Can Utility Bills Appear on Your Credit Report?

Utility bills don't usually appear on your credit reports—unless you fail to pay them.

This can be both a good and bad thing: good because late payments don't always automatically count against you, and bad because your on-time payment history doesn't help your score. That is changing, however: As you'll see, on-time utility payments can now actually help your credit score.

How Can a Utility Bill Hurt Your Credit?

Utility companies do not report accounts and payment history to the three major credit bureaus (Experian, TransUnion and Equifax), and as a result, these types of bills have not historically had an impact on your credit scores. For a utility company to be able to report information to a credit bureau, they must meet the requirements of the Fair Credit Reporting Act, such as updating payment information regularly and being able to respond to disputes within legally mandated timeframes.

One of the few instances where your utility and telecom bills—including energy, phone and cable—will affect your credit score is if you miss enough payments that the provider sends your debt to a collection agency or charges off your account, assuming you're not going to pay it.

Collections on Your Credit Report

Companies typically turn to collection agencies when bills are severely past due and the providers are unsure whether they will ever recover the debt. Once a collection agency assumes the debt, it typically opens a collection account in the debtor's name and sends a record of that account to one or all of the three major credit bureaus. When that happens, the collections account becomes a part of your credit file.

Once a collection account or charge-off becomes part of your credit history, it can have a lasting negative effect on your credit score. These are considered derogatory marks and can remain in your credit file for seven years. Even if you pay the collection agency and the account is closed, a record of the debt will still remain.

Collection accounts don't only negatively impact your credit scores, but they can also come with expensive fees that increase your overall debt. If you've had a collection account opened for a past debt, it's best to try to resolve it as soon as you can before the issue escalates any further.

How Utility Bills Can Now Improve Your Credit Score

While historically, utility bills in good standing have not been included in credit reports, a groundbreaking new innovation called Experian Boost®ø allows users to get credit for on-time payments made on utility and telecom accounts.

Experian Boost works instantly, allowing users with eligible payment history to see their FICO® ScoreΘ increase in a matter of minutes. Currently, it is the only way you can get credit for your utility and telecom payments.

Through the new platform, users can opt in to allow Experian to connect to their bank accounts and identify past utility and telecom payments—including cable and phone bills—that were paid on time. After the user verifies the data and confirms they want it added to their credit file, they will receive an updated FICO® Score instantly.

Can Utility Bills Reported to Experian Impact Lending Decisions?

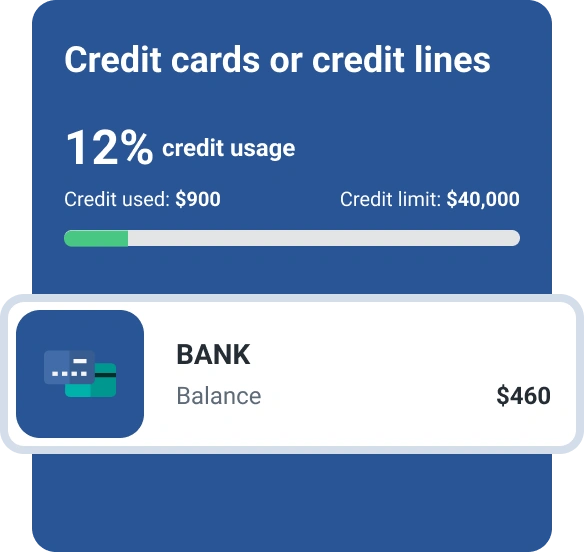

With Experian Boost, your utility bills might be the key to unlocking new financial possibilities. Once you connect your bank account and receive your new FICO® Score, you may have an easier time getting approved for certain credit products.

An added benefit of Experian Boost is if you are eligible for an increased score, you should see a boost across all of your different FICO® Scores. FICO® Scores are the most commonly used credit scores by lenders and come in several varieties depending on who is requesting to see it. In some cases, auto lenders, bankcard issuers and mortgage lenders will use a different version of your FICO® Score to decide whether to approve you for their specific loan.

Overall, boosting your FICO® Score should help you with future lending decisions. Not only do lenders decide to issue new credit based on your credit reports and scores, but they often use this information to establish interest rates and loan terms. Having an increased score can help you get approved for more competitive credit and might help you get a reduced interest rate—which can save you thousands of dollars over the life of a loan.

If you are unsure whether you've had a collection account added to your credit file, you can check by getting a free copy of your credit report from Experian. Periodically monitoring your credit reports can help you stay on top of any changes in your accounts—which may help your credit history over time.

What’s on your credit report?

Stay up to date with your latest credit information—and get your FICO® Score for free.

Get your free reportNo credit card required

About the author

Stefan Lembo-Stolba leads Experian Consumer Service's data research on Ask Experian, publishing insights based on Experian's credit data of over 220 million U.S. consumers.

Read more from Stefan Lembo