Can You Get a Home Equity Loan With Bad Credit?

Quick Answer

It’s possible to qualify for a home equity loan with a bad credit, but you’ll likely need a credit score of at least 680 for approval. Some lenders allow for lower credit scores if your other financials are strong.

Generally, you'll need a FICO® ScoreΘ of at least 680 to qualify for a home equity loan. If your credit score is below 680, however, all is not lost. You may still be able to get a home equity loan with bad credit, but you should be aware of the downsides first.

Tapping your home equity may allow you to cover emergency expenses and almost any other cost you might face, such as a major home renovation project. Home equity loans are also a popular option to consolidate high-interest debt. Let's go over your options for borrowing against your home equity when your credit is less than stellar.

What Is a Home Equity Loan?

Home equity is the percentage of your home you actually own. So, if your home is worth $400,000 and your outstanding loan balance is $250,000, your equity is $150,000. A home equity loan may allow you to access up to 80% or 85% of that equity—$120,000 to $127,500 in this example. You'll receive the money in one lump sum and repay it in fixed monthly payments during your repayment term, which typically ranges from five to 30 years.

Remember, a home equity loan is considered a second mortgage that uses your home as collateral. If you fall behind on payments and default on the loan, your lender could foreclose on your home.

Learn more: How Does a Home Equity Loan Work?

Compare home equity loans

Check today’s home equity loan offers and current rates to unlock your home’s value with a predictable monthly payment.

Can You Get a Home Equity Loan With Bad Credit?

You can still qualify for a home equity loan if your credit isn't perfect, especially if you meet other criteria like having solid income and a low debt-to-income ratio (DTI). Still, most lenders look for a minimum credit score of at least 680, while more lenient ones may accept a score as low as 620.

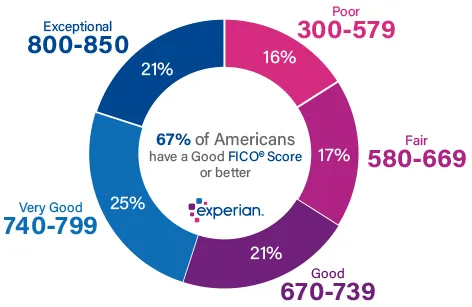

That means if your credit falls in the poor range (below 580), you likely won't qualify for a home equity loan. As a general rule, the higher your credit score, the greater the loan amount you may qualify for. If your credit could be better, consider improving it before applying. Even a modest improvement from the upper fair range (580 to 669) into the good credit range (670 to 739) may lead to a substantially lower rate, which could save you thousands over the life of your loan, depending on your loan amount and term.

Requirements for Home Equity Loans

Applying for a home equity loan is much like applying for your primary mortgage. The lending requirements are similar and include factors such as:

- Sufficient home equity: Home equity lenders may allow a combined loan-to-value (CLTV) ratio of up to 85% or even higher. This ratio measures the size of your loan—and any other loans attached to your home, including the proposed home equity loan—compared to your home's appraised value. Your lender will likely require a home appraisal to ensure adequate equity to secure the loan.

- Minimum credit score: Minimum credit score requirements vary from lender to lender, but most require a FICO® Score of 680 or greater. Stricter lenders want borrowers to maintain a minimum score of 720. You may still qualify for home equity financing if your score falls below 680 if your equity or income is strong.

- Proof of income: Lenders want to see that you have stable employment and sufficient income to comfortably afford new loan payments. Be prepared to produce W-2s and recent pay stubs or other documentation as proof of income.

- Low DTI: How your debt and income compare is one of the most important factors lenders consider when reviewing your loan application. Your DTI measures how much of your gross monthly income is used to pay your monthly debts. A low DTI shows lenders you're likely to manage new debt responsibly. Most lenders require a DTI ratio of 43% or less.

- Strong payment history: Even though your payment history is included in your credit score, your lender will want to take a closer look at it. They're more likely to approve your loan if your payment history shows you consistently make on-time payments on all your accounts.

- Proof of insurance: Just as auto lenders require you to carry car insurance to finance a new vehicle, home equity lenders want proof of homeowners insurance to protect their investment against loss if your property suffers major damage.

Learn more: Requirements for a Home Equity Loan or HELOC

How to Get a Home Equity Loan With Bad Credit

Follow these steps to get a home equity loan, even if your credit could be better.

1. Check Your Credit Reports

Before applying for a new home equity loan, review your credit reports to see what potential lenders may see when reviewing your application. You can get your credit report for free anytime from Experian. You can also obtain free weekly credit reports from the other two major credit bureaus, TransUnion and Equifax, online at AnnualCreditReport.com.

Look closely for inaccuracies that could harm your score. Issues could be as simple as a misspelled name or more serious, like an inaccurate late payment. You have the right to dispute information on your credit report for free.

2. Improve Your Credit

Cleaning up your credit report may help your credit score and, in turn, improve your approval odds and loan terms. Take additional steps to improve your credit, like paying down your debt balances, which account for 30% of your FICO® Score. Your payment history makes up 35% of your FICO® Score, so make every effort to pay your bills on time to continue building on your credit.

Along the same lines, avoid using credit for large purchases when preparing for a second mortgage. Increased balances could harm your credit by increasing your credit utilization ratio, but will raise your debt-to-income ratio as well.

Learn more: What Affects Your Credit Scores?

3. Calculate Your DTI

Make sure your DTI is below 43% before submitting a home equity loan application; staying at or below this threshold is typically required by home equity lenders. You can calculate your DTI by adding up your monthly installment debt payments, including auto loan, personal loan and student loan payments, and your minimum monthly revolving debt payments on credit cards and lines of credit. Divide your total by your gross monthly income.

