What Are the Types of Car Insurance?

Quick Answer

Car insurance is required in nearly every state. Available types of car insurance vary but generally include liability, comprehensive, collision, personal injury protection (PIP), medical payments (MedPay) and uninsured and underinsured motorist coverage.

The road can be a risky place for drivers. Everything from debris to potholes to speeding motorists can put you and your car in danger. But having adequate auto insurance can minimize your out-of-pocket expenses for accident-related injuries and vehicle damage.

Because different coverages apply in different circumstances, policies typically include multiple layers of coverage that can protect you in a variety of scenarios. Read on to learn about the most common types of car insurance you can include in your policy, plus add-ons you may want to consider for enhanced protection.

1. Liability Insurance

Liability coverage has two parts—bodily injury liability and property damage liability—that kick in when you're at fault in an accident. Bodily injury liability helps pay for medical costs related to injuries you cause others, and property damage liability helps pay for damage you cause to another person's vehicle or other property. Liability also covers your legal fees if someone sues you after an accident.

Although it's required in nearly every state, minimum liability requirements are rarely sufficient to cover damages from a serious accident. For added protection, consider increasing your policy limit.

Tip: Liability insurance coverage is typically written as a series of three maximum coverage amounts, such as 25/50/25. This means you have coverage up to $25,000 for bodily injury per person, $50,000 for all bodily injuries per accident and $25,000 for property damage per accident.

Learn more:How Much Car Insurance Do I Need?

2. Comprehensive Insurance

A crash isn't the only thing that can damage your vehicle. Severe weather, fire, theft, vandalism, flooding and more can result in thousands of dollars in repair bills. Comprehensive insurance covers damage to your car not caused by a collision. If the damage exceeds the actual cash value of your vehicle, your insurer will cut you a check for what your car is worth—minus your deductible.

Comprehensive coverage isn't required by law in any state, but lenders typically require it if you're financing your vehicle.

3. Collision Insurance

Collision insurance covers damage to your car if you're at fault in an accident. It can also help pay for repairs—up to the fair market value—if you hit a pothole, roll your vehicle or crash into a stationary object, such as a guardrail or telephone pole. Like comprehensive insurance, collision coverage is optional nationwide. However, lenders generally require it until you pay off your loan or your lease is up.

Tip: Both comprehensive and collision insurance are required if you have an auto loan or lease.

4. Personal Injury Protection (PIP)

Personal injury protection, also known as no-fault insurance, pays to treat injuries you and your passengers sustain in an accident. It also covers lost wages and, depending on where you live, may help pay for funeral expenses, services for routine tasks you can't perform because of your injuries and other costs related to the accident.

PIP is required in 12 no-fault states where drivers must file injury claims with their insurance company, regardless of who is at fault, and three states with at-fault insurance systems. It's optional in a handful of others, but not all states offer it.

Learn more: What States Have No-Fault Insurance?

5. Medical Payments (MedPay) Coverage

Like PIP, MedPay covers your and your passengers' injuries after an accident, no matter who is at fault. However, it doesn't cover lost wages and other expenses that PIP covers. MedPay is available in almost every state, but it's only required in two (Maine and New Hampshire).

6. Uninsured and Underinsured Motorist Coverage (UI/UIM)

Uninsured and underinsured motorist insurance covers your injuries and vehicle damage if an uninsured driver or driver without enough insurance causes an accident or you're involved in a hit-and-run. It may also cover you if someone hits you with their car when you're a pedestrian.

UI/UIM is mandatory in some states and optional in others. Even if your state doesn't require it, it may be worth purchasing since approximately 13% of drivers nationwide are uninsured.

Other Types of Car Insurance

In addition to the core types of coverage you can include in your policy, many others are available that can provide additional protection, even if they're not required by law or your lender.

- Gap coverage: If the insurance company declares your car a total loss after an accident or other covered incident, you will receive the actual cash value of the vehicle. If you owe money on an auto loan or lease, the amount you get from your insurer may be less than what you owe, leaving you to make up the difference. Gap insurance covers the difference between what you owe and the insurance payout.

- Rental car reimbursement: The average cost of a rental car is $54 per day, according to travel search engine Kayak.com. Rental car reimbursement can save you a bundle by paying for your rental—up to the daily maximum—while your car is being repaired after a covered incident.

- Roadside assistance: If you don't already have roadside assistance through another provider, adding it to your car insurance policy can provide peace of mind if you're ever stuck on the side of the road. It typically covers flat tires, jump-starts, towing and lockouts.

- Glass coverage: Comprehensive coverage usually pays for non-accident-related glass and windshield repair or replacement. But you generally have to pay your deductible every time you file a comprehensive claim, which can add up. Glass coverage pays for repairs and replacements, often with no deductible.

- Classic car insurance: Cover the cost of replacing or repairing your collector or antique car with this insurance, which covers your prized vehicle for its full value and pays for specialized repairs.

- Equipment insurance: This comes in two forms: original equipment manufacturer insurance, which pays for factory-original parts when repairs or replacements are needed, and custom parts and equipment insurance, which pays for repairs or replacement of aftermarket customizations such as oversized wheels.

- New car replacement coverage: Because a new car's value drops quickly—by about 30% in the first two years of ownership, according to Kelley Blue Book—replacing a new car that's totaled can cost more than your insurance payout. New car replacement coverage pays to replace a totaled vehicle with a new one of the same make and model if the car is declared a total loss within a certain number of years or miles of purchasing it.

Frequently Asked Questions

The Bottom Line

Having adequate auto insurance coverage can mean the difference between experiencing a financial blip or financial hardship after an accident or other covered incident. Relying on your state's minimum insurance requirements may not be enough to protect you after a serious accident or other incident that requires major repairs.

Regularly review your coverage options, policy limits and deductibles to make sure you're comfortable with the protection your policy provides and that you can afford to pay your deductibles if the need arises.

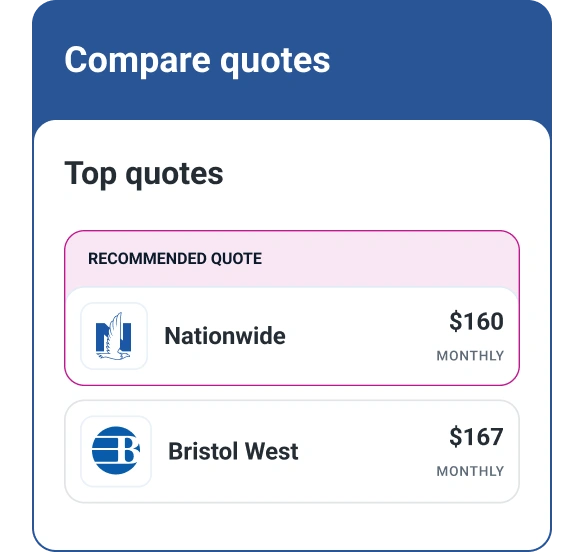

Don’t overpay for auto insurance

If you’re looking for ways to cut back on monthly costs, it could be a good idea to see if you can save on your auto insurance.

Find savingsAbout the author

Jennifer Brozic is a freelance content marketing writer specializing in personal finance topics, including building credit, personal loans, auto loans, credit cards, mortgages, budgeting, insurance, retirement planning and more.

Read more from Jennifer