What Is a Subprime Mortgage?

Quick Answer

A subprime mortgage is a home loan designed for borrowers with limited or damaged credit. Features of these loans may include high interest rates, high closing costs, longer repayment periods and high down payment requirements.

A subprime mortgage is a home loan designed for borrowers with low credit. Subprime mortgages typically carry higher fees and interest rates than the "prime" mortgages available to borrowers with good credit. Subprime mortgages often are only available with adjustable interest rates that can rise and fall over the life of the loan, and they may have longer repayment periods than prime mortgages. Here's how subprime mortgages work, when to consider one and the pros and cons of this type of home loan.

What Is a Subprime Mortgage?

A subprime mortgage is a home loan offered to borrowers with poor credit. Though the definition of a subprime borrower varies from one lender to the next, subprime mortgages may be available to borrowers with a FICO® ScoreΘ below 670.

The term "subprime mortgage" fell out of favor following the 2008 financial crisis, so subprime mortgages are sometimes advertised as "nonprime." Some subprime mortgages are classified as non-qualified loans (non-QM), indicating lenders must provide strict documentation of borrowers' ability to repay the loans.

Learn more: What Does Subprime Mean?

How Do Subprime Mortgages Work?

Subprime mortgages work like conventional loans, but they have some unique qualities.

Pricing on subprime mortgages can vary by mortgage type (see below), but all subprime mortgages share these attributes:

- Higher interest charges: Rates on subprime mortgages are typically several percentage points higher than those on conventional mortgages.

- Higher closing costs: Lenders offset some of the risk by collecting high fees upfront. Origination fees may be higher on subprime loans than on traditional loans, for example.

- Higher down payment requirements: Borrowers with outstanding credit may be able to finance a home by putting down as little as 3% of the purchase price, but subprime borrowers may be required to put down 25% or more.

You can apply for subprime mortgages at banks, credit unions and online lenders. Subprime borrowers typically undergo a stricter underwriting process as lenders want to make sure you can repay the loan.

Tip: Lenders determine the minimum credit score requirements for loans they offer, so it's important to shop around for a mortgage. It's possible you'll qualify only for a subprime mortgage with one lender but another lender will consider you eligible for a conventional mortgage. And, even if all lenders consider your scores subprime, some could offer better loan terms than others.

Compare mortgage rates

Check today’s rates to find the best loan offers. Staying updated on current rates helps you secure a competitive mortgage and save more over time.

What Are the Types of Subprime Mortgages?

Here are three kinds of subprime mortgages you may encounter:

Adjustable-Rate Mortgage (ARM)

ARMs start out with relatively low payments for a number of years (five, seven and 10 years are common) based on an introductory interest rate; then the interest rate adjusts periodically for the remainder of the loan term.

ARM interest rates—and their monthly payments—typically reset every six or 12 months following the initial fixed-rate period, rising or falling in sync with the relevant index the lender uses to determine rates. The maximum annual increase is capped by federal regulation, but shifting payments can put strain on household budgets.

Tip: ARMs aren't exclusive to subprime mortgages. You can also get an ARM if you have good credit.

Learn more: Common Types of Adjustable-Rate Mortgages

Extended-Term Mortgage

These loans may come with fixed interest rates but feature repayment terms of 40 or even 50 years, instead of the 30-year norm for conventional mortgages. Over the life of the loan, that can mean hundreds of additional payments, and interest compounding for an extra decade or more, with the potential to cost hundreds of thousands of dollars more than a conventional loan.

Interest-Only Mortgage

Similar in structure to an adjustable-rate mortgage, an interest-only mortgage provides low initial payments by giving you the option to pay only interest due on the loan (without any principal payments) for the first three to 10 years of the loan term. At the end of this introductory period, you can renew the loan or refinance, but you must begin paying down principal.

