Do You Need Good Credit to Finance a Motorcycle?

Quick Answer

There’s no credit score cutoff that guarantees you will or won’t be able to finance a motorcycle, but having good credit could make it easier to qualify for a loan and get better interest rates.

Buying a motorcycle may not cost as much as buying a car. Unless you've been saving diligently so you can pay cash for it, however, you'll still likely need to finance your purchase. The cost of a new motorcycle starts at around $5,000 and can be as high as $35,000, according to Altus Motorsports. Higher-end models can cost between $10,000 and $35,000, beginner models commonly range from $5,000 to $10,000, and used models can be had more cheaply than that.

Taking out a loan lets you pay for your purchase over time, but you first need to qualify. While you don't need a specific minimum credit score to get a motorcycle loan, people with higher scores tend to have an easier time qualifying and receive lower rates. Ride along as we explain how your credit affects motorcycle financing.

Compare rates on a new auto loan

Find a good auto loan with today’s rates. Compare current rates and offers to find the best loan for you.

What Credit Score Do You Need to Finance a Motorcycle?

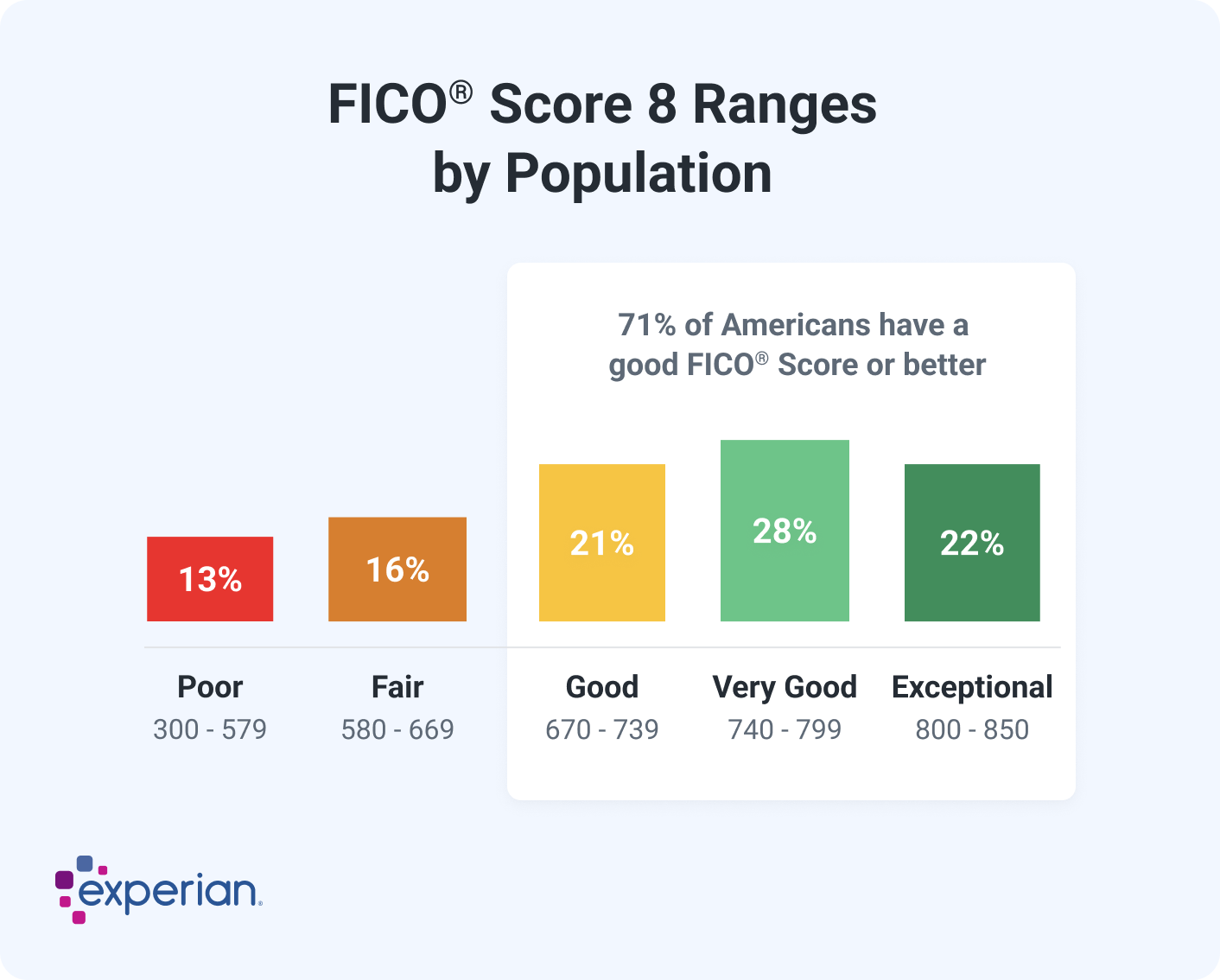

Different lenders have different lending criteria, and there's no universal credit score that guarantees you will qualify for a motorcycle loan. That said, you typically need a good FICO® ScoreΘ or higher to get the best rate and terms. General-use FICO® Scores range from 300 on the low end to 850 on the high end, with scores of 670 and above falling in the "good" to "exceptional" categories.

