How to Get Low-Interest Personal Loans

Quick Answer

You can get a low-interest personal loan by improving your credit score, comparing lender offers, adjusting your loan amount or terms, offering collateral or exploring bank discounts.

With a low-interest personal loan, you can finance major expenses, like home improvement or debt consolidation, at a low cost. Successfully getting a low-interest personal loan depends on your credit and where you apply. Here's what to know about getting a low-interest personal loan and how to improve your chances of qualifying.

Types of Personal Loans

There are two types of personal loans: secured and unsecured. Each comes with its own risks, benefits and pricing, and each type may offer low interest rates.

Secured Personal Loans

A secured personal loan requires you to provide collateral for the loan, which the lender can seize if you don't repay the loan. This collateral protects the lender in case of loan default.

Collateral can include:

- Cash or savings account balances

- Certificates of deposit (CDs)

- Investments, such as stocks or bonds

- Home equity

- Valuable items like art or jewelry

- Vehicles you own

Because collateral lowers the lender's risk, secured loans often have lower interest rates and higher loan limits. This can make them a solid option for borrowers with low or limited credit. However, some lenders may restrict how loan funds can be used.

Learn more: What Can Be Used as Collateral on a Personal Loan?

Unsecured Personal Loans

Most personal loans are unsecured, meaning they don't require collateral. Approval is based on your credit history, income and debt-to-income ratio (DTI). If you default, lenders can't take your property, but they can report missed payments to the credit bureaus, send your account to collections or take legal action against you.

Unsecured personal loans typically have higher interest rates and lower borrowing limits than secured loans, especially for borrowers without excellent credit. These loans do offer more flexibility in how you can use the funds. The loan is disbursed in a lump sum, and then you're free to use the money for almost any expense.

How to Get a Low-Interest Personal Loan

There are several strategies you can use to try to get a low-interest personal loan.

Improve Your Credit Score

Your credit score is one of the most important factors lenders use to set personal loan interest rates. Borrowers with good to exceptional credit scores—typically 700 and above—tend to receive the lowest interest rates because lenders view them as less likely to miss payments or default. Improving your score before applying can help you qualify for a lower rate.

To improve your credit, start by checking your credit report and FICO® ScoreΘ to see where you stand. Reviewing your credit report allows you to identify potential issues that could keep you from qualifying for a low interest rate. If necessary, take steps to improve your credit score.

- Pay down high credit card balances. Doing so lowers your credit utilization and reduces the total debt you're carrying. This can be one of the quickest ways to improve your credit scores.

- Bring past-due accounts current. Bringing your accounts current will stop further negative reporting, and future consistent payments can help raise your credit score.

- Make all your payments on time. Payment history is the most important credit scoring factor, so a history of consistent on-time payments can help improve your credit score.

- Dispute inaccurate negative information. You have the right to dispute inaccurate credit report information, such as incorrect late payments or accounts that aren't yours, which could improve your credit.

- Add eligible accounts to your payment history with Experian Boost®ø. Including positive payment history from eligible utility, cable, rent, insurance and streaming payments can help improve your credit scores powered by Experian data.

Tip: Avoid applying for other new credit before applying for a personal loan. New accounts and hard inquiries lenders make when reviewing loan applications can temporarily lower your credit score and could affect your approval odds.

Compare Multiple Lenders

Interest rates vary from one lender to another. Shopping around allows you to compare offers and identify lenders with the most competitive terms. As you research different lenders, consider checking:

- Credit unions

- Online lenders

- Banks, especially banks you already have a relationship with

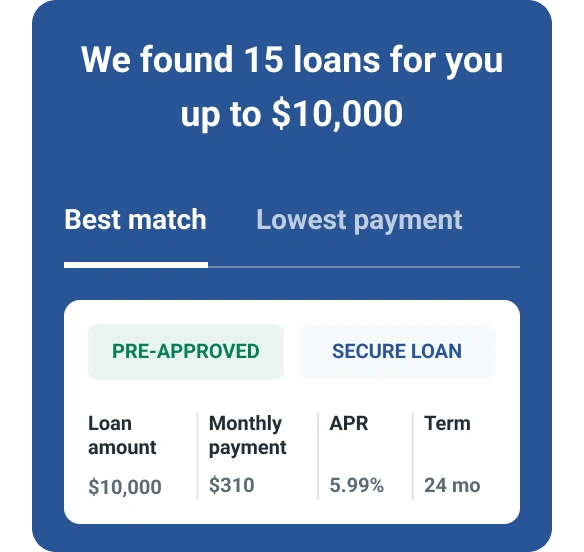

Many personal loan lenders allow you to prequalify with only a soft credit inquiry, which lets you review estimated rates and repayment terms without affecting your credit scores. Keep in mind that prequalifying doesn't guarantee approval. Final approval and loan terms depend on your complete application and a hard credit pull.

