What Is a Home Equity Loan?

Quick Answer

Home equity loans let you borrow against the equity in your home and pay it back over time. While home equity loans have some advantages compared with other financing options, there are also important risks to consider.

Wondering how to finance a home remodeling project, pay for your child's wedding or pay off high-interest credit card debt? With home prices in many areas hitting record highs, borrowers with equity in their homes may be considering home equity loans. A home equity loan is a lump sum of money secured by your home and repaid in fixed monthly installments.

Before pursuing a home equity loan, however, take the time to understand how they work.

What Is a Home Equity Loan?

A home equity loan lets you borrow against the equity you've built in your home, using your home as collateral. Equity is your home's market value minus your mortgage balance. Although it's often called a second mortgage, a home equity loan doesn't affect your mortgage. Your mortgage interest rate, term and payments stay the same—you'll just have an additional loan with another monthly payment.

The interest rate on your home equity loan will be fixed, which means your monthly payments won't change over the loan term (typically five to 30 years). You receive the loan in a lump sum and repay it in monthly installments.

Example: Say you want to tap into your home's equity, and assume the following details:

- You paid $225,000 for your home

- You owe $125,000 on your mortgage

- Your home is now worth $425,000

Crunching the numbers, you have $300,000 in equity. You can typically borrow 75% to 85% of your home's equity, so with $300,000 in equity, you could borrow $225,000 to $255,000.

Learn more: How to Calculate Home Equity

Compare home equity loans

Check today’s home equity loan offers and current rates to unlock your home’s value with a predictable monthly payment.

What Can You Use a Home Equity Loan For?

A home equity loan can be used for nearly any purpose, including:

- Debt consolidation

- Medical bills

- Home or car repairs

- Legal expenses

- Larger-than-expected tax bills

- A child's wedding

- Home improvement

Tip: Using a home equity loan to consolidate debt isn't an ideal move since it will convert your unsecured debt to debt that's secured by your home, increasing the risk of losing your home. If you do use it to delete debt such as credit cards, avoid running up card balances as you work to pay off the loan.

Learn more: Should I Use a Home Equity Loan for Debt Consolidation?

Home Equity Loan Requirements

You'll generally need to meet these requirements to get a home equity loan:

- FICO® ScoreΘ of 680 or more: Lenders usually require a FICO® Score of at least 680 for a home equity loan. However, some prefer a score of 720 or higher. Others may give you a home equity loan with a FICO® Score below 680 if you have lots of equity, a sizable income or a low debt-to-income ratio (DTI).

- Solid payment history: Lenders generally review your credit report to see if you have a history of making on-time payments for a variety of credit accounts.

- Proof of income: Lenders check your pay stubs and W-2 forms for evidence that your income is sufficient to cover the loan payments.

- Debt-to-income ratio of 43% or less: Your DTI is the percentage of your gross monthly income needed to pay your debts. A DTI of 44% or more could make it hard to get a home equity loan.

- Sufficient equity: Most lenders require your equity to equal at least 15% to 20% of the home's value.

- Proof of homeowners insurance: Your home is collateral for the loan; lenders generally require home insurance to safeguard it.

Learn more: Can You Get a Home Equity Loan With Bad Credit?

Pros and Cons of a Home Equity Loan

Before you decide to borrow against your home, weigh the pros and cons of home equity loans.

Pros of Home Equity Loans

-

Can allow you to borrow a large sum: A home equity loan often lets you borrow more money than other financing options, including personal loans.

-

Could mean a tax break: Use a home equity loan for substantial improvements that add to your home's value, extend its useful life or adapt it for new uses, and the interest paid on the loan may be deductible come tax time.

-

Lower interest rates: Since they're secured by your home, home equity loans generally have lower interest rates than personal loans or credit cards.

-

Fixed interest rates: The interest rate won't change during the loan term, so you know exactly how much borrowing will cost.

-

Fixed monthly payments: A fixed interest rate means monthly payments stay the same, making it easier to budget.