If your credit scores are less than 670, don't despair. That doesn't mean you won't be able to find a motorcycle loan. However, it may require a little more legwork, and you may not get the best rate or terms.

Can You Finance a Motorcycle With No Credit?

Having a thin credit file can make it challenging—but not necessarily impossible—to secure financing. Lenders like to see how potential borrowers have managed credit in the past before making application decisions because it helps them predict how likely someone is to repay their loan on time.

If you don't have a robust credit history, here are a few tips that may help you qualify for a loan:

- Save up for a large down payment. The less money you borrow, the less risk the lender assumes. Applying for a smaller loan amount may improve your chances of qualifying.

- Establish a solid credit history before financing a motorcycle. Financial institutions have products, such as secured credit cards and credit-builder loans, designed to help people establish a solid credit history. If you can postpone your purchase, using these products to help build your credit profile before applying for a motorcycle loan may help you qualify.

- Get a cosigner. A cosigner is someone who agrees to make your loan payments if you're unable to. Having someone with a solid credit history cosign your loan may improve your chances of qualifying and getting a lower rate.

Learn more: How to Build Credit: A Comprehensive Guide

Benefits of Having a Good Credit Score

When applying for a loan, having good credit scores has multiple advantages, including:

- Higher approval odds: People with strong credit profiles are more likely to be approved than people with poor credit.

- Lower interest rates: You're more likely to qualify for better rates with higher credit scores.

- Larger loan amounts: Lenders are generally more willing to offer larger loan amounts to people with solid credit.

- More financing options: Since lenders are all about minimizing risk, you may have more financing options with higher credit scores.

Learn more: Why Do You Want a Good Credit Score?

How to Improve Your Credit Score Before Applying for a Motorcycle Loan

If your credit needs some help, here are some tips to help you improve your credit scores before applying for a loan:

- Pay your bills on time. Your debt payment history is the single most important factor in calculating your credit scores. Getting current on past-due accounts and making all future payments on time can help increase your scores.

- Pay down debt. Your credit utilization ratio, or the amount of credit you use compared to the amount you have available, is the second most influential credit scoring factor. Lower ratios generally have a more favorable impact than higher ones.

- Limit new credit applications. Credit applications can have a small but temporary negative effect on your credit due to the hard inquiry associated with each one. To best protect your credit score and improve chances for approval, avoid applying for other types of credit until after you've secured your motorcycle loan.

- Address credit information you believe was reported in error. It's possible that negative information on your credit reports was reported in error or as a result of fraud, which can drag your scores down. You have the right to dispute information on your credit reports that you believe is incorrect to have it removed or updated.

- Become a credit card authorized user. An authorized user is someone who is added to the primary account holder's credit card account and can make purchases but isn't responsible for paying the bills. Becoming an authorized user can help build your credit history if the creditor reports payments on authorized users' credit profiles. If you use this strategy, it's important to choose the primary account holder wisely. If they have a shaky credit history or start missing payments, it could negatively affect your credit scores.

- Add alternative credit data. Services like the Experian Boost®ø feature add non-traditional credit data like eligible cellphone bill, utility, rent and insurance payments to your credit reports, which can help you build credit.

What Else Do Motorcycle Lenders Look at to Determine Financing?

Your credit history plays a crucial role in your ability to qualify for a loan, but it's not the only factor lenders consider. Here are some others they may use to determine loan eligibility.

- Debt-to-income ratio (DTI): Your DTI is the total amount of debt payments you have each month compared to your income. Lower ratios indicate you may have the capacity to take on additional payments while higher ratios may indicate you're stretching your budget too thin. Lenders are more likely to approve your loan application if you have a lower ratio.

- Income: You need to earn enough to make your loan payments. To ensure you have the money you need to repay your loan, your lender will review your income.

- Loan amount: The amount you borrow affects your ability to make your payments; lenders want to know you have the ability to pay back what you borrow.

- Loan term: Longer loan terms reduce your monthly payments by stretching them out over a longer period of time, but you're more likely to owe more than the motorcycle is worth with a longer loan term, making them riskier for lenders.

- Motorcycle: Lenders may be more willing to approve your loan application if you're purchasing a new motorcycle instead of a used one because they're worth more. If you're unable to make your loan payments and the lender repossesses your motorcycle, they may be able to recoup more of their losses when selling a newer model.

The Bottom Line

Whether you're buying it for fuel efficiency or fun, a motorcycle can be a welcome addition to the other vehicles in your garage or driveway. But before joining your local motorcycle club, check your credit reports and credit scores to ensure there won't be any bumps in the road when you submit your loan application.

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

Jennifer Brozic is a freelance content marketing writer specializing in personal finance topics, including building credit, personal loans, auto loans, credit cards, mortgages, budgeting, insurance, retirement planning and more.

Read more from Jennifer