What Is a CD Ladder?

Quick Answer

A CD ladder is a savings strategy where you put money into multiple CDs with different terms and interest rates so they mature on a staggered basis. When each CD matures, you can either withdraw the cash or put it into another CD.

Certificates of deposit (CDs) can earn more interest than traditional savings accounts, but typically penalize you for withdrawing money before the CD matures. A CD ladder is a savings strategy where you invest in multiple CDs with different maturity dates. As each CD matures, you can withdraw the money or reinvest it in a new CD. CD ladders can also help maximize earnings by letting you lock in higher annual percentage yields (APYs) if interest rates rise.

What Is a CD Ladder?

A CD ladder is an alternative to putting a lump sum into one CD, locking all the money into a certain term. Instead, you split your savings among several CDs with varying maturity dates. Banks typically charge penalties for withdrawing money from a CD before maturity. CD laddering gives you more latitude to withdraw funds without penalties.

Example: If you put $10,000 into a five-year CD and needed to withdraw funds a year later, you'd typically be penalized. With CD laddering, you could put $2,000 each into five CDs that mature in one, two, three, four and five years. A CD matures each year, providing an annual opportunity to withdraw the cash if you need it, or roll it into another CD if you don't.

CD laddering also lets you lock in interest rates at different times as market rates fluctuate.

Typically, CDs with longer terms earn higher APYs. With a CD ladder, you can put some cash into longer-term CDs earning higher interest, and some into shorter-term CDs for quicker access. When interest rates rise, roll the funds from a maturing CD into a new CD to benefit from a higher APY.

Earn Money Faster

Compare high-yield CDs

Find a high-yield CD with today’s APY. Compare current APY and offers to find the best certificate of deposit for you.

