What Is Personal Injury Protection (PIP)?

Quick Answer

Personal injury protection helps pay for medical bills, lost wages and other expenses related to injuries you or your passengers sustain in a car accident, regardless of who is at fault.

Personal injury protection (PIP) is a type of car insurance coverage that pays for certain accident-related expenses if you or your passengers are injured in a crash, no matter who is at fault. It helps you get money more quickly because policyholders file claims with their own insurer instead of waiting for the insurance companies to determine who was at fault.

PIP, also known as no-fault insurance, is required in states that have no-fault car insurance systems and a few that have at-fault systems. It's optional in a handful of other states, but availability varies based on where you live. Here's what you need to know about how PIP protects you after an accident and whether you need to buy it.

What Does Personal Injury Protection Cover?

Personal injury protection helps pay for medical bills, lost wages and other costs if you and your passengers are in a crash, regardless of who caused the accident. It also covers you if you're hit by a car while walking or riding a bike. Expenses covered by PIP vary by state but generally include:

- Medical expenses, such as prescriptions, medical supplies, surgery and nursing care

- Lost wages

- Funeral expenses

- Routine services, such as house cleaning and child care, for tasks you can't perform while you're recovering from your injuries

What PIP Doesn't Cover

PIP coverage is limited to expenses related to your and your passengers' injuries. It doesn't cover:

- Other people's injuries: If you're involved in a crash and people in another car are injured, they can file a PIP claim with their insurer to receive payment for their injuries.

- Your liability to others: The no-fault insurance system only applies to injuries; it doesn't apply to property damage. If someone else's vehicle is damaged in an accident you cause, your property damage liability should kick in to pay for repairs. You may also be responsible for serious injuries you cause to others. In that case, your bodily injury liability coverage may kick in to cover medical bills, lost wages and other expenses that exceed the other person's PIP policy limit.

- Theft or damage to your vehicle: PIP won't pay to replace your car if it's damaged or someone steals it, but comprehensive and collision will if you include them in your policy. Collision covers crash-related damage and comprehensive covers theft and non-accident-related damage.

- Medical expenses that exceed the policy limit: While PIP makes it easy to get reimbursed from your insurance company, it only covers costs up to the policy limit. If your medical bills exceed that threshold and the other person is at fault, you may be able to file a bodily injury liability claim with their insurer to cover the added expenses. If you were at fault, you may need to rely on your health insurance to cover the excess costs.

Do I Need Personal Injury Protection?

Whether you're required to have personal injury protection depends on where you live. Currently, 12 no-fault states and three at-fault states require drivers to purchase it. However, three no-fault states—Kentucky, New Jersey and Pennsylvania—allow drivers to opt out of the no-fault system and purchase tort or at-fault insurance instead.

States That Require PIP

Personal injury protection is required in 12 states that have no-fault insurance laws:

- Florida

- Hawaii

- Kansas

- Kentucky

- Massachusetts

- Michigan

- Minnesota

- New Jersey

- New York

- North Dakota

- Pennsylvania

- Utah

Additionally, three states—Delaware, Maryland and Oregon—that have at-fault auto insurance systems also require drivers to maintain this type of coverage.

States That Offer PIP as an Add-On

Some at-fault states offer PIP as optional coverage that drivers can, but aren't required to, include in their policy. Those states are:

- Arkansas

- New Hampshire

- South Dakota

- Texas

- Virginia

- Washington

Learn more: What States Have No-Fault Insurance?

What's the Difference Between PIP, Bodily Injury Liability and MedPay?

While PIP, bodily injury liability and MedPay, also known as medical payments coverage, can help pay for medical expenses after an accident, they apply in different situations, and availability varies. The table below provides an overview of the three types of coverage.

| Personal Injury Protection | Bodily Injury Liability | MedPay |

|---|---|---|

| Covers injuries you and your passengers sustain, lost wages, services for routine tasks you can't complete, funeral expenses | Covers injuries you cause someone else | Covers injuries you and your passengers sustain |

| Applies no matter who is at fault | Applies to the at-fault driver | Applies no matter who is at fault |

| Required in 15 states | Required in nearly every state | Optional in most states |

Personal injury protection pays for your and your passengers' medical bills and lost wages. In some states, it may also cover funeral expenses and services to complete daily activities you can't perform while you recover. It doesn't cover other people's injuries—for that you need liability coverage. PIP is available in no-fault states and some at-fault states, but it isn't available in all states.

MedPay can help offset the financial burden of accident-related medical expenses, no matter who is at fault, if you live in a state that doesn't offer PIP. It's available in almost every state, but it won't pay for additional expenses that PIP covers, such as services to help with routine tasks like housekeeping or driving.

