Does Opening a New Credit Card Improve Your Credit Score?

Quick Answer

Over time, opening a new credit card could help you build credit by improving your payment history and increasing your available credit.

If you're considering applying for a new credit card, it's important to weigh the impact on your credit with other benefits, such as promotional interest rates or the opportunity to earn rewards.

Applying for a new credit card may lead to a small, temporary dip in your credit score because it typically generates a hard inquiry on your credit report. For that reason, it may be best to avoid a new card if you're planning to apply for an important loan soon, such as a mortgage or car loan.

Over time, though, a credit card can have a positive impact on your credit long term if you manage it well. That can make getting a new card a great strategy for building credit. Here's what you need to know.

How Can Opening a New Credit Card Help Your Credit?

There are several ways that opening a new credit card can help you build credit and increase your credit score.

Increase Available Credit

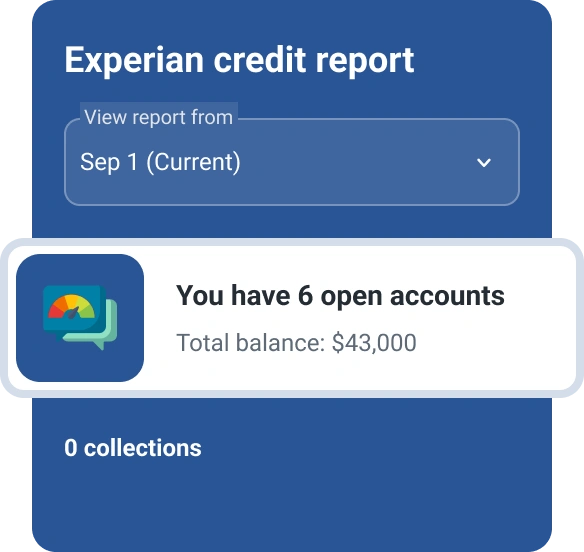

When you open a new credit card, you increase your available credit. The amount of available credit you have can have an important indirect impact on your credit score.

By increasing your available credit, you can decrease your credit utilization ratio. Your credit utilization is the amount of credit you're using divided by your total available credit. Credit utilization is a key influence on your amounts owed, a credit scoring factor responsible for 30% of your FICO® ScoreΘ, the score used by 90% of top lenders. The lower your credit utilization, the better for your credit score.

But you'll need to avoid maxing out your new credit card to maintain a low utilization rate. Many experts suggest keeping your credit utilization below 30%, but the best credit utilization is in the single digits. Also, keep in mind that paying off your credit card each month won't necessarily guarantee that you'll have a low credit utilization ratio. If your creditor reports your balance to the credit bureaus before you make a payment, a high balance can still hurt your scores.

Learn more: How to Calculate Credit Card Utilization

Improve Credit Mix

Credit mix refers to the different types of credit you have. While there are many different types of credit, you can fit them into two main categories: installment credit and revolving credit.

Installment loans are money you borrow in a lump sum then repay over a set term, such as mortgages and auto loans. On the other hand, credit cards are a type of revolving credit: a line of credit you can borrow from and repay indefinitely, as long as you follow the card terms. Responsibly managing a mix of installment credit and revolving credit can be good for your score.

Credit mix determines 10% of your FICO® Score. So, if all your credit accounts are currently installment loans—for instance, maybe you have student loans and an auto loan—then opening a new credit card could have a positive impact.

Build a Positive Payment History

Your payment history makes up 35% of your FICO® Score, and it's the most important factor in determining your creditworthiness. A new credit card gives you the opportunity to build an excellent credit history, but you'll need to be sure to always pay on time.

It's best to pay off your credit card in full each month to avoid paying interest and to keep your credit utilization ratio low. But if you aren't able to pay off your entire balance, be sure to make at least the minimum payment by the due date to ensure you add positive data to your payment history—and, conversely, steer clear of damage to your score.

How Can Opening a New Credit Card Hurt Your Credit?

Before you decide to open a new credit card, consider the possible negative impacts.

May Generate a Hard Inquiry

When you apply for a credit card, the issuer typically pulls your credit to check on your borrowing habits and credit score. That will likely result in a hard inquiry on your credit report.

A single hard inquiry usually leads to a small, temporary drop in your credit score—typically less than five points. Hard inquiries remain on your credit report for two years, meaning they'll be visible to lenders who check your credit. But they'll affect your credit score for less than one year.

So, while a hard inquiry here and there isn't something to sweat over, it's a good idea to limit your credit card applications and get prequalified for a credit card before you apply.

