At Experian, one of our priorities is consumer credit and finance education. This post may contain links and references to one or more of our partners, but we provide an objective view to help you make the best decisions. For more information, see our Editorial Policy.

In this article:

A credit card is a type of credit that allows you to borrow money, repay it and borrow again. When used wisely, a credit card can be one of the most effective financial payment tools available, and it's possible to enjoy many of the benefits credit cards offer without paying interest.

If you're considering a credit card, here's what you need to know.

What Is a Credit Card?

A credit card is a payment card that you can use to make purchases online and at the point of sale. When you use a credit card to pay for goods or services, you authorize the credit card company to make the purchase for you, with the promise to pay the exact amount back at a later date.

Credit cards may also come with various features, such as rewards, APR promotions, travel perks and insurance protections.

How Do Credit Cards Work?

Credit cards work by allowing you to borrow money to pay for a purchase now, then repay the balance later. They're a type of revolving credit. That means they allow you to borrow up to a set credit limit, and you can repeatedly borrow and pay off your balance.

When you make a purchase on your credit card, the charge amount is added to your current balance and lowers your available credit. When you make a credit card payment, your available credit increases.

You can continue to use your card as long as you stay within your credit limit. But if you don't pay off your balance in full each month, you could be charged interest—more on this below.

Learn more >> How Do Credit Cards Work?

What Information Appears on a Credit Card?

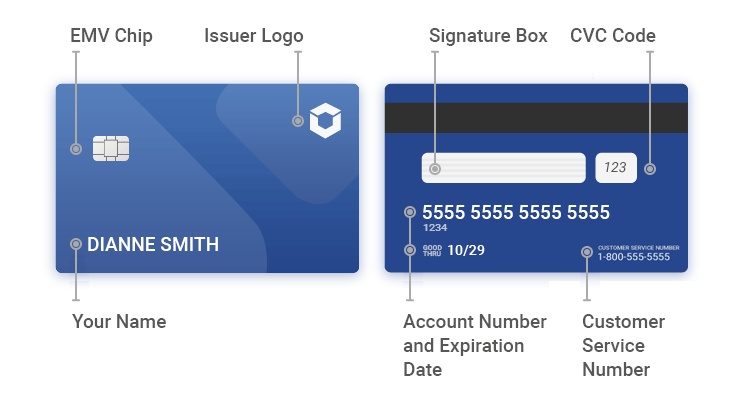

Physical credit cards have several features that help identify the cardholder and card issuer, along with other details to facilitate seamless transactions. Elements include:

- Issuer logo: The credit card issuer's logo may be on the front or the back of the credit card—think Capital One or Chase.

- Payment network logo: While your credit relationship is with the card issuer, your charges are processed by one of the four major payment networks. As such, you'll see an American Express, Discover, Mastercard or Visa logo on the front or back of the card.

- EMV chip: The EMV chip, which you'll find on the front of the card, stores encrypted credit card data, allowing you to make point-of-sale purchases more securely.

- Contactless symbol: Some credit cards use short-range wireless technology to allow you to tap your card to a compatible card reader instead of swiping or inserting it. The symbol looks similar to a Wi-Fi symbol, and you'll find it on the front or back of the card if your card has this feature.

- Magnetic stripe: On the back of the credit card, you'll find its magnetic strip, which stores your credit card information, albeit less securely than the EMV chip.

- Your name and account number: Your name as it appears on your credit card application appears on the front or back of the card, as well as your account number. If you're unsure which payment network your card runs on, look at the first figure of your card number. If it's a three, it's an American Express card; if it's a four, it's a Visa card; if it's a five, it's a Mastercard card; and if it's a six, it's a Discover card.

- Expiration date: Your card expiration date shows merchants the month and year when your credit card is no longer usable. Before the expiration date, your card issuer will send you a new card. It may be on the front or back of the card.

- CVV code: Short for card verification value, it'll be a three-digit number on the back of the card if you have a Discover, Mastercard or Visa card. If you have an American Express card, it's a four-digit number on the front of the card.

- Customer service phone number: The card issuer provides a customer service number on the back of the credit card, which you can call if you have questions or a problem to resolve.

- Signature box: Credit cards include a field where cardholders are encouraged to sign their name.

Types of Credit Cards

There are several different types of credit cards you can choose from, each with its own set of features. Here's a quick summary of each one.

Rewards Credit Card

A rewards credit card offers value in the form of cash back, points or miles on your everyday purchases. In some cases, it may also offer welcome bonuses and other perks. Some rewards credit cards are issued in partnership with an airline or hotel brand, allowing you to earn rewards and benefits with the co-branded partner.

Learn more >> What Is a Rewards Credit Card?

