What Is Comprehensive Car Insurance?

Quick Answer

Comprehensive car insurance covers damage to your vehicle not caused by collisions, including fire, natural disasters, falling or flying objects, theft or vandalism, and more.

Damage to your car is always upsetting, but it feels especially unfair when the damage isn't your fault. If a tree falls on your car while you're sleeping at home or a similar disaster strikes, comprehensive insurance can come to the rescue.

Comprehensive insurance covers damage to your vehicle caused by something other than a collision, such as theft, a natural disaster or a rock cracking your windshield. Sometimes known as "other than collision" coverage, comprehensive insurance helps protect you from the expense of repairing or replacing your car after a covered loss.

What Is Comprehensive Insurance?

Comprehensive car insurance pays to repair or replace your car if it's stolen or damaged by a non-collision event. This is different from collision insurance, which covers damage to your car when you hit another car or object while driving.

Comprehensive coverage is optional unless your car is leased or financed, in which case lenders usually require it to protect the vehicle. When you file a comprehensive insurance claim, you're responsible for paying your deductible.

Tip The deductible is the amount you pay out of pocket when filing a claim; your insurance company covers the rest of your costs.

Here's an example of how comprehensive insurance works:

- A hailstorm dents the hood and roof of your car.

- You file an insurance claim for repairs, which are estimated at $3,500.

- You have a $500 deductible, so the insurance company covers $3,000 of the repair cost. You pay the rest.

What Does Comprehensive Insurance Cover?

Although you should always check your specific policy for details, comprehensive insurance generally covers damage from these risks:

- Fire or explosion

- Natural disasters, such as floods, tornadoes, earthquakes or hurricanes

- Falling or flying objects, such as hailstones, tree branches or telephone poles

- Theft of the vehicle or part of the vehicle, such as the catalytic converter

- Vandalism

- Civil disobedience, such as a riot

- Striking an animal, such as a deer or cow

- Cracked or broken windshield or auto glass

What Isn't Covered by Comprehensive Insurance?

Comprehensive insurance doesn't cover the following risks:

- Damage caused by a collision while driving

- Wear and tear or mechanical problems

- Damage caused by a pothole

- Theft of items from your vehicle (homeowners or renters insurance covers this)

- Injuries to you, your passengers or other people, such as a tree branch crushing the roof of your car when passengers are inside

Learn more: What Does Car Insurance Cover?

What's the Difference Between Comprehensive and Collision?

Comprehensive and collision insurance both cover physical damage to or loss of your vehicle, but they cover different situations. Which type of coverage to use when filing an insurance claim depends on how the damage was caused.

- Comprehensive insurance covers you if your car is stolen or damaged by anything other than a collision.

- Collision insurance covers damage to your car when you collide with another car or object while driving.

| Comprehensive Insurance | Collision Insurance | |

|---|---|---|

| What does it cover? |

|

|

| Is it required by law? | No | No |

| Do lenders require it? | When you lease or finance a car, the lender may require it | When you lease or finance a car, the lender may require it |

| What's the deductible? | $0 to $2,000 | $0 to $1,000 or more |

| How much does it cost? | Average cost is about $263 per year, or around $22 per month | Average cost is about $723 per year, or just over $60 per month |

If you want comprehensive insurance, some insurance companies require you to purchase collision insurance too. You'll typically need to buy both types of coverage if you have a leased or financed car.

Do I Need Comprehensive Insurance?

Comprehensive car insurance isn't legally required by any state, but lenders and leasing companies usually require purchasing it if you have a loan or lease. This is done to protect the vehicle, which they still own, from theft or damage.

Once your car is paid off, however, it's up to you whether to buy comprehensive coverage—and doing so isn't necessarily worthwhile. Buying comprehensive coverage may not be worth the expense if your car's current value is less than 10 times the annual cost of collision and comprehensive insurance, the Insurance Information Institute advises. Ultimately, the decision to buy comprehensive insurance or go without comes down to your comfort with financial risk.

Learn more: How Much Car Insurance Do I Need?