Learn more: Does Applying for Credit Cards Hurt Your Credit?

Decreases the Average Age of Your Accounts

A new credit card lowers the average age of all your credit accounts, which can have a negative impact on your score. The length of your credit history accounts for 15% of your FICO® Score, so being selective about new credit can have a positive impact.

That said, making on-time payments and keeping your balances low can have an even larger impact, so don't forget to balance the potential positives of a new card to make the best choice all around.

Learn more: How Credit Cards Can Affect Your Credit Score

How to Build Credit With a Credit Card

You can use a credit card to build credit and avoid falling into some common pitfalls with these tips.

- Make on-time payments. Your payment history has the single largest impact on your credit scores, so it's essential to pay your bills on time every month. Beyond a negative credit impact, overdue payments can lead to late fees and penalty interest rates. Consider signing up for autopay to ensure you never miss a payment.

- Don't max out your credit card. Aim to keep your credit card balance low to avoid a high credit utilization ratio. One way to build credit without racking up a balance is to use your card to pay a small monthly bill each month, such as a streaming service. Then, pay off the balance by the end of the billing cycle to avoid interest charges.

- Stick with a budget. It's not uncommon to fall into the bad habit of overspending on a credit card. But going into debt has a negative impact on your finances long term, especially if you're paying a high interest rate. Be sure you're spending within your means and avoiding debt by using your credit card alongside a budget.

Learn more: How to Use a Credit Card to Build Credit

How Many Credit Cards Is Too Many?

There isn't one set answer to how many credit cards is too many. How many credit cards you should have comes down to personal preference, spending habits and how much effort you want to put toward keeping your cards organized.

In general, it's often beneficial to have at least one credit card. Beyond that, having multiple cards can help you increase your available credit and take advantage of different types of credit card rewards, for example. But you'll need to be committed to keeping close tabs on your credit accounts to catch any suspicious transactions and ensure you're making on-time payments.

Learn more: How Many Credit Cards Should I Have?

Should I Close Old Credit Cards?

In general, it's a good idea to keep your old credit cards open. Closing old credit cards lowers your available credit, which in turn can raise your credit utilization. That could have a negative impact on your credit scores.

Also, if the card is one of your oldest credit accounts, closing it could eventually lower the average age of your credit, depending on the credit scoring model. That said, accounts closed in good standing remain on your credit report for 10 years, so closing a credit card won't immediately impact the length of your credit history.

There could be times when canceling a card makes sense. First, if having access to a higher line of credit is encouraging you to overspend, you might decide it's for the best to close one or more of your cards. Second, if you're paying an annual fee for a credit card you don't get much use out of, it may make financial sense to close it (or request a downgrade to a card with no annual fee from your issuer).

Learn more: Does Closing a Credit Card Hurt Your Credit?

The Bottom Line

While opening a new credit card can cause an initial dip in your score, it can be a good long-term strategy for improving your payment history and building credit.

Beyond opening a new credit card, there are other ways to build credit. You could consider becoming an authorized user on a trusted loved one's credit card, for instance. You can also get credit for eligible, on-time monthly payments with Experian Boost®ø, a free feature that lets you add household bills to your credit report. That can help you get more out of paying for utilities, streaming services, internet, certain types of insurance and other monthly bills.

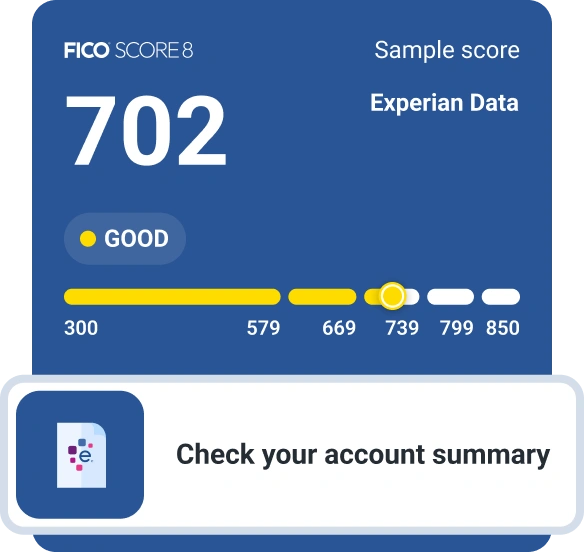

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

Evelyn Waugh is a personal finance writer covering credit, budgeting, saving and debt at Experian. She has reported on finance, real estate and consumer trends for a range of online and print publications.

Read more from Evelyn