How to Choose the Best Car Insurance Company

Quick Answer

You can find the right auto insurance provider by determining the coverage you need, setting a budget, looking for discounts, getting insurance quotes and evaluating insurance companies’ financial stability and customer satisfaction levels.

No one wants to overpay for car insurance, but choosing the right auto insurance provider isn't just about getting the lowest rates. It's also important to select an insurance company that offers the coverage you need, is financially stable and is helpful when you file a claim. Here are six steps to picking the right auto insurance provider.

1. Determine What Coverage You Need

States may require drivers to have a minimum amount of liability coverage, uninsured and underinsured motorist coverage and personal injury protection. If your car is leased or financed, your lender or leasing company may require you to carry a certain amount of comprehensive and collision coverage, both of which pay for damage to your vehicle. You might also want to get medical payments coverage. The Insurance Information Institute has a list of each state's minimum insurance requirements.

To protect your assets against lawsuits, you may want to buy more auto insurance coverage than the law requires. You can also buy umbrella insurance, which covers liability and other costs beyond the limits of your auto insurance.

You may need or want special auto insurance coverage such as:

- Guaranteed asset protection (gap) insurance: Due to depreciation in value, if your new car is totaled, you might owe more on the loan than the insurance company will pay out. Gap insurance pays the difference between the car's value and the amount of your loan.

- Classic car insurance: This covers the unique needs of antique or collectible cars, such as the cost of vintage parts or specialized repairs.

- Rideshare insurance: If you plan to drive for a rideshare company, this coverage protects you if you have an accident in between logging in to the rideshare app and accepting a request from a passenger.

- Windshield or glass insurance: This coverage pays to replace or repair window and windshield glass with little or no deductible.

- Accident forgiveness coverage: This can prevent your insurance premiums from increasing after an accident (typically one that you cause).

2. Set a Budget

Before shopping for an auto insurance provider, it's a good idea to make a budget or revisit your existing budget. How much can you spend on car insurance? You may have to cut back in other areas to afford the car insurance you need. Aim to strike a balance between coverage and affordability.

3. Decide on Your Deductible

Your insurance deductible is what you're responsible for paying out of pocket before the insurer covers the rest of a loss. Some types of car insurance have a deductible; you can typically select the amount, which may range from $0 to $2,500. In general, the lower the deductible, the higher your premiums will be. Conversely, a higher deductible can save money on premiums; just make sure you can pay the deductible if you need to.

4. Look for Discounts

Most auto insurance providers offer discounts, but available discounts can vary from one insurance company to another. For example, an insurance carrier might offer discounts for seniors, for good drivers, for alternative-fuel vehicles or for buying both home and auto insurance (a practice known as bundling). If you're insuring a teen driver, choosing a provider that offers student discounts can save you money. Don't drive much? Check to see if an insurer offers pay-per-mile insurance or other low-mileage discounts. You may also qualify for discounts if you belong to a certain organization, are in the military or work at a certain company.

5. Get Rate Quotes

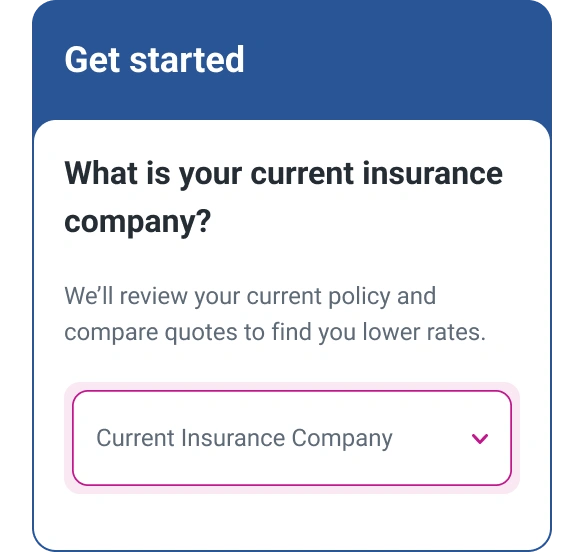

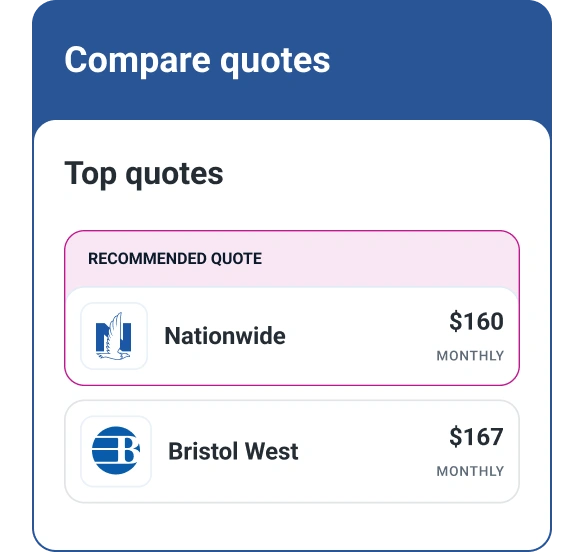

Once you know which auto insurance providers offer the types of coverage, deductible options and discounts you're looking for, it's time to get rate quotes. Quotes are estimates of how much your premiums might be, based on basic information about your household, ZIP code, vehicle, desired coverage and driving habits.

You can get car insurance quotes by contacting an insurance agent who represents a specific carrier or an independent broker who represents multiple insurance companies. You can also get quotes online at an insurance carrier's website or by using online comparison tools that gather quotes from multiple providers in one place.

To get a more accurate quote for car insurance, gather the following information before you start:

- Vehicle identification numbers (VINs) for the cars you want to insure

- Driver's license numbers for each driver in your household

- Estimated total mileage per vehicle per year, as well as estimated daily commuting mileage

- A copy of your existing car insurance policy (if you have one)

- Amount you pay annually and monthly for car insurance

To ensure you're comparing apples to apples, ask each insurer for quotes for the same type and amount of coverage and the same deductibles.

6. Research Insurance Providers

You've found a couple of insurance providers whose auto policies look good. Before you purchase insurance, however, do some investigating to make sure the company is solid.

- Check the company's financial strength. Look at ratings from A.M. Best, Fitch, Kroll Bond Rating Agency, Moody's and Standard & Poor's, all of which evaluate the financial stability of insurance carriers.

- Evaluate customer satisfaction. Read online customer reviews and check for car insurance ratings from companies such as J.D. Power and Associates and Consumer Reports. Check with your state's department of insurance or use this tool from the National Association of Insurance Commissioners to see what kinds of complaints have been filed against the insurance company you're considering.

- Confirm the insurance company is licensed in your state. You can find this information at your state's department of insurance website.

The Bottom Line

When applying for auto insurance coverage, you may be able to lower your premiums by maintaining good credit. Many states allow insurance carriers to check your credit-based insurance score when determining your premium rates. Checking your regular credit score—which is based on similar data—can give you an idea of where your credit-based insurance score stands. Making payments on time and paying down debt can help improve both credit scores.

Don’t overpay for auto insurance

If you’re looking for ways to cut back on monthly costs, it could be a good idea to see if you can save on your auto insurance.

Find savingsAbout the author

Karen Axelton is Experian’s in-house senior personal finance writer. She has over 20 years of experience as a journalist and has written or ghostwritten content for a variety of financial services companies.

Read more from Karen