Cons

-

Closing costs and fees: Lenders may charge closing costs of 2% to 5% of the loan amount. There may also be appraisal fees, loan origination fees and other fees.

-

Fixed interest rates: Even if interest rates drop after you get a home equity loan, your interest rate and payment stay the same, so you won't benefit from lower rates.

-

Two mortgage payments: A monthly payment on a second mortgage could strain your finances, making it harder to save money or invest for retirement.

-

Reduced equity: A home equity loan reduces your valuable equity. If you sell the home, you must repay the loan, diminishing your profits. Equity depends on home prices, so if home values decline, you could owe more than your home is worth.

-

Risk of losing your home: Your home is collateral, so if you can't make the loan payments, the bank can foreclose on your home.

Home Equity Loan vs. Home Equity Line of Credit

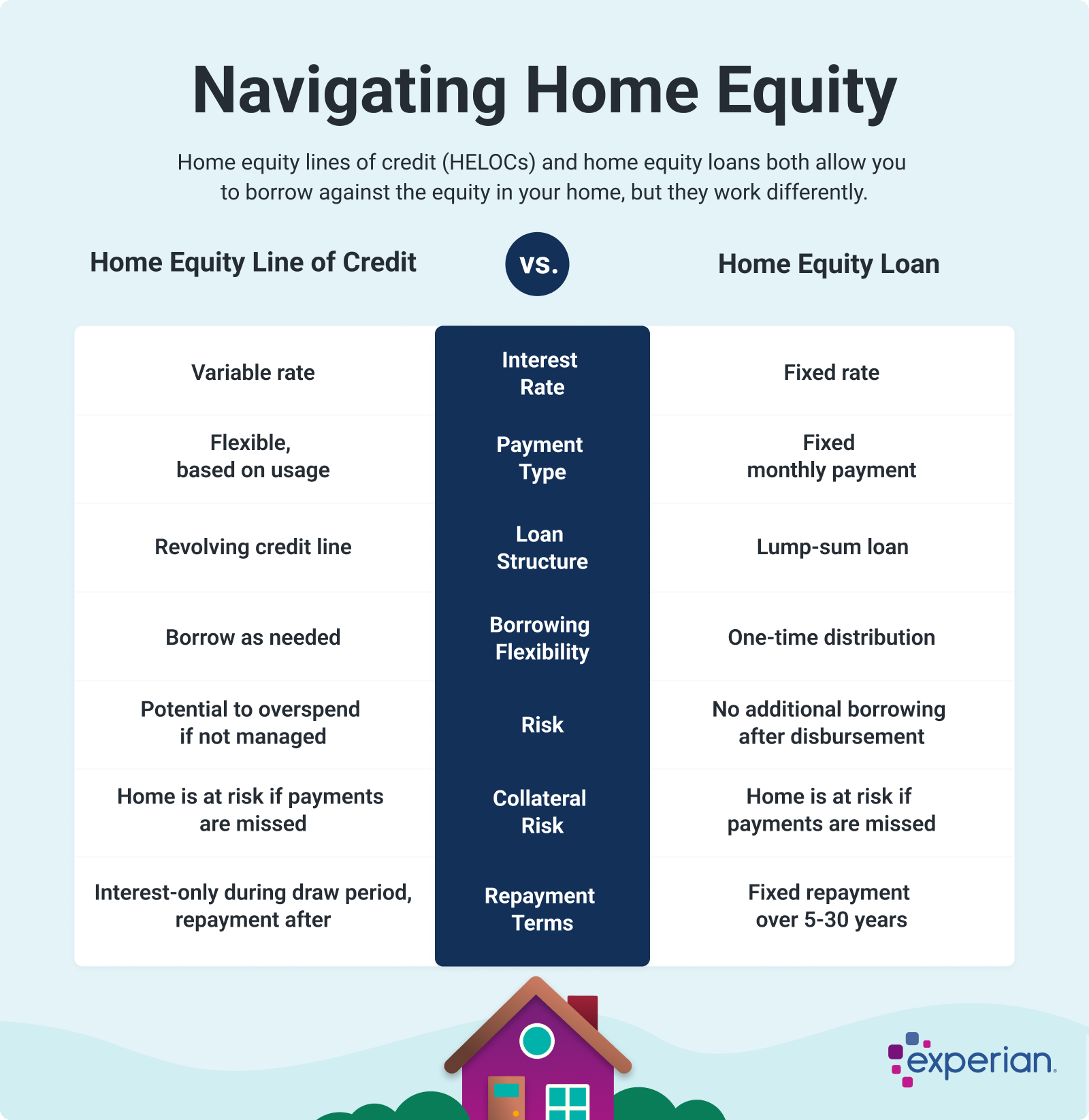

Another way to borrow against your home equity is with a home equity line of credit (HELOC). A HELOC gives you access to a revolving credit line for a certain period, called the draw period. As with a credit card, you can borrow up to your credit limit; as you pay down what you've borrowed, you can borrow from the HELOC again.

Although both home equity loans and HELOCs use your home as collateral, there are key differences.

Learn more: Home Equity Loan vs. HELOC: What's the Difference?

Home Equity Loan vs. Cash-Out Refinancing

Cash-out refinancing is normally a popular option for homeowners with equity, but high mortgage interest rates are currently making it a much less appealing option. A cash-out refi replaces your mortgage with a new, larger mortgage, while cashing out up to 80% of your equity. If you have $100,000 worth of equity and a $200,000 mortgage balance, for example, you could get a new mortgage for $280,000 and cash out up to $80,000 in equity.

Cash-out refinancing can make sense if the new mortgage has a lower interest rate than the old one. As of mid-May, 2025, average 30-year rates were below 7%, holding steady and down almost a quarter of a percent from a year before, according to data from Freddie Mac. Compare current rates to the rate you're paying now for a sense of whether refinancing could be a good deal. Be sure to factor in refinance closing costs, which add to the total you'll pay.