Interest-only mortgages work best if you make standard interest-plus-principal monthly payments and only resort to lower interest-only payments in cases of emergency, such as times with unexpected expenses. If home prices are declining in your neighborhood, you might even find yourself upside down on the loan, and facing a short sale or foreclosure.

Interest only mortgage calculator

Adjustable-Rate vs. Extended-Term vs. Interest-Only Mortgages

| Adjustable-Rate Mortgage | Extended-Term Mortgage | Interest-Only Mortgage | |

|---|---|---|---|

| Term | 30 years | 40-50 years | 15 or 30 years |

| Payment structure | After an introductory period with a fixed interest rate, interest charges reset regularly, in sync with a published interest rate or benchmark. | Loan terms extend to 40 or even 50 years, far longer than the conventional 30-year terms standard for U.S. home loans. | During the introductory phase (typically three to 10 years), only relatively low interest-only payments are required; thereafter, higher interest-and-principal payments are required. |

| Equity | Loan is amortized, so equity accrues gradually: Earliest payments are mostly interest, and portion paid toward principal increases with each payment. Final payments are nearly all principal. | Loan is amortized, so equity accrues gradually: Earliest payments are mostly interest, and portion paid toward principal increases with each payment. Final payments are nearly all principal. | No equity accrues on interest-only payments, but principal-plus-interest payments made in the initial phase will accumulate equity. During the loan's second phase, principal-plus-interest payments are amortized, so equity accrues gradually: Earliest payments are mostly interest, and the share of principal in each payment increases each month. |

| Best for | Borrowers who need a low initial payment but anticipate income growth sufficient to handle payment increases as needed when rate adjustments kick in. | Homebuyers who cannot qualify for shorter-term loans, with a goal of refinancing with a shorter-term loan after establishing stronger credit. | Individuals who plan to make full interest-plus-principal payments as often as possible, but need leeway to make smaller payments occasionally. |

Subprime Mortgage vs. Prime Mortgage

The chief differences between a subprime mortgage and a conventional, or "prime," mortgage are as follows.

Credit Score Requirements

Lenders set their own minimum score requirements, but prime loans are generally available to borrowers with FICO® Scores of 670 or greater, and some lenders require minimum scores as high as 720.

Subprime mortgages may be available to borrowers with credit scores as low as 580.

Learn more: What Are the Different Credit Score Ranges?

Down Payment Requirements

For prime mortgages, lenders routinely accept down payments as low as 10% with a requirement that the buyer pay for mortgage insurance if they put less than 20% down. Borrowers with good credit may be eligible for down payments as low as 3%.

By contrast, on subprime mortgages, down payment requirements of 25% or more of the purchase price are not uncommon.

Learn more: How Your Down Payment Affects Your Mortgage

| Subprime Mortgage | Prime Mortgage | |

|---|---|---|

| Credit score* | Poor or fair credit | Good, very good and excellent credit |

| Down payment | 25% or more of purchase price | 20% of purchase price to avoid private mortgage insurance (PMI), but as low as 3% of purchase price |

| Interest rate | Typically higher than the current benchmark rates | Typically near or in line with the current benchmark rates |

*Score and down payment requirements are subject to lender discretion, so these are general guidelines

Pros and Cons of Subprime Mortgages

If you're considering a subprime mortgage, it's important to weigh the potential benefits and drawbacks of accepting such a loan.

Pros

-

Enabling homeownership: Subprime mortgages offer a pathway to homeownership when you can't qualify for a conventional home loan. If you haven't established a substantial credit history, or if your credit scores are damaged from past mishaps or missteps, a subprime loan may be your only mortgage option.

-

Credit score benefits: If you keep up with your mortgage payments and manage other debt wisely, you'll likely see improvement in your credit scores. Regular on-time mortgage payments will help you build a positive payment history, and payment history is the single largest factor influencing credit scores, responsible for up to 35% of your FICO® Score.

