Pros and Cons of Home Equity Loans

Quick Answer

With a fixed interest rate and predictable monthly payment, a home equity loan can be a relatively low-cost way to access the equity in your home. You could lose your home if you can’t make the payments, however.

The average homeowner has $203,000 of accessible equity in their home, according to ICE Mortgage Technology's March 2025 Mortgage Monitor report. Home equity loans are one way you can tap into that equity—if you're willing to risk your house. Before taking that chance, consider the potential benefits, downsides and alternatives for getting the extra cash you need.

What Is a Home Equity Loan?

A home equity loan is an installment loan that allows you to borrow against your home's equity—the difference between what you owe on your mortgage and the house's current market value. Considered second mortgages, home equity loans typically have fixed interest rates, and you repay the amount you borrow in equal monthly installments throughout the loan term. Lenders generally allow homeowners to borrow around 80% of their equity.

Example: If your house is worth $400,000 and you owe $100,000 on your mortgage, you have $300,000 of equity in your home. Many lenders will allow you to borrow up to 80% of that—$240,000—in a home equity loan (and more in some cases).

Learn more: How to Calculate Home Equity

Pros of a Home Equity Loan

Home equity loans can help you fund important goals, such as a home remodel or a child's college education, with some specific benefits.

Lower Interest Rates

Because a home equity loan is secured by your home, interest rates tend to be lower compared to unsecured loans or credit cards.

Learn more: Is a Collateral Loan Right for You?

Fixed Interest Rates

Home equity loans have fixed interest rates, so you'll know the total cost of the loan upfront if you're approved.

Predictable Monthly Payments

Because you're borrowing a lump sum of cash with a fixed interest rate, your monthly payment won't change throughout the loan term, making it easier to budget.

Long Loan Terms

Home equity loans allow you to borrow potentially large sums of money (depending on the amount of equity you have) with lengthy repayment timelines. They typically have loan terms ranging from five to 30 years.

Potential Tax Deduction

If you use the funds you borrow to renovate your home or make improvements, the interest you pay on a home equity loan may be tax deductible, up to applicable limits—if you itemize your deductions. If you take the standard deduction, you can't deduct your interest payments.

Learn more: Tax Breaks for Homeowners

Compare home equity loans

Check today’s home equity loan offers and current rates to unlock your home’s value with a predictable monthly payment.

Cons of a Home Equity Loan

Home equity loans offer many benefits, but the drawbacks are serious and can include the loss of your house.

Risk of Foreclosure

Because your house is the collateral that secures a home equity loan, you could lose your home if you're unable to make your payments. Foreclosures may stay on your credit reports for up to seven years, damaging your credit.

Credit Score Requirements

You'll likely need a good credit profile to qualify for a home equity loan. Requirements vary by lender, but you generally need a FICO® ScoreΘ of at least 660.

Learn more: Can You Get a Home Equity Loan With Bad Credit?

Closing Costs and Fees

You may have to pay closing costs and fees when you get a home equity loan. Costs tend to be about 2% to 5% of the loan amount.

Possible Negative Equity

If the value of your home decreases after getting a home equity loan, you could owe more than the house is worth, making it difficult to sell if you want to move.

Learn more: What Is Negative Equity?

Longer Funding Time

The time to close varies by lender, but it can take anywhere from four to seven weeks to close on a home equity loan, much longer than it would take to get a personal loan or open a credit card.

Should You Get a Home Equity Loan?

Whether a home equity loan is your best option depends on multiple factors, including how much you need, how you plan to use the money, your credit profile and your financial situation. Here are some scenarios when it may be worth considering.

- You're making home improvements. Using a home equity loan to make home improvements or renovate may increase the value of your home, and you may be able to get a tax deduction for the interest you pay on the loan.

- You're paying for educational expenses. For some families, tapping into their home's equity can be a way to pay for college expenses, but it may not be worth the risk. Federal student loans may offer protections home equity loans don't, including the potential for loan forgiveness, graduated repayment plans and the option to pause payments in certain situations. However, if your student has maxed out all their federal loan options and you still have costs to cover, a home equity loan may provide funding at lower interest rates than private loans or other funding options.