Learn more: How Much Does It Cost to Refinance a Mortgage?

Alternatives to Borrowing Against Your Home Equity

A HELOC and cash-out refinance aren't the only alternatives to a home equity loan. Here are some other options to consider:

- Get a personal loan. You can find personal loans for up to $100,000. Like home equity loans, personal loans can be used for any purpose. They're generally unsecured, so there's no risk to your home, although failure to repay them can have major negative consequences on your credit.

- Apply for a personal line of credit. If your credit is good, you may qualify for a personal line of credit at a bank or credit union. Like HELOCs, these credit lines let you borrow up to a credit limit and pay interest only on what's borrowed. You typically have three to five years to draw on the credit line and a similar time frame to repay it.

- Find money in your budget. Can you reduce expenses, get a side gig or sell belongings instead of borrowing?

- Use a credit card with a 0% introductory annual percentage rate (APR). Borrowers with good to excellent credit may qualify for credit cards offering 0% intro APRs on purchases for a limited time, typically 12 to 21 months. You can use the card to finance a big expense over time without incurring any interest by paying the balance in full before the promotional period ends. After that, you'll pay a standard APR on any remaining balance.

The Bottom Line

Home equity loans can help you cover major expenses and offer some advantages over other financing options. However, they could cost you your home if you can't make the payments. Carefully consider your alternatives before deciding on a home equity loan.

Whether you're seeking a loan, line of credit or credit card, a good credit score can help you get better terms and lower interest rates. Before applying for credit, check your credit report and FICO® Score and take steps to improve your score if necessary.

Curious about your mortgage options?

Explore personalized solutions from multiple lenders and make informed decisions about your home financing. Leverage expert advice to see if you can save thousands of dollars.

Learn moreAbout the author

Karen Axelton is Experian’s in-house senior personal finance writer. She has over 20 years of experience as a journalist and has written or ghostwritten content for a variety of financial services companies.

Read more from Karen