Is Personal Loan Interest Tax Deductible?

Quick Answer

Personal loan interest is generally not tax deductible. However, you may be able to deduct it if you use the loan for business expenses, qualified education costs or taxable investments.

Personal loan interest is generally not tax deductible. However, the IRS does allow deductions if you use the loan for specific purposes and meet all eligibility requirements.

Here's what you need to know about when personal loan interest qualifies for a tax deduction and how to claim it.

Is Interest on a Personal Loan Tax Deductible?

Personal loan interest generally isn't tax deductible because the IRS classifies personal loans as consumer debt. Unlike mortgage interest or student loan interest, which have specific tax benefits built into the tax code, personal loans don't receive preferential treatment.

But as with so many other elements of the tax code, there are some exceptions to this rule. The key distinction is in how you use the funds.

Learn more: What Can You Deduct on Your Taxes?

Compare tax preparation services

You could save time preparing your taxes, and get assistance maximizing your refund. Plus, many services provide audit assistance to give you confidence when you file.

When Can You Deduct Personal Loan Interest on Your Taxes?

The IRS allows personal loan interest deductions only when you use the funds for specific qualifying purposes. The three main categories where interest may be deductible include:

- Business expenses

- Qualified educational expenses

- Taxable investments

Keep in mind that if you use a personal loan for multiple purposes, you can only deduct the portion of interest that corresponds to the qualifying use.

Example: If you borrow $10,000 and use $7,000 for business expenses and $3,000 for personal expenses, you can only deduct 70% of the interest paid.

Here's a deeper dive into each of the eligible expenses.

Business Expenses

You may be able to deduct interest on a personal loan if you use the funds for legitimate business expenses. This applies whether you run a full-time business, work as a freelancer or operate a side business.

Qualifying business expenses can include:

- Purchasing equipment or supplies

- Covering operating costs

- Buying inventory

- Funding business-related travel

- Investing in rental property furnishings or improvements

The interest becomes a business expense that you can deduct from your business income, which may reduce your overall tax liability. If your business expenses exceed your income for the year, you may report a business loss that could offset other types of income on your tax return.

To claim the deduction, you'll need to demonstrate that the loan proceeds went directly toward business expenses that are ordinary and necessary for your venture. Be sure to keep detailed records and receipts showing how you used the funds.

Qualified Educational Expenses

If you use a personal loan exclusively to pay for qualified educational expenses, the interest may qualify for the student loan interest deduction. This scenario typically occurs when you use a personal loan to refinance existing student loans or pay for college costs directly.

Qualified educational expenses include:

- Tuition and fees

- Required course materials and supplies

- Room and board (for students enrolled at least half-time)

- Computers

- Transportation to and from school

- Child care expenses

- Disability expenses

- Costs related to studying abroad

- Professional testing, licenses or certifications

- Some basic personal expenses

The student loan interest deduction allows you to deduct up to $2,500 in interest paid per year, depending on your income. It's an above-the-line deduction, meaning you can claim it even if you don't itemize deductions on your tax return.

Note, however, that there are several requirements and limitations. For example, you can't claim the deduction if:

- You aren't legally obligated to pay the interest.

- Your filing status is married filing separately.

- Someone else claims you as a dependent.

- Your modified adjusted gross income exceeds IRS limits.

Additionally, the loan must be taken out for yourself, your spouse or your dependent while they're enrolled at least half-time in a degree or certificate program at an eligible educational institution.

Taxable Investments

You may be able to deduct personal loan interest if you use the borrowed funds to purchase taxable investments. This is known as investment interest expense.

Qualifying investments include:

The key limitation is that you can only deduct investment interest up to the amount of your net investment income for the year. If your investment interest expense exceeds your investment income, you can carry forward the unused portion to future tax years.

To claim this deduction, you must itemize deductions on Schedule A of your tax return. Additionally, the deduction doesn't apply to investments in tax-advantaged accounts like individual retirement accounts (IRAs) or 401(k) plans, or to purchases of tax-exempt investments such as municipal bonds. The same is true for passive investments, such as a business you hold a stake in but in which you don't participate.

Learn more: Things Not to Use a Personal Loan For

Are Personal Loans Taxable Income?

Personal loan proceeds aren't considered taxable income because you're required to repay the borrowed amount. But again, there are exceptions to the rule, specifically if your lender forgives or cancels part of your debt.

- When forgiven debt is taxable: You may be on the hook for taxes if you settle your debt for less than what you owe or negotiate some other type of debt reduction with a creditor. When this happens, your lender will typically send you Form 1099-C showing the amount of canceled debt, which you must report on your tax return.

- When forgiven debt isn't taxable: If your personal loan debt is discharged during bankruptcy proceedings, the forgiven amount typically doesn't count as taxable income. Similarly, if you're insolvent at the time the debt is forgiven—meaning your total debts exceed your total assets—part or all of the canceled amount may be excluded from your taxable income.

If you receive a 1099-C form for canceled debt, consult with a tax professional to determine whether the forgiven amount is taxable in your situation and whether any exceptions apply.

Make the Most of Your Personal Loan

Understanding when personal loan interest is tax deductible can help you make smarter borrowing decisions. While most personal loan interest isn't deductible, using the funds for business, education or investments may provide tax benefits.

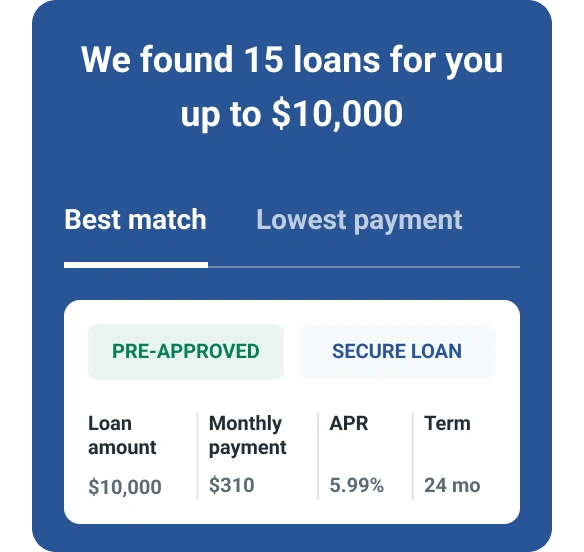

Before taking out a personal loan, it's important to compare rates from multiple lenders to ensure you get the best deal. Your credit score plays a significant role in the interest rate you'll qualify for, so check your credit report for free with Experian to see where you stand. Building your credit before applying can help you secure lower rates and save money over the life of the loan.

Save time—find the right tax prep service

Skip the guesswork with these top tax preparation services. Get help filing your taxes confidently and on time.

Get tax help nowOn SuperMoney.com

About the author

Ben Luthi has worked in financial planning, banking and auto finance, and writes about all aspects of money. His work has appeared in Time, Success, USA Today, Credit Karma, NerdWallet, Wirecutter and more.

Read more from Ben