Cons

-

Cost: Charges on subprime mortgages can be significantly higher than those on prime loans, potentially costing you tens or even hundreds of thousands of dollars more than a conventional mortgage on the same property.

-

Budgeting challenges: The annual rate reset on an ARM and the shift to higher required payments following the intro period on an interest-only mortgage may put stress on many household budgets. If you go either route, plan carefully and do your best to set aside funds to help cushion major payment hikes.

-

Slow equity accumulation: Early payments on amortized loans like mortgages are mostly interest, with just a small portion going toward principal. Payments toward the end of the loan term are mostly principal, with just a small share of interest. Home equity—the portion of the home you own—accumulates as you pay down principal. An extended-term loan stretches this process out significantly.

| Loan Term | Equity After 30 Years |

|---|---|

| 30 years | 100% |

| 40 years | 46% |

| 50 years | 34% |

Should You Get a Subprime Mortgage?

A subprime mortgage may be right for you, but it's best to seek one only after investigating more conventional mortgage options with several lenders. Variations in lending standards mean you could qualify for a conventional fixed-rate, 30-year mortgage with one lender, while another might offer only subprime loans. (This may be particularly true if you have a FICO® Score in the high 500s or low 600s, where lenders often draw the line for subprime applicants.)

If you decide to seek a subprime mortgage, make sure you understand its terms clearly, including the potential for payment increases. Pay close attention as well to any prepayment penalties, and how much they could cost you if you refinance your loan in the future.

Learn more: How to Buy a House: Step-by-Step Guide

Alternatives to a Subprime Mortgage

Before settling on a subprime mortgage, it may be worth considering some of these other options, which could be more affordable and less risky for you and your home.

Get a Cosigner

If you cannot qualify for a conventional mortgage on your own, getting a relative or friend with good credit to act as a cosigner might help you avoid a subprime loan.

A cosigner's credit scores and income are considered along with yours when determining loan eligibility. You're still considered the primary borrower and owner of the house, but a cosigner shares equal responsibility with you for ensuring your loan is repaid. If you fail to make payments, your cosigner's credit scores will also suffer, and the cosigner can be pursued for payment.

FHA Loans

Insured by the Federal Housing Administration, FHA loans have a minimum credit score of 500 if you make a 10% down payment on your purchase. If you put down less than that, the minimum credit score required is 580.

They do, however, come with higher mortgage insurance requirements than some conventional loans, and you'll pay for this insurance longer the less you put down.