Balance Transfer Credit Card

A balance transfer credit card allows you to move a balance from another credit card and pay it down, often with an introductory 0% APR promotion. Depending on the card, the promotional period can last anywhere from 12 to 21 months. The caveat is that you typically have to pay an upfront balance transfer fee of 3% to 5% of the transferred amount. Some balance transfer cards also offer a 0% APR promotion on new purchases, and some even come with rewards.

Learn more >> How to Do a Balance Transfer in 5 Steps

0% Intro APR Credit Card

These credit cards offer introductory 0% APR promotions on new purchases made with your card. Promotional periods can last anywhere between six and 21 months, depending on which card you choose. In some cases, 0% intro APR credit cards also offer rewards and welcome bonuses, making them a great choice for large expenses you need to pay down over time.

Learn more >> How Do Intro 0% APR Credit Cards Work?

Secured Credit Card

Designed for borrowers with poor, limited or no credit, secured credit cards require an upfront security deposit to get approved—typically a minimum of $200 and generally equal to your credit limit. With responsible use, you can build a positive credit history and, in some cases, you can get your deposit back without needing to close your account. However, some card issuers may require you to close your account to get a deposit refund.

Learn more >> What Is a Secured Credit Card?

Student Credit Card

Tailored to college students, student credit cards allow eligible borrowers who are new to credit to establish their credit history and possibly even earn rewards and other benefits without a security deposit.

Learn more >> How to Get a Student Credit Card

Store Credit Card

Also called a retail credit card, store credit cards are issued in partnership with individual retailers and may offer specific rewards and benefits when you shop with the co-branded retailer. While most retail credit cards can only be used with the co-branded retailer, some allow you to use your account anywhere.

Learn more >> Pros and Cons of Store Credit Cards

Business Credit Card

A business credit card usually comes with rewards and perks tailored to small business owners. This type of card also usually has a larger credit limit compared to a personal credit card, and it may also help you establish a business credit history.

Learn more >> Pros and Cons of Business Credit Cards

Compare top credit cards matched for you

Pros and Cons of Credit Cards

| Pros | Cons |

|---|---|

| Makes it easier to track your spending | Credit card fees can add up |

| Rewards can add value to your everyday spending | If you carry a balance, interest rates can be high |

| More convenient and secure than cash | Approval requirements can be unclear |

| Can help you build and maintain good credit | Can harm your credit if you don't use them responsibly |

| You can avoid interest by paying your balance in full each month | Interest rates are variable and can fluctuate over time |

| Other benefits can help save you money and improve your lifestyle | Making only minimum payments could result high-interest debt |

Should You Get a Credit Card?

The decision of whether or not to get a credit card depends on your current situation and your financial goals. In particular, here are some situations where it can make sense to apply for a credit card:

- You want to build or maintain a good credit score.

- You're on a budget and expect to pay your balance in full every month.

- You want to earn cash back, points or miles on your everyday purchases, along with other perks.

- You want to take advantage of the added security and fraud protections credit cards provide.

On the flip side, it may not make sense to get a credit card if you have issues with overspending or you're concerned that a credit card would tempt you to overspend.

Consider Becoming an Authorized User

If you're not ready for a credit card quite yet, consider asking a loved one to add you as an authorized user on their account. If they've used the card responsibly, its history can help build your credit profile.

You'll also get a card that's tied to the account and can make purchases. That said, only the primary cardholder is responsible for making payments, so you'd need to make arrangements with them to cover your purchases.

Learn more >> Will Being an Authorized User Help My Credit?

How to Choose a Credit Card

Picking the right credit card can feel like a daunting task. While it may be tempting to go with the first option you like, it's important to take your time to ensure you find the best fit for you. Here are some steps you can take to accomplish your goal:

- Check your credit score. There are credit cards available to borrowers across the credit spectrum, but your options may be limited if your credit score needs some work. Register with Experian to get free access to your FICO® Score☉ and Experian credit report to get an idea of where you stand.

- Look at your spending habits. If you're thinking about applying for a card that offers rewards, take a look at your expenses over the past few months to understand where you spend most of your money. Some rewards cards offer bonus rewards in certain spending categories, while others simply offer a high flat rewards rate on everything.

- Determine what you're looking for in a card. If you're interested in a rewards card, consider what type of rewards currency you want to earn: cash back, points or miles. Also, think about other features you want in a card. Examples include 0% intro APR promotions; general travel benefits; perks with a specific airline, hotel brand or retailer; and more.

- Shop around. Once you have a picture of what you're looking for, start researching cards that fit your credit profile. If you have good or excellent credit—usually a FICO® Score of 670 and above—you'll have a broad selection. But if your credit score is below that threshold, you'll have fewer choices for now.

Once you decide on a card, you can typically apply for it through the lender's website, over the phone or possibly even in person at a local bank or credit union branch.