Choose a Shorter Repayment Term

In general, personal loans with shorter repayment terms come with lower interest rates because the lender's risk is limited to a shorter period of time. This also means higher monthly payments, but you'll pay less total interest over the life of the loan.

Longer repayment terms typically offer more affordable payments, which sound good if you're on a tighter budget. However, these loans often come with higher rates and higher total interest. If your goal is to secure a low interest rate, choose the shortest term you can comfortably afford based on your income and expenses.

You can use an online personal loan calculator to see how potential loan terms and interest rates will affect your monthly payments and the total loan cost.

Borrow Less

The amount you borrow can affect the interest rate you're offered. Higher loan amounts may increase the lender's risk, which can lead to a higher annual percentage rate (APR). While some lenders allow you to borrow up to $100,000, borrowing only what you need can help keep your interest rate and monthly payment lower.

Many lenders let you prequalify for multiple loan amounts. This allows you to see how different loan amounts affect your interest rate, monthly payment and total loan cost before you submit an application.

Get a Cosigner

If your credit score or income isn't strong enough to qualify for a low interest rate on your own, applying with a cosigner who has excellent credit may improve your chances. A cosigner agrees to share responsibility for loan repayment, which lowers the lender's risk and can help you access better terms.

Cosigning is a serious commitment. Keep in mind that late or missed payments will affect both your and your cosigner's credit. Your cosigner may be held responsible if you can't repay the loan.

Offer Collateral

Providing collateral can help you qualify for a lower interest rate by reducing the lender's risk, especially if you're borrowing a high amount. Lenders may allow you to borrow up to a percentage of the collateral's value. Interest rates are often lower when a larger percentage of the loan is secured by that collateral.

Not all lenders offer secured personal loans, so it helps to look specifically for lenders that accept the type of collateral you have. Remember that the property or assets you offer can be seized if you default on the loan.

Access Bank Discounts

Some banks and credit unions offer relationship discounts on personal loans to existing customers or members. These discounts may be available if you already have a checking or savings account with the institution.

Some lenders also offer a small interest rate reduction if you enroll in autopay. Be sure to read the fine print carefully. Autopay discounts may apply only if you enroll when the loan is originated and continue autopay for the entire loan term.

Personal loan calculator

Things to Keep in Mind When Applying for Low-Interest Loans

Here are some loan particulars to consider when you're shopping around for a new loan:

- Interest rate: This determines how much you pay to borrow and varies by lender, your credit and loan type. The interest rate is one of the most important aspects of borrowing and should be weighed heavily when shopping for a new loan.

- APR: The annual percentage rate includes interest and most fees to give a clear picture of the loan's actual cost. While APRs and interest rates are often used interchangeably, they're different. If the lender doesn't charge any fees, your interest rate and APR may be equal.

- Fees: You may pay origination fees, prepayment penalties, late fees and other costs. Fees can increase the overall cost of borrowing, so make sure you know the details associated with your loan.

- Term: Personal loan terms typically range from one to seven years. Loans with longer terms have lower monthly payments, while those with shorter terms typically have higher payments, assuming interest rates are the same. The longer it takes you to repay your loan, the more interest you'll end up paying.

- Inquiries: Multiple hard inquiries in a short period can affect your credit score and approval odds.

- Loan amount: Before taking out a personal loan, compare your financing options. Sometimes a 0% introductory APR credit card is a better choice for small or short-term needs.

Learn more: Personal Loan Fees to Watch Out For

Frequently Asked Questions

The Bottom Line

Qualifying for a low-interest personal loan takes preparation. You can raise your approval odds by improving your credit, comparing lenders and choosing the best loan terms. If you don't qualify for a low interest rate, consider applying with a cosigner, offering collateral or lowering your loan amount or repayment term. Experian's free credit monitoring service can help you see where your credit stands and what steps you could take to help improve your scores before applying for a personal loan.

Need a personal loan?

Whether you're looking to eliminate debt or access cash fast, compare personal loan offers matched to your credit profile.

Start now for freeAbout the author

LaToya Irby is a personal finance writer who works with consumer media outlets to help people navigate their money and credit. She’s been published and quoted extensively in USA Today, U.S. News and World Report, myFICO, Investopedia, The Balance and more.

Read more from LaToya