- You're making a large, one-time purchase. Home equity loans can help you buy essential items when you're short on cash. For example, if your HVAC system and hot water heater both go out on the coldest day of winter. However, you shouldn't use them for discretionary purchases such as vacations.

- You're covering unexpected medical costs. A home equity loan can help you pay off medical debt. However, negotiating the bill down, asking about a payment plan or requesting assistance from a nonprofit may be a better option than putting your home at risk.

Tip: Be wary of swapping unsecured debt, such as medical bills and student loans, for secured debt that jeopardizes your house. It may sound tempting, especially if you can qualify for a lower interest rate, but you could lose your home if you can't make your payments.

How to Get a Home Equity Loan

If you're considering borrowing against the equity in your home, here's what you need to do to prepare.

- Check your home equity. You typically need to have at least 20% equity to qualify for a home equity loan. You can get a ballpark idea of how much equity you have by looking up estimates of your home's current value and subtracting the amount you currently owe on your mortgage.

- Consider your loan purpose. Relatively low rates may make a home equity loan an attractive option for making a one-time essential purchase or improvements that will increase the value of your home. If you need a smaller loan amount or want to make discretionary purchases, it may not be your best bet.

- Be realistic about repayment. Review your budget and borrow only what you can comfortably repay. Stretching your finances to the max when your home is at risk is a bad idea.

- Set aside your closing costs. You can get an estimate of the loan's closing costs from your lender. Be sure you have the cash you need saved up before closing.

- Get your documents ready. The lender may ask to see paystubs, W-2s, bank statements and other documents to assess your ability to repay the loan. Gathering these up ahead of time may allow you to complete the application process more quickly.

- Apply for the loan. Complete the lender's application and provide any documents they request. Because rates and loan terms vary by provider, shopping around and comparing quotes is one of the best ways to find the lowest possible rate.

- Schedule an appraisal. The lender will likely request an appraisal during the application process to get a formal assessment of your home's current market value. This will help determine how much you can borrow.

- Close on the loan. If your application is approved, you'll generally close on your loan four to seven weeks later. Timelines vary based on the lender.