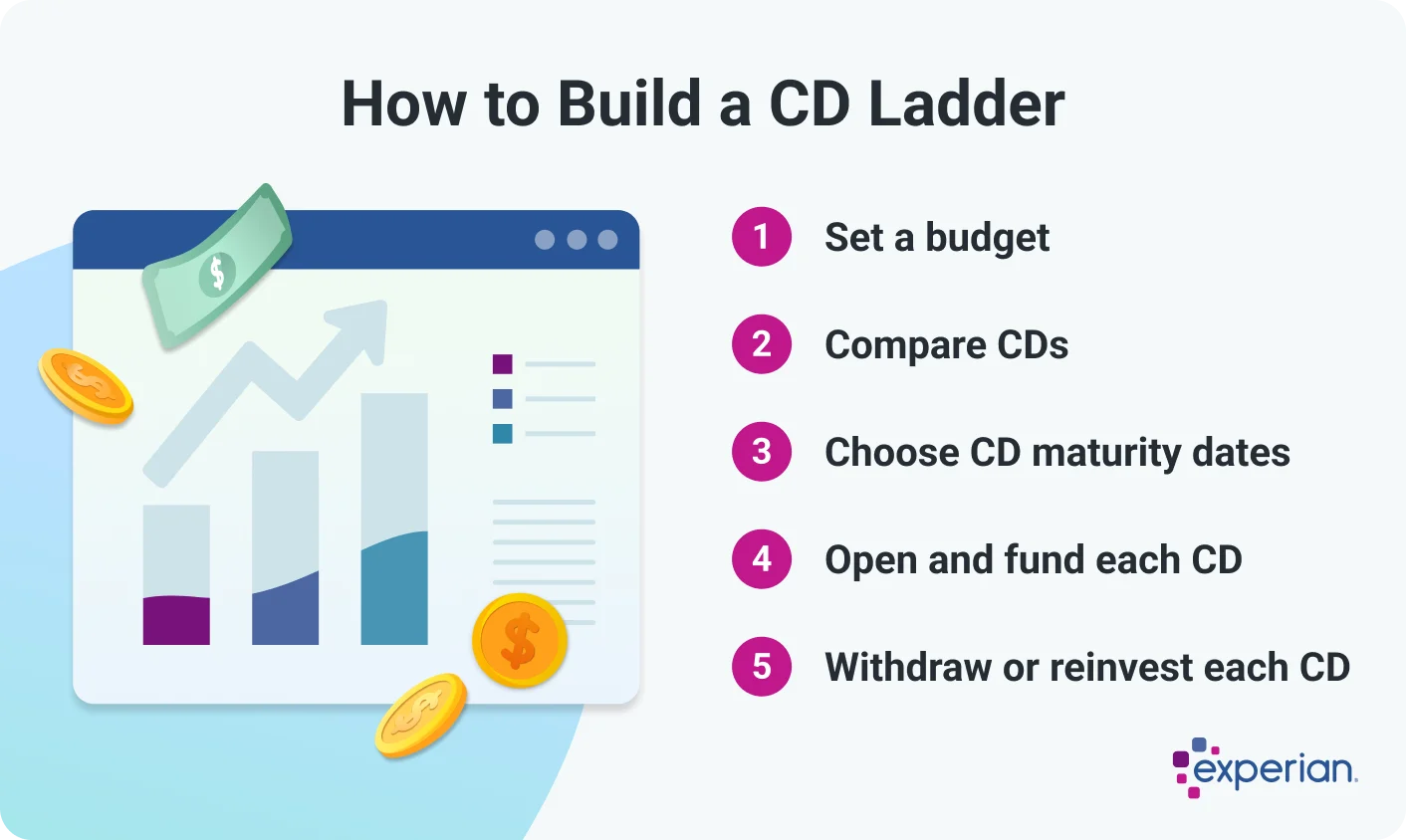

How to Build a CD Ladder

Here's how to build your own CD ladder.

1. Set a Budget

Based on your goals and other savings, decide how much to invest. CDs generally require a minimum deposit of $500 to $2,500; jumbo CDs usually require at least $100,000.

CDs at banks insured by the Federal Deposit Insurance Corp. (FDIC) and credit unions insured by the National Credit Union Administration (NCUA) are guaranteed up to $250,000 per depositor, account category and financial institution. If you're investing more than $250,000, you'll want to split your funds among multiple institutions.

Learn more: How Much Money Should I Put in a CD?

2. Compare CDs

You can find CDs at traditional banks, online banks and credit unions. To choose the best CD for you, shop around and compare APYs, terms, fees and penalties for early withdrawal.

3. Choose CD Maturity Levels

Traditional CDs usually have terms of one month to five years; however, some banks offer up to 10-year terms. Having a ladder with CDs that mature once a year is an easy way to get started, but you could also build a ladder with CDs maturing every few months.

For example, suppose you want to remodel your home in five years and have $20,000 to invest. You could structure your CD ladder this way:

- $4,000 in a one-year CD

- $4,000 in a two-year CD

- $4,000 in a three-year CD

- $4,000 in a four-year CD

- $4,000 in a five-year CD

To save for your wedding in two years, you could use a shorter-term CD ladder, such as:

- $5,000 in a six-month CD

- $5,000 in a one-year CD

- $5,000 in an 18-month CD

- $5,000 in a two-year CD

4. Open and Fund Each CD

You can generally apply for CDs online or in person. When applying, you'll receive a disclosure statement explaining how the account works. An opening deposit is required to fund the account.

5. Withdraw or Reinvest Each CD at Maturity

When each CD matures, you typically have a seven- to 10-day grace period to decide what to do. Track each CD's maturity date on your calendar so you don't miss this window.

You can withdraw your deposit plus accrued interest and spend it. If you want to keep saving, you can look for better interest rates elsewhere, add funds to the CD or choose a different term.

Using the home remodeling example, suppose you opened five CDs in May 2025 and plan to remodel in 2030. Here's what you might do as each CD matures:

- May 2026: Roll a one-year CD into a new four-year CD

- May 2027: Roll a two-year CD into a new three-year CD

- May 2028: Roll a three-year CD into a new two-year CD

- May 2029: Roll a four-year CD into a new one-year CD

- May 2030: All CDs mature; withdraw all the funds

Tip: Many CDs automatically renew for the same term but the current interest rate if you don't take action during the grace period—typically only about a week. Be sure to check rates and determine whether it makes sense to let your CD roll over before it's too late.