Bodily injury liability is required in almost every state, and its purpose is to protect others from harm you may cause. It won't cover your injuries, but it will cover other people's if you're at fault in an accident. In states with at-fault insurance systems, bodily injury liability kicks in if you cause an accident that injures someone—no matter how minor their injuries are. In no-fault states, bodily injury liability acts as a back-up to PIP and kicks in when injuries are severe or exceed a specific dollar amount.

How Much PIP Should I Get?

If you live in a no-fault state, you need to buy at least the minimum amount of PIP your state requires. However, some states allow you to increase your policy limits for greater protection. Here are some factors to consider when deciding whether increasing your policy limits is right for you.

- Health insurance: If you don't have health insurance or your coverage is very limited, buying additional PIP can help minimize your out-of-pocket medical costs if you're in an accident.

- Health insurance deductible: If you have a stellar health plan with a low deductible and low co-insurance payments you could afford to pay after an accident, relying on your health insurance to cover bills that exceed your PIP policy limit may be a better option than purchasing additional PIP coverage. However, increasing your PIP limits may make sense if you have a high-deductible health plan that would cause financial hardship after an accident.

- Lost income replacement: Personal injury protection doesn't just pay your medical bills—it may also reimburse you for lost wages if you can't work due to an accident-related injury. If you don't have a robust emergency fund or other income source to cover your bills if you need to miss work, increasing your policy limit may be worth it. However, if you have disability insurance to replace your income if you're unable to work, tapping into that policy may be a better alternative than increasing your PIP limit.

Determining your policy limits and balancing the need for broad coverage with an affordable rate requires a review of your budget, emergency savings and other assets that can help you make ends meet in an emergency. Whether you choose to increase your PIP policy limits or not, be aware that PIP may not be enough to cover all your medical expenses, especially after a serious accident.

Learn more: How to Get the Best Car Insurance

How Much Does PIP Cost?

In general, PIP represents about 15% to 20% of your policy premium, according to Liberty Mutual. However, many factors can affect the price you pay, including:

- Driving history: People with clean driving histories generally pay less for car insurance than drivers with spotty records.

- Policy limits: Increasing your PIP policy limits increases the cost of your policy.

- Deductible: In some states, PIP coverage has a deductible attached to it. Higher deductibles generally result in lower upfront costs. However, you'll pay more out of pocket if you need to file a claim. Be sure to weigh the benefit of upfront savings on your premium with the potential cost of paying your deductible.

- State and insurer: Insurance costs can vary significantly by state and insurer. Where you live and the insurance company you choose can affect the amount you pay.

The Bottom Line

Personal injury protection helps pay for your and your passengers' medical expenses after an accident—even if your state doesn't require it. Having PIP can speed up claim payments if you're injured in an accident because you don't have to wait for the insurance companies to haggle over who was at fault.

Regardless of whether you include PIP in your policy, it's important to remember that personal injury protection is just one coverage option. It's crucial to review all available coverages to ensure you have adequate protection that minimizes your out-of-pocket expenses and protects your assets after an accident.

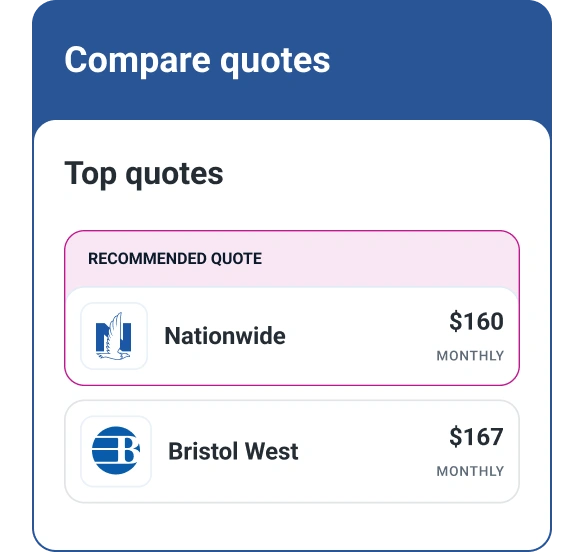

Not sure whether your current policy meets your needs? Check out Experian's car insurance comparison tool to get quotes from dozens of top insurance providers.

Don’t overpay for auto insurance

If you’re looking for ways to cut back on monthly costs, it could be a good idea to see if you can save on your auto insurance.

Find savingsAbout the author

Jennifer Brozic is a freelance content marketing writer specializing in personal finance topics, including building credit, personal loans, auto loans, credit cards, mortgages, budgeting, insurance, retirement planning and more.

Read more from Jennifer