How to Get Comprehensive Insurance

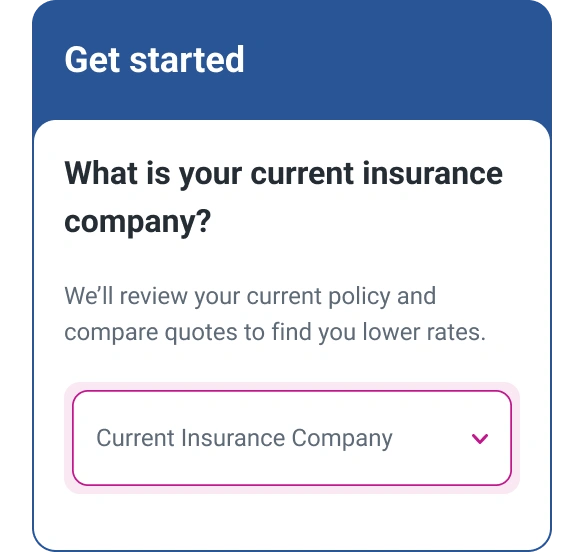

You can easily add comprehensive insurance to your existing auto policy by contacting your insurance company and paying the additional premium. However, as long as you're planning to make a change to your car insurance, why not shop around? It's always a good idea to consider other options—and it could save you some money on premiums. Follow these steps to get comprehensive car insurance quotes from insurance companies.

- Have your information handy. To get car insurance quotes, you'll typically be asked to provide some basic information:

- Your driver's license number

- Your address

- The make, model, year and vehicle identification number (VIN) for the cars you want to insure

- Your annual mileage

- The amount and type of coverage you want

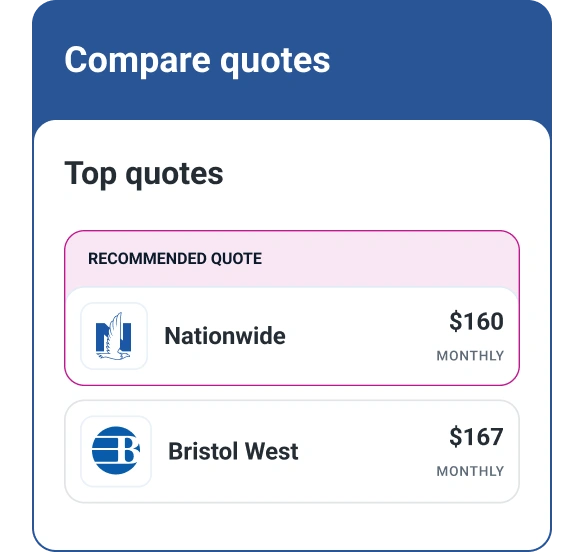

- Get quotes. Gather quotes from several insurance companies, being sure to compare the same type and amount of coverage. You can get quotes by visiting insurance companies' websites, calling the companies or using an online car insurance comparison tool. The latter is an easy way to get quotes from multiple providers at once.

- Compare offers. The most affordable car insurance coverage isn't always the best for you. In addition to price, evaluate each insurance carrier's financial stability and reputation for customer service. Check out financial ratings of insurance companies from A.M. Best, Moody's and Standard & Poor's; online reviews from customers; and customer satisfaction ratings from sources such as Consumer Reports and J.D. Power and Associates.

- Purchase a policy. Select the date you want your policy to be effective and make your premium payments. Find out if there are discounts for paying in full, setting up autopay or disabling paper billing.

- Cancel your old policy. Once your new policy is in force, contact your previous insurance company to cancel your old policy. It's important to make sure there's no lapse in coverage.

Learn more: Step-By-Step Checklist for Getting Car Insurance

Frequently Asked Questions

The Bottom Line

Although not every driver needs comprehensive car insurance, purchasing it can ease your worries about getting hit with a major expense if your car is stolen or damaged by events outside your control.

Improving your credit score could help you pay less for comprehensive insurance. In most states, insurance carriers can check your credit-based insurance score when you apply for car insurance. This score is based on similar factors as your consumer credit score, so checking your credit score could indicate whether there's room for improvement. Paying your bills on time, bringing late payments current and reducing your credit utilization can help boost your credit score and potentially lower the cost of car insurance.

Don’t overpay for auto insurance

If you’re looking for ways to cut back on monthly costs, it could be a good idea to see if you can save on your auto insurance.

Find savingsAbout the author

Karen Axelton is Experian’s in-house senior personal finance writer. She has over 20 years of experience as a journalist and has written or ghostwritten content for a variety of financial services companies.

Read more from Karen