Personal loans for 2026

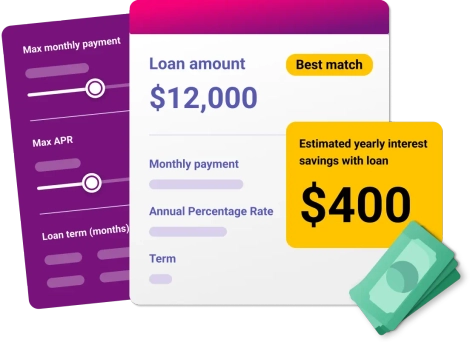

Get cash fast. See your rates with no impact to your credit scores.

Checking your options won’t hurt your credit scores

Loan amount and savings are illustrative only. Results may vary.

Best personal loans from our partners

As of March 2026, compare personal loans with rates as low as 6.7%, loan amounts up to $250,000 and same-day funding options available.

Best for fast funding: LendingPoint

Recommended FICO® ScoreΘ

Fair - Good

| Est. APR | 7.99 - 35.99% |

|---|---|

| Term | 24 - 48 mo |

| Loan amount | $2,000 - $30,000 |

| Est. monthly payment | $90 - $1,187 |

Recommended FICO® ScoreΘ

Good - Exceptional

| Est. APR | 8.74 - 35.49% |

|---|---|

| Term | 24 - 84 mo |

| Loan amount | $5,000 - $100,000 |

| Est. monthly payment | $228 - $3,237 |

Best for small amounts: Upgrade

Recommended FICO® ScoreΘ

Fair - Exceptional

| Est. APR | 7.74 - 35.91% |

|---|---|

| Term | 36 - 60 mo |

| Loan amount | $1,000 - $50,000 |

| Est. monthly payment | $31 - $1,804 |

Best for debt consolidation: Happy Money

Recommended FICO® ScoreΘ

Fair - Exceptional

| Est. APR | 7.95 - 29.99% |

|---|---|

| Term | 24 - 60 mo |

| Loan amount | $5,000 - $50,000 |

| Est. monthly payment | $226 - $1,617 |

Best for peer-to-peer lending: Prosper

Recommended FICO® ScoreΘ

Poor - Exceptional

| Est. APR | 8.99 - 35.99% |

|---|---|

| Term | 24 - 60 mo |

| Loan amount | $2,000 - $50,000 |

| Est. monthly payment | $91 - $1,806 |

Recommended FICO® ScoreΘ

Poor - Exceptional

| Est. APR | 6.70 - 35.99% |

|---|---|

| Term | 36 - 60 mo |

| Loan amount | $1,000 - $50,000 |

| Est. monthly payment | $31 - $1,806 |

Recommended FICO® ScoreΘ

Fair - Exceptional

| Est. APR | 6.99 - 35.99% |

|---|---|

| Term | 36 - 60 mo |

| Loan amount | $2,000 - $50,000 |

| Est. monthly payment | $62 - $1,806 |

Recommended FICO® ScoreΘ

Fair - Exceptional

| Est. APR | 7.90 - 35.99% |

|---|---|

| Term | 24 - 60 mo |

| Loan amount | $1,000 - $60,000 |

| Est. monthly payment | $45 - $2,168 |

Recommended FICO® ScoreΘ

Fair - Very Good

| Est. APR | 13.37 - 35.99% |

|---|---|

| Term | 12 - 60 mo |

| Loan amount | $1,000 - $15,000 |

| Est. monthly payment | $89 - $542 |

Recommended FICO® ScoreΘ

Fair - Exceptional

| Est. APR | 7.99 - 35.99% |

|---|---|

| Term | 24 - 60 mo |

| Loan amount | $5,000 - $40,000 |

| Est. monthly payment | $226 - $1,445 |

Recommended FICO® ScoreΘ

Fair - Exceptional

| Est. APR | 8.99 - 29.99% |

|---|---|

| Term | 24 - 60 mo |

| Loan amount | $15,000 - $50,000 |

| Est. monthly payment | $685 - $1,617 |

Recommended FICO® ScoreΘ

Fair - Very Good

| Est. APR | 9.95 - 35.95% |

|---|---|

| Term | 24 - 60 mo |

| Loan amount | $2,000 - $35,000 |

| Est. monthly payment | $92 - $1,264 |

Recommended FICO® ScoreΘ

Fair - Exceptional

| Est. APR | 7.39 - 28.70% |

|---|---|

| Term | 60 - 120 mo |

| Loan amount | $20,000 - $250,000 |

| Est. monthly payment | $400 - $6,352 |

Recommended FICO® ScoreΘ

Good - Exceptional

| Est. APR | 9.98 - 26.80% |

|---|---|

| Term | 24 - 72 mo |

| Loan amount | $5,000 - $50,000 |

| Est. monthly payment | $231 - $1,403 |

Recommended FICO® ScoreΘ

Poor - Good

| Est. APR | 9.99 - 35.99% |

|---|---|

| Term | 36 - 60 mo |

| Loan amount | $1,000 - $35,000 |

| Est. monthly payment | $32 - $1,264 |

Recommended FICO® ScoreΘ

Fair - Exceptional

| Est. APR | 11.69 - 35.99% |

|---|---|

| Term | 36 - 60 mo |

| Loan amount | $1,000 - $50,000 |

| Est. monthly payment | $33 - $1,806 |

Recommended FICO® ScoreΘ

Poor - Exceptional

| Est. APR | 18.00 - 35.99% |

|---|---|

| Term | 36 - 60 mo |

| Loan amount | $1,500 - $20,000 |

| Est. monthly payment | $54 - $723 |

How to find the best personal loan for you

Know your FICO® ScoreΘ

It plays a big role in the personal loans you’re likely to qualify for, and the rates and terms you might get.

Compare loan options

Determine how much you’ll need, then look for a low APR and monthly payment that fits your budget.

Look for extra benefits

Consider lender-specific perks, like getting a reduced interest rate if you set up autopay.

Get pre-qualified

Once you find a personal loan to apply for, pre-qualifying first can tell you if you’re likely to be approved.

No impact to your credit scores if you’re not approved

Experian’s No Ding Decline™⊛

When applying for a loan, most lenders will perform a hard inquiry on your credit report which can negatively impact your credit scores. With Experian’s No Ding Decline, only a soft inquiry is performed when applying for loans labeled No Ding Decline, so if you are declined there is no impact to your credit scores.

You could save up to $3,531* with a low, fixed-rate personal loan

| High-interest credit card | Personal loan | |

|---|---|---|

| Balance | $11,700 | $11,700 |

| Monthly payment | $334 for 60 months | $275 for 60 months |

| Average interest rate | 23.62% | 14.48% |

| Total paid with interest | $20,041 | $16,510 |

| *Estimated interest savings: $3,531 | ||

Personal loan calculator

Use this calculator to compare loan amounts, rates, and terms to estimate what you’ll pay for your loan.

Frequently asked questions

Explore more personal loans