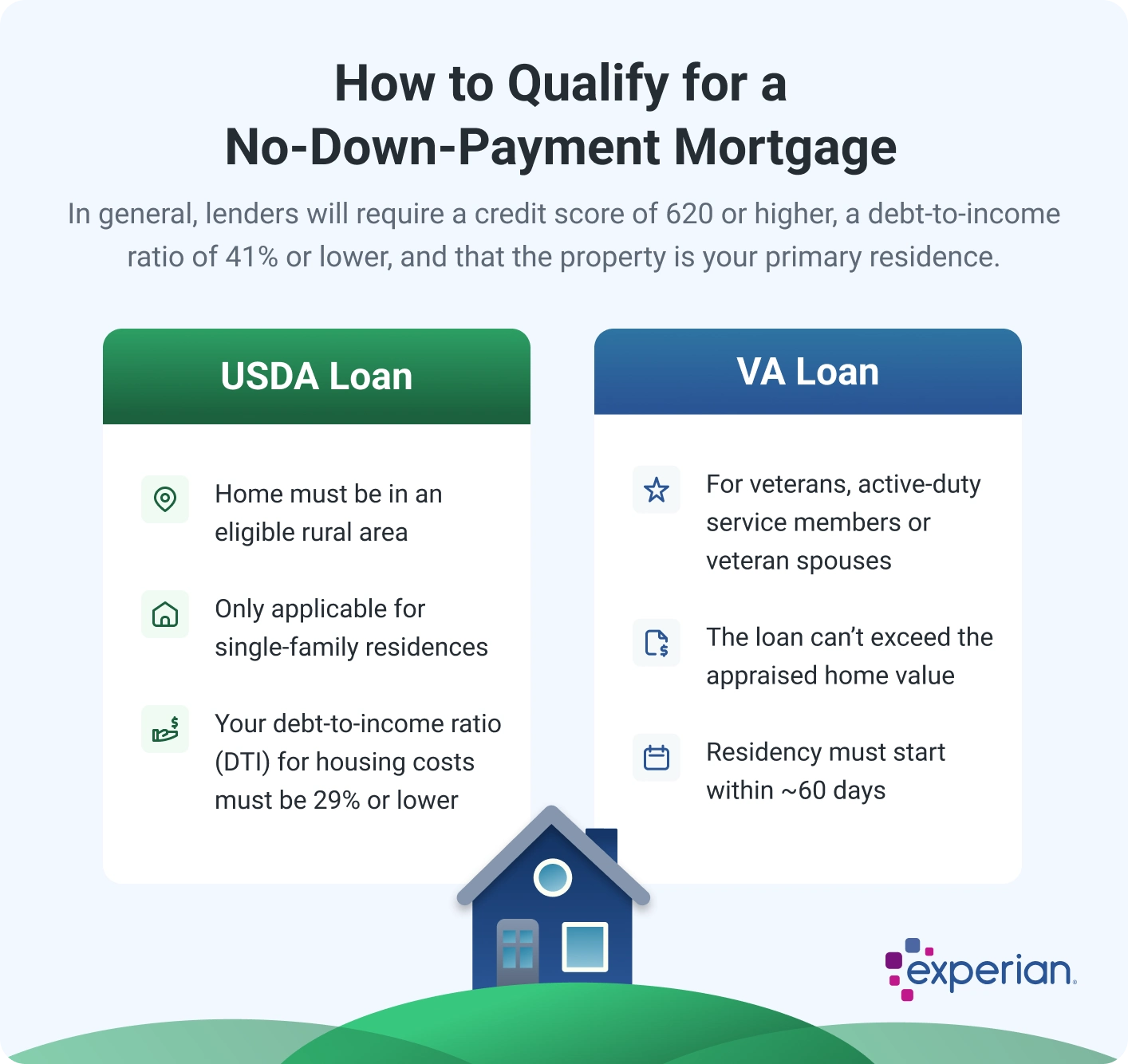

VA Loans

VA loans are backed by the U.S. Department of Veterans Affairs (VA) for select members of the military community, their spouses and other eligible beneficiaries.

There's no minimum credit score set by the VA, but lenders who provide VA loans typically seek scores of 620 or higher and borrowers must meet other eligibility requirements related to their military service or that of a family member.

USDA Loans

The U.S. Department of Agriculture backs mortgages, known as USDA loans, for buyers with low to moderate incomes seeking to buy designated rural properties. The USDA does not require a minimum credit score, and lenders may accept applicants with scores as low as 580, although some require scores of at least 640.

Frequently Asked Questions

The Bottom Line

If your credit scores are low and a subprime mortgage is the only type of home loan you qualify for, the loan may be your best opportunity to become a homeowner in the immediate future. Because these loans carry high interest rates and potential for shifting payment amounts, managing them can be challenging and expensive.

To understand how mortgage lenders are likely to view your loan application, you can check your FICO® Score and credit report for free from Experian. Use what you find there as guidance on ways you can improve your credit in the hopes of qualifying for a lower-interest mortgage in the future.

Curious about your mortgage options?

Explore personalized solutions from multiple lenders and make informed decisions about your home financing. Leverage expert advice to see if you can save thousands of dollars.

Learn moreAbout the author

Jim Akin is freelance writer based in Connecticut. With experience as both a journalist and a marketing professional, his most recent focus has been in the area of consumer finance and credit scoring.

Read more from Jim