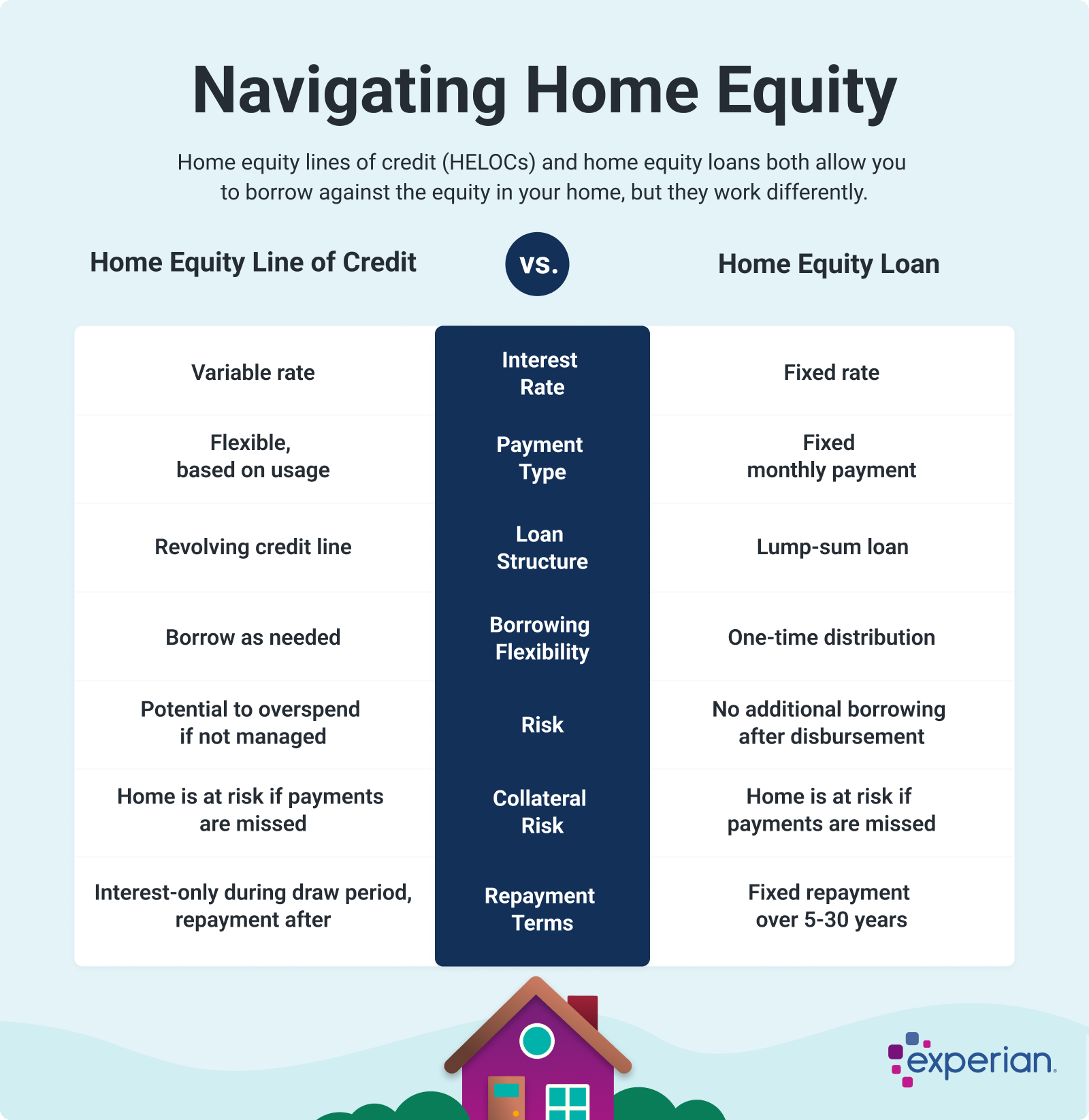

Home Equity Loan vs. HELOC

Many times when homeowners consider tapping some of the home equity they've accumulated, they consider home equity loans and home equity lines of credit (HELOCs). Both are common options to access equity, but there are some key differences between the two.

Alternatives to a Home Equity Loan

If you're unsure whether a home equity loan is right for you, here are a few alternatives to consider.

- HELOC: As noted above, HELOCs offer flexibility that home equity loans don't provide. Because you can borrow against your line of credit repeatedly, they may be a good option if you're unsure how much money you need or you have multiple upcoming projects you need to finance. Remember, a HELOC's variable interest rate makes payments more difficult to budget, and they may be larger than expected if rates rise after you open the line of credit.

- Personal loan: Personal loans can be used for almost any reason, are available in a wide range of loan amounts and don't require you to use your home as collateral. Personal loan rates are typically higher than home equity loan rates.

- Cash-out refinance: You can also tap into your home's equity by replacing your current mortgage with a larger one, then keeping the difference between the original and new loan amount in cash. With a cash-out refinance, you only have one monthly payment, but your loan terms change, which may increase (or decrease) your interest rate and extend the repayment period.

- Reverse mortgage: A reverse mortgage allows you to borrow against the equity in your home without making loan payments as long as you live in the house and meet certain conditions. Your loan balance accrues interest and fees each month, increasing rather than decreasing over time. As the balance increases, the equity you have in your home decreases. Reverse mortgages are only available to borrowers 62 and older, and scams are common, so be sure to do your due diligence and work with a reputable lender if you decide to get one.

Frequently Asked Questions

The Bottom Line

A home equity loan may be a good option if you want to finance a one-time fixed expense, are confident you can make the payments and have a financial cushion that can give you some wiggle room in your budget if you experience an unexpected financial hardship. But because you risk losing your home if you're unable to repay the loan, it's crucial to carefully weigh the pros and cons of this borrowing option.

If you're planning to borrow against your home equity, you'll need a good credit score to get the best rates and terms. Check your FICO® Score and credit report for free from Experian to see where you stand.

Curious about your mortgage options?

Explore personalized solutions from multiple lenders and make informed decisions about your home financing. Leverage expert advice to see if you can save thousands of dollars.

Learn moreAbout the author

Jennifer Brozic is a freelance content marketing writer specializing in personal finance topics, including building credit, personal loans, auto loans, credit cards, mortgages, budgeting, insurance, retirement planning and more.

Read more from Jennifer