Credit Report

Quick Answer

Your credit reports will list your ex-spouse on joint debts taken on in marriage for up to 10 years after the accounts are closed. Joint accounts with zero balance are usually closed in divorce; those with balances may be refinanced via individual loans or balance transfers.

Your ex-spouse's name will appear on your credit reports after divorce if you took on debt together during your marriage, and for up to 10 years after joint debt accounts are closed. To get an ex's name removed from your credit report, you'll need to close those accounts and let them expire or have them assigned individually to yourself or your ex.

Why Your Ex-Spouse's Name Appears on Your Credit Report

It's common for married couples to apply for credit and borrow money jointly, an approach that allows both spouses' incomes to be factored into loan eligibility. If a loan is issued to a couple jointly, then:

- Both individuals' names are listed on the loan agreement or credit contract.

- Balance and payment information for the joint account appears on both individuals' credit reports.

- Both parties are equally responsible for making sure the debt is repaid according to the terms of the credit agreement.

How to Remove Your Ex-Spouse's Name from Your Credit Report

Getting your former spouse's name off your credit report typically requires closing out shared accounts—and that, in turn, usually requires paying the accounts in full—and then waiting up to 10 years for the account's payment history to expire from your credit reports.

One strategy for eliminating a shared credit card account with an outstanding balance is to have both former spouses open new credit card accounts that permit balance transfers, and to have each party transfer half of the balance on the shared account to their new card. The shared account can then be closed. A similar strategy could be applied to unsecured personal loans.

If one former spouse is an authorized user on the other's account, the primary account holder can remove the ex's name from the account, even if there's an outstanding balance on the card. Calling the card issuer and ending the authorization prevents activity on the card (and the name of that card's owner) from appearing on the de-authorized user's credit reports.

The handling of outstanding authorized-user balances can get tricky in divorces, however. With any authorized-user account, the primary account holder is contractually responsible for paying all balances, but if the balance on the account is considered marital debt, the divorce court may order the de-authorized spouse to cover half of the balance.

What to Do if You Can't Separate Accounts

In divorce proceedings, efforts typically are made to split a couple's financial responsibilities cleanly, but that's not always possible with every joint credit account. A common instance is a jointly held loan on an asset such as a house, car or boat that one ex-spouse plans to keep after the divorce.

In such cases, divorce decrees typically order the party who retains the asset to pay the monthly bill for the joint debt, but legal responsibility is still shared by both parties. Both parties' names will remain listed on the account, and it will continue to appear on both parties' credit reports. If a payment is missed or the property is repossessed or foreclosed on, negative entries will appear on both former spouses' credit reports and hurt both of their credit scores.

Barring the death of either party or foreclosure or bankruptcy due to non-payment, both parties in a divorce remain responsible for a joint debt until one of the following occurs:

- The financed asset is sold, at which point any remaining balance on the debt is paid and the former spouses split net proceeds in accordance with terms of their divorce decree.

- The spouse who retains the asset refinances it, paying off the original joint loan and replacing it with a new account in their name alone.

- The joint debt is paid off in full and the account is closed.

All these scenarios end with the closing of jointly held accounts, but even that doesn't remove them from both parties' credit reports. Each closed account, along with its payment history and the names of the parties responsible for it, will remain on both former spouses' credit reports for up to 10 years.

The Bottom Line

Purging a former spouse's name from your credit report may not be possible if you borrowed money jointly with them. If joint credit accounts outlast your marriage, you will continue to share financial responsibility for them with your ex until they are closed. And even after they are closed, records of those accounts (including your name and your former spouse's) and their payment histories will remain on your credit reports for up to 10 years before expiring. They're part of your credit history as well as your marital past.

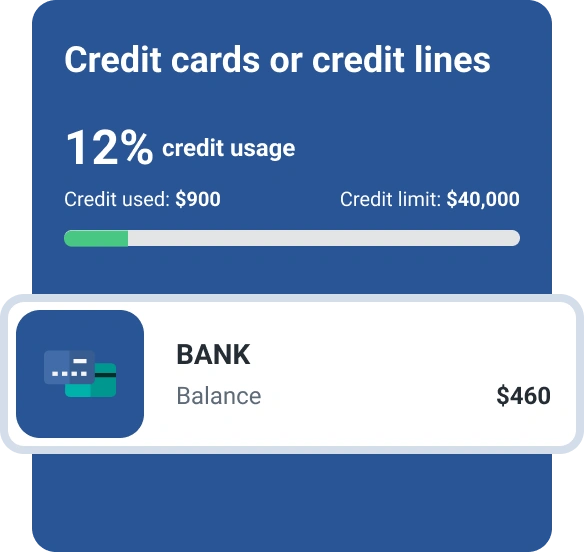

To keep track of how any jointly held debts may be impacting your credit, check your credit report and credit score regularly, or sign up for free credit monitoring to be notified of any changes to your credit reports.

What’s on your credit report?

Stay up to date with your latest credit information—and get your FICO® Score for free.

Get your free reportNo credit card required

About the author

Jim Akin is freelance writer based in Connecticut. With experience as both a journalist and a marketing professional, his most recent focus has been in the area of consumer finance and credit scoring.

Read more from Jim