Learn more >> What to Consider When Choosing a New Credit Card

Common Credit Card Terms

If you're getting a credit card for the first time or you're a casual credit card user, there may be some terms you're not familiar with. Here's a quick summary of some of the most common credit card terms you'll come across:

| Annual fee | Some credit cards charge an annual fee for the privilege of owning the card. Annual fees are common among travel rewards credit cards and credit cards for borrowers with poor and fair credit |

|---|---|

| Annual percentage rate (APR) | The APR on a credit card is the same as its interest rate, and it's typically variable, so it can fluctuate along with market rates. The headline APR is typically the rate for purchases. |

| Balance transfer | A balance transfer occurs when you move debt from one credit card to another one. |

| Balance transfer fee | When transferring a balance from one card to another, credit card issuers often charge a balance transfer fee, which is usually 3% to 5% of the transfer amount. |

| Balance transfer APR | This is the interest rate that applies to balance transfers. While it's typically the same as the card's purchase APR, it doesn't qualify for a grace period. |

| Billing cycle | Your card's billing cycle is the length of time between your statement dates. At the end of each billing cycle—which lasts roughly a month—your card issuer will calculate your new balance that needs to be repaid. |

| Cash advance | This is a feature that allows you to access some of your card's credit limit in the form of a cash withdrawal, usually at an ATM or a physical branch. |

| Cash advance APR | Cash advance APRs apply only when you use the cash advance feature. They're typically higher than the purchase APR and don't qualify for a grace period. |

| Credit limit | Your card's credit limit dictates how much you can spend on the account. Once you reach your credit limit, your card issuer may decline all other charges until you pay down some of your balance. |

| Credit utilization rate | This ratio reflects how much of your available credit you're using at a given time. You can calculate your utilization rate by dividing your card's balance by its credit limit, and it's an influential factor in your credit score. |

| Grace period | This is the period between your monthly statement closing date and your due date. If you pay off your balance in full during this period, you'll avoid interest charges. Grace periods can vary but if a card offers one, it must be at least 21 days. |

| Introductory APR | Some cards offer introductory APRs on purchases or balance transfers that can be as low as 0%. |

| Late payment fee | Your card issuer may charge a late fee if you don't pay your minimum amount due by your monthly due date. |

| Minimum payment | This is the minimum amount you need to pay each month to maintain a positive payment history. It's usually calculated as a small percentage of your balance. |

| Penalty APR | Once you're 60 days late on a payment, your card issuer may institute a penalty APR that's higher than your purchase APR and can remain in place for six months or longer. |

| Statement balance | Your statement balance is the total amount you owe at the end of each billing cycle. It's calculated as the sum of your purchases from the previous billing cycle plus any unpaid balances, interest and fees. |

How to Get a Credit Card for the First Time

If you're looking for your first credit card, you may not have as many options as someone who's established a strong credit history. However, there are still some good options available. Here's how to find them:

- Choose the best type of card for you. If you're a college student, a student credit card may be a better fit than a secured credit card because it doesn't require a security deposit. If you can't qualify for a student card, you may also consider a debit-credit hybrid card, which may require a security deposit but with added flexibility.

- Compare card features. Starter credit cards don't usually offer a lot of bells and whistles, but you can still compare rewards rates, interest rates and other basic features that can add value to your cardholder experience.

- Avoid high fees. Some credit cards marketed to people with poor or no credit histories come with exorbitant fees. While they can be easy to get, there are plenty of options that don't charge an annual fee and have more reasonable APRs. Make it a priority to avoid cards that charge monthly fees or upfront processing fees.

- Prepare to develop good credit habits. Your first credit card likely won't have a high credit limit, so it's important to use the card sparingly to maintain a low credit utilization rate. Also, make it a goal to pay your balance on time and in full to build credit and avoid interest charges.

Learn more >> An Essential Guide to Your First Credit Card

What to Do if Your Credit Card Application Is Denied

If you've been denied a credit card, it's important to understand the reasons and take steps to improve your approval odds the next time you apply. Here are some steps you can take:

- Review the adverse action notice. You should receive an adverse action letter detailing the reasons for your denial. This can give you a starting point to evaluate how to proceed.

- Check your credit reports. If you were denied due to credit-related reasons, review your credit reports to pinpoint areas you can address. You can register with Experian to get access to your Experian credit report for free anytime, and also get weekly reports for free from all three credit bureaus through AnnualCreditReport.com.

- Determine your next steps. Once you have a grasp on your situation, decide on the best path toward approval. If you have a low credit score, for instance, consider applying for a card that better matches your credit profile. Alternatively, you could take steps to improve your credit, increase your income or take other steps to address the reasons for denial. You also have the right to dispute credit report information if you believe it is inaccurate.

Learn more >> Does Getting Denied Credit Affect Your Credit Scores?

Get Matched With a Credit Card Based on Your Credit Profile

It can be difficult to know whether or not you're eligible for a certain credit card. Whether you have your eye on a specific card or you simply want to shop around, Experian can help you find credit cards matched to your credit profile. The service is free and can make it easier to apply with confidence.