Learn more: Mistakes to Avoid With a CD

Alternative CD Ladder Structures

Depending on your goals, consider these alternative CD ladder structures.

- A mini CD ladder is a good option if you don't want any of your money tied up too long. It uses CDs with a term of one year or less, such as three-month, six-month, nine-month and 12-month CDs.

- A barbell CD ladder splits your money between one long-term CD and one short-term CD. Part of your money is more accessible in the short-term CD; part earns a higher APY in the long-term CD. The barbell CD ladder can help you save for a shorter-term goal (like a vacation) and a longer-term goal (like home improvement) at the same time.

- A bullet CD ladder involves opening several CDs that all mature at the same time. Suppose you want to buy a home in five years. You have $5,000 to invest today, and plan to save another $5,000 toward your home down payment each year. You could put $5,000 into a five-year CD now, $5,000 into a four-year CD next year, $5,000 into a three-year CD in two years and so on.

Learn more: Top Strategies for CD Savers

Pros and Cons of CD Laddering

Before setting up a CD ladder, consider the benefits and downsides.

Pros

-

Easier access to your money: CD laddering is less restrictive than investing in a single CD. As each CD matures, you can access your funds without penalties.

-

Predictable returns: Savings account interest rates are usually variable, but rates on CDs are typically fixed from when you open the account—so you know how much you'll earn.

-

Low risk: CDs from FDIC- or NCUA-guaranteed financial institutions are safe ways to save. You generally can't lose money deposited in a CD, although you might forfeit some interest earnings for withdrawing funds early.

-

Flexibility: If interest rates rise, you can cash out short-term CDs to invest in new CDs. If rates drop, you can rest easy that your long-term CDs will keep earning higher rates.

Cons

-

Modest returns: When planning for long-term goals like retirement, bonds or other investments could offer higher returns than CDs.

-

Limited access to funds: Even with laddering, you must wait for your CD to mature to avoid early withdrawal penalties. A high-yield savings or money market account can offer similar APYs while allowing unlimited access to your funds.

-

Can be complicated: Managing multiple CDs can be challenging, especially if they're all in different places.

-

May automatically renew: Unless you act quickly after a CD matures, it may automatically renew, locking your money up again.

Learn more: How to Adjust Your CD Ladder When Rates Change

Should You Build a CD Ladder?

Here are some scenarios where CD laddering could make sense.

- You want to mitigate interest rate risk. Fixed interest rates deliver predictable earnings, while CD laddering lets you make adjustments when interest rates rise.

- You're saving for goals that are spaced out over time. A CD ladder can help you save for both short- and medium-term goals, such as traveling to Europe next year and buying a home in five years.

- You need predictable cash flow. Use CD ladders that mature in a regular cadence to save for predictable annual or biannual expenses, such as property taxes or insurance premiums.

Learn more: Best Low-Risk Investments

The Bottom Line

When you have extra cash and want to earn a higher APY than a traditional savings account offers, CD laddering can be a smart financial move. Offering security, flexibility and guaranteed returns, CDs can help you save for the future and diversify your financial portfolio.

Along with saving, regularly reviewing your credit report and credit score is key to maintaining good financial health. Make it easier with free credit monitoring from Experian. You'll get free access to your Experian credit report and FICO® ScoreΘ and alerts of important changes to your credit, helping you stay on top of your finances.

Grow your money safely with a CD

Lock in savings with a certificate of deposit—earn higher interest rates over a fixed term.

Compare accountsAbout the author

Karen Axelton is Experian’s in-house senior personal finance writer. She has over 20 years of experience as a journalist and has written or ghostwritten content for a variety of financial services companies.

Read more from Karen