Example: If your monthly debts total $3,000 and you make $9,000 each month, your DTI is 33% ($3,000 debt / $9,000 income = 0.33 x 100 = 33%).

4. Determine Your Home Equity

To estimate your home equity, subtract what you owe on your mortgage from your home's appraised value. It's also helpful to understand your combined loan-to-value (CLTV) ratio. CLTV includes any loans attached to your home, including the one you're applying for. A CLTV of 85% or lower indicates you have sufficient equity to qualify for a new loan.

Example: If your home is worth $502,000 and you have $246,000 to pay on your mortgage, then you would have $256,000 in home equity. With a 20% equity lender requirement, the total amount you could borrow would be $256,000 - ($502,000 x 0.20) = $155,600.

If you borrowed $100,000, then the total debt on your home would become $346,000. Your CLTV would be $346,000 / $502,000 = 68.9%.

Learn more: How to Calculate Home Equity

5. Gather Your Financial Documents

Round up any documents that support the data you provide on your home equity loan application. For example, you'll need your pay stubs, W-2s or other acceptable documentation, account statements and tax returns as proof of income.

6. Shop and Compare Lenders

Consider getting home equity loan quotes from multiple lenders to help identify the loan that benefits you the most. Prioritize loans that offer the best combination of low interest rates, minimal closing costs and limited fees or prepayment penalties.

Should You Get a Home Equity Loan With Bad Credit?

Weigh the pros and cons of any loan before proceeding. That's particularly true with home equity loans since they're secured by your home. Here are the pros and cons to consider:

Pros

- Lower interest rates: Home equity loans typically carry lower rates than other forms of credit, such as credit cards and personal loans. This could make them a good option for consolidating high-interest debt.

- Fixed interest rates: Home equity loans generally come with fixed interest rates. Even if interest rates rise, your rate and payment stay the same throughout your loan term. Having predictable payments makes it easy to budget for them.

- Potential tax benefit: The IRS allows you to deduct your home equity loan interest on your income taxes so long as the loan funds are used to "buy, build or substantially improve" your primary residence.

Cons

- Risk of foreclosure: The most significant downside to home equity loans is that your home is collateral on the loan. That means you could lose your home to foreclosure if you fall behind on payments and default on the loan. Before signing loan documents, it's essential to run the numbers to make sure you can comfortably afford the new payments.

- Closing costs and fees: Closing costs typically range from 2% to 5% of the home equity loan amount, though some don't charge closing costs at all. When comparing home equity loan offers, consider not only the interest rate but also the closing costs and fees associated with the loan.

- Lowers home equity: A home equity loan diminishes your home equity, which is an important consideration if you plan on selling your home in the future. Less equity equals less profit when you sell. Even worse, your loan could go upside down if home values fall. In that case, it could be difficult to sell or refinance your home because the sale proceeds might not cover both your primary mortgage and the home equity loan.

Learn more: Pros and Cons of Home Equity Loans

What to Do if Your Home Equity Loan Application Is Denied

If your home equity loan application is denied, contact the lender to understand the reasons behind their decision. Common reasons for denial include credit, income or employment issues, insufficient equity or the home appraisal. Once you discover the specific reasons why your lender denied your application, you can take steps to improve your approval odds the next time you apply.

You have the right to request a credit report for free after a company takes an adverse action against you, such as denying your loan application based on your credit.

Alternatives to Home Equity Loans

A home equity loan is a popular choice for consolidating debt, funding a home renovation, covering a large expense, or other purposes. However, your financial situation is unique, and other financing alternatives may be worth considering, such as:

- Home equity line of credit (HELOC): Like a home equity loan, a HELOC is a second mortgage that uses your home equity as collateral. However, unlike a home equity loan, which provides a single lump-sum payment, a HELOC works like a credit card by allowing you to draw funds as needed for a certain time period, up to your credit limit.

- Personal loan: A personal loan may be preferable to home equity loans since they typically don't require any collateral, meaning your home isn't at risk. However, as an unsecured loan, interest rates are usually higher than those with home equity loans.

- Cash-out refinance: A cash-out refinance lets you access your home's equity by replacing your existing mortgage with a larger one. The lender pays off your current loan and gives you the difference in cash, minus closing costs. You can typically borrow up to 80% to 85% of your home's value, but borrowing above 80% may require private mortgage insurance (PMI).

- 0% introductory APR credit cards: With a strong credit score, you might qualify for a credit card offering a 0% intro APR credit card for up to 21 months. You might use the card to cover a large unexpected expense and have enough time to repay the amount interest-free.

Compare personal loan rates

Find APRs from 4.99% to 35.99% and flexible terms of 12 to 120 months. Loan amounts range from $1,000 up to $250,000, with funding available the same day or up to 7 days.

Offers from our partners

View all of our Best Personal Loans for 2026 to see what you’re likely to qualify for, and the rates and terms you might get.

Frequently Asked Questions

The Bottom Line

A home equity loan can help you achieve important goals like consolidating debt or covering a home improvement project. It's still a good idea to weigh the pros and cons and how a new loan might impact your overall financial health.

While some lenders work with borrowers with less than ideal credit, it makes sense to improve your credit score fast before applying. With good credit, you may qualify for lower interest rates and save significantly over the loan's term. Start by checking your credit report and score for free with Experian and address any issues you find on your report.

Curious about your mortgage options?

Explore personalized solutions from multiple lenders and make informed decisions about your home financing. Leverage expert advice to see if you can save thousands of dollars.

Learn moreAbout the author

Tim Maxwell is a former television news journalist turned personal finance writer and credit card expert with over two decades of media experience. His work has been published in Bankrate, Fox Business, Washington Post, USA Today, The Balance, MarketWatch and others. He is also the founder of the personal finance website Incomist